Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find your target country's annual GDP (at current market prices) and the Current Account balance from the ADB excel sheet. Calculate and plot the

![U.S. BALANCE OF PAYMENTS ACCOUNT, 2017 ($ IN BILLIONS) A. CURRENT ACCOUNT [DOLLAR OUTFLOW (-)]: TRADE BALANCE](https://dsd5zvtm8ll6.cloudfront.net/questions/2023/10/653b3e44a3f5a_1698381381010.jpg)

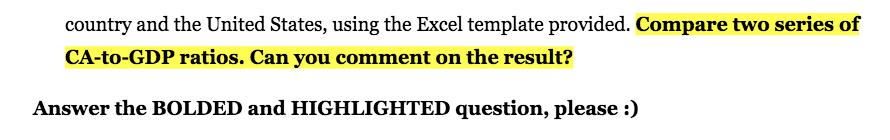

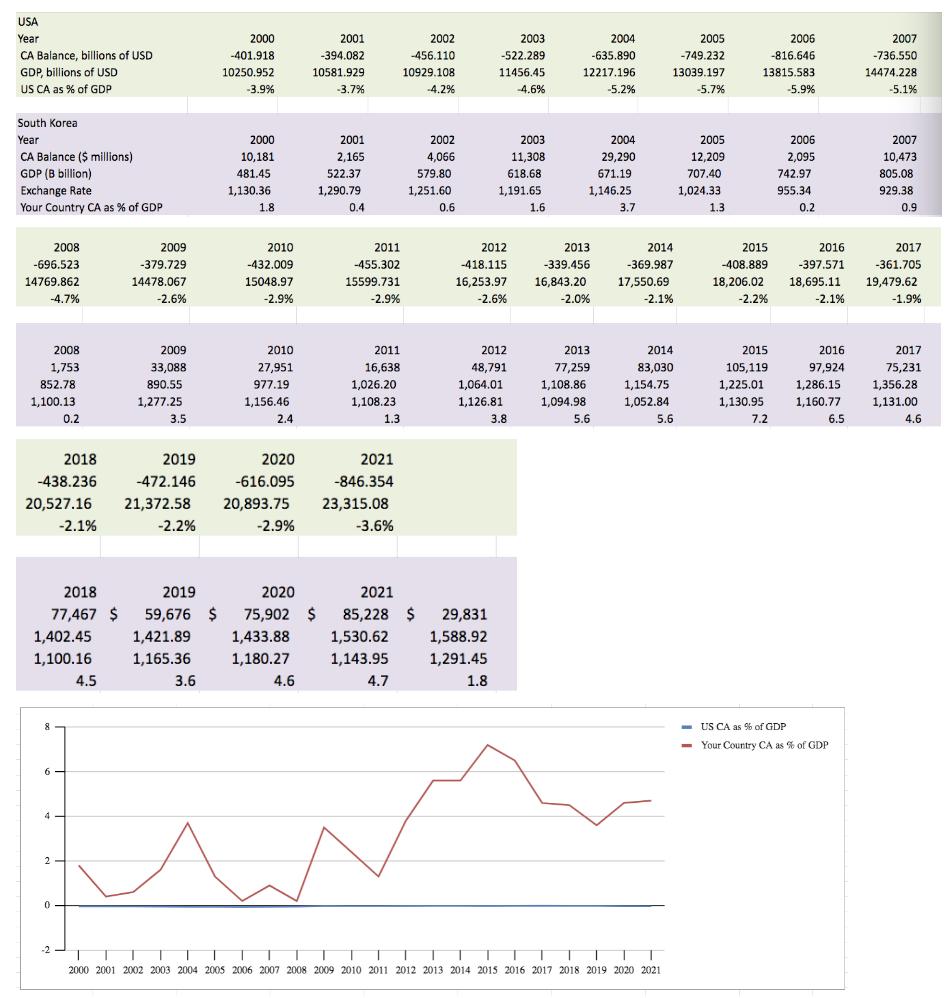

Find your target country's annual GDP (at current market prices) and the Current Account balance from the ADB excel sheet. Calculate and plot the annual CA -to-GDP ratio for the country and the United States, using the Excel template provided. Compare two series of CA-to-GDP ratios. Can you comment on the result? Find your target country's annual GDP (at current market prices) and the Current Account balance from the ADB excel sheet. Calculate and plot the annual CA -to-GDP ratio for the country and the United States, using the Excel template provided. Compare two series of CA-to-GDP ratios. Can you comment on the result? Answer the BOLDED and HIGHLIGHTED question, please :) U.S. BALANCE OF PAYMENTS ACCOUNT, 2017 ($ IN BILLIONS) A. CURRENT ACCOUNT [DOLLAR OUTFLOW (-)]: TRADE BALANCE Export GOODS: SERVICES: Import GOODS: SERVICES: NET TRADE BALANCE PRIMARY INCOME Receipts Investment Income Compensation of Employees C. FINANCIAL ACCOUNT: Payments Investment Income Compensation of Employees NET PRIMARY INCOME SECONDARY INCOME Receipts Payments NET SECONDARY INCOME CURRENT ACCOUNT BALANCE: B. CAPITAL ACCOUNT [DOLLAR INFLOW (+)]: CAPITAL ACCOUNT TRANSACTIONS, NET Net U.S. acquisition of financial assets [Dollar outflow (+)] DIRECT INVESTMENT PORTFOLIO INVESTMENT OTHER INVESTMENTS RESERVE ASSETS Net U.S. incurrence of liabilities [Dollar inflow (+)] DIRECT INVESTMENT PORTFOLIO INVESTMENT OTHER INVESTMENTS Financial Derivatives [Dollar outflow (+)] FINANCIAL ACCOUNT BALANCE (+ = Dollar outflow) OVERALL BALANCE OF PAYMENTS: STATISTICAL DISCREPANCY D. BALANCE SOURCE: US DEPT OF COMM, BUREAU OF ECON ANALYSIS