Question

7. 8. 9. You hear on the news that the S&P 500 was down 2.3% today relative to the risk-free rate (the market's excess return

7.

8.

9. You hear on the news that the S&P 500 was down 2.3% today relative to the risk-free rate (the market's excess return was 2.3%). You are thinking about your portfolio and your investments in Zynga and Proctor and Gamble.

a. If Zynga's beta is 1.4, what is your best guess as to Zynga's excess return today?

b. If Proctor and Gamble's beta is 0.6,what is your best guess as to P&G's excess return today?

10. Suppose the risk-free return is 5.7% and the market portfolio has an expected return of 9.4% and a standard deviation of 16%. Johnson & Johnson Corporation stock has a beta of 0.28. What is its expected return?

11. Suppose Intel stock has a beta of 1.79, whereas Boeing stock has a beta of 0.82. If the risk-free interest rate is 6.4% and the expected return of the market portfolio is 12.5%, according to the CAPM,

a. What is the expected return of Intel stock?

b. What is the expected return of Boeing stock?

c. What is the beta of a portfolio that consists of 65% Intel stock and 35%Boeing stock?

d. What is the expected return of a portfolio that consists of 65% Intel stock and 35% Boeing stock? (There are two ways to solve this.)

12. At the beginning of 2007 (the year the iPhone was introduced), Apple's beta was 1.4 and the risk-free rate was about 5.3%. Apple's price was $81.82. Apple's price at the end of 2007 was $199.54. If you estimate the market risk premium to have been 6.9%, did Apple's managers exceed their investors' required return as given by the CAPM?

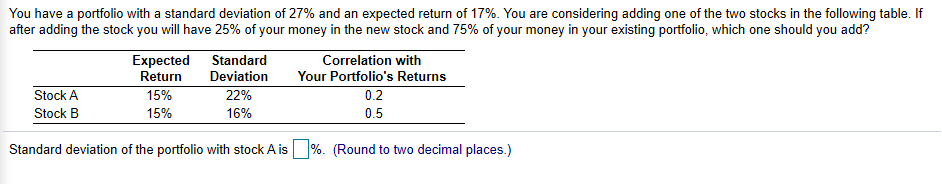

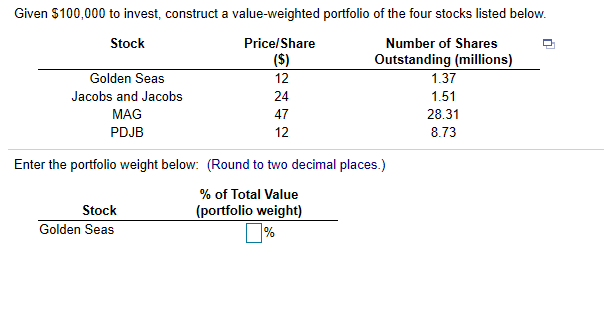

You have a portfolio with a standard deviation of 27% and an expected return of 17%. You are considering adding one of the two stocks in the following table. If after adding the stock you will have 25% of your money in the new stock and 75% of your money in your existing portfolio, which one should you add? Correlation with Your Portfolio's Returns Expected Return 15% 15% Standard Deviation 22% 16% Stock A Stock B Standard deviation of the portfolio with stock A is %. (Round to two decimal places.) Given $100,000 to invest, construct a value-weighted portfolio of the four stocks listed below. Stock Price/Share Number of Shares Outstanding (millions) 1.37 1.51 28.31 8.73 Golden Seas Jacobs and Jacobs MAG PDJB 24 Enter the portfolio weight below: (Round to two decimal places.) % of Total Value (portfolio weight) Stock Golden SeasStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started