http://bea.gov/international/index.htm#bop 2017 2,312.271 1,553.383 758.888 2,870.716 2,360.878 509.838 -558 927.848 921.816 6.032 706.386 686.699 19.687 221.5 154.049 272.645 -118.6 -455.6 24.746 sum of capital + Current 379.222 586.695 218.522 -1.690 354.829 799.182 383.671 -23.074 -378.0 52.8 0.0 1,182.749 1,537.682 -23.074 -430.8 USA Year CA Balance, billions of USD GDP, billions of USD US CA as % of GDP South Korea Year CA Balance ($ millions) GDP (B billion) Exchange Rate Your Country CA as % of GDP 2008 -696.523 14769.862 -4.7% 2008 1,753 852.78 1,100.13 1,402.45 1,100.16 8 6 2018 2019 77,467 $ 59,676 $ 1,421.89 1,165.36 4 0.2 2 0 -2 2009 -379.729 14478.067 -2.6% 2009 33,088 890.55 1,277.25 4.5 3.5 2000 -401.918 10250.952 -3.9% 3.6 2000 10,181 481.45 1,130.36 2018 2019 2020 2021 -472.146 -616.095 -846.354 -438.236 20,527.16 21,372.58 20,893.75 23,315.08 -2.1% -2.2% -2.9% -3.6% 1.8 2010 -432.009 15048.97 -2.9% 2010 27,951 977.19 1,156.46 2.4 2001 -394.082 10581.929 -3.7% 2020 75,902 $ 1,433.88 1,180.27 4.6 2001 2,165 522.37 1,290.79 0.4 2011 -455.302 15599.731 -2.9% 2011 16,638 1,026.20 1,108.23 1.3 2002 -456.110 10929.108 -4.2% 2002 4,066 579.80 1,251.60 0.6 2003 -522.289 11456.45 -4.6% 2003 11,308 618.68 1,191.65. 1.6 2012 -418.115 16,253.97 -2.6% 2021 85,228 $ 29,831 1,530.62 1,588.92 1,291.45 1,143.95 4.7 1.8 2012 48,791 1,064.01 1,126.81 3.8 2004 -635.890 12217.196 -5.2% 2004 29,290 671.19 1,146.25 2013 -339.456 16,843.20 -2.0% 2013 77,259 1,108.86 1,094.98 5.6 3.7 2014 -369.987 17,550.69 -2.1% 2005 -749.232 13039.197 -5.7% 2014 83,030 1,154.75 1,052.84 5.6 TT T T T T T T T TT T T T T T T T T 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2005 12,209 707.40 1,024.33 1.3 2006 -816.646 13815.583 -5.9% 2015 -408.889 18,206.02 -2.2% 2015 105,119 1,225.01 1,130.95 7.2 2006 2,095 742.97 955.34 0.2 2016 -397.571 18,695.11 -2.1% 2016 97,924 1,286.15 1,160.77 6.5 US CA as % of GDP Your Country CA as % of GDP 2007 -736.550 14474.228 -5.1% 2007 10,473 805.08 929.38 0.9 2017 -361.705 19,479.62 -1.9% 2017 75,231 1,356.28 1,131.00 4.6 Find your target country's annual GDP (at current market prices) and the Current Account balance from the ADB excel sheet. Calculate and plot the annual CA -to-GDP ratio for the country and the United States, using the Excel template provided. Compare two series of CA-to-GDP ratios. Can you comment on the result? Find your target country's annual GDP (at current market prices) and the Current Account balance from the ADB excel sheet. Calculate and plot the annual CA -to-GDP ratio for the country and the United States, using the Excel template provided. Compare two series of CA-to-GDP ratios. Can you comment on the result? Answer the BOLDED and HIGHLIGHTED question, please :) U.S. BALANCE OF PAYMENTS ACCOUNT, 2017 ($ IN BILLIONS) A. CURRENT ACCOUNT [DOLLAR OUTFLOW ( - )]: TRADE BALANCE Export GOODS: SERVICES: Import GOODS: SERVICES: NET TRADE BALANCE PRIMARY INCOME Receipts Investment Income Compensation of Employees C. FINANCIAL ACCOUNT: Payments Investment Income Compensation of Employees NET PRIMARY INCOME SECONDARY INCOME Receipts Payments NET SECONDARY INCOME CURRENT ACCOUNT BALANCE: B. CAPITAL ACCOUNT [DOLLAR INFLOW (+)]: CAPITAL ACCOUNT TRANSACTIONS, NET Net U.S. acquisition of financial assets [Dollar outflow (+)] DIRECT INVESTMENT PORTFOLIO INVESTMENT OTHER INVESTMENTS RESERVE ASSETS Net U.S. incurrence of liabilities [Dollar inflow (+)] DIRECT INVESTMENT PORTFOLIO INVESTMENT OTHER INVESTMENTS Financial Derivatives [Dollar outflow (+)] FINANCIAL ACCOUNT BALANCE (+= Dollar outflow) OVERALL BALANCE OF PAYMENTS: STATISTICAL DISCREPANCY D. BALANCE SOURCE: US DEPT OF COMM, BUREAU OF ECON ANALYSIS http://bea.gov/international/index.htm#bop 2017 2,312.271 1,553.383 758.888 2,870.716 2,360.878 509.838 -558 927.848 921.816 6.032 706.386 686.699 19.687 221.5 154.049 272.645 -118.6 -455.6 24.746 sum of capital + Current 379.222 586.695 218.522 -1.690 354.829 799.182 383.671 -23.074 -378.0 52.8 0.0 1,182.749 1,537.682 -23.074 -430.8 USA Year CA Balance, billions of USD GDP, billions of USD US CA as % of GDP South Korea Year CA Balance ($ millions) GDP (B billion) Exchange Rate Your Country CA as % of GDP 2008 -696.523 14769.862 -4.7% 2008 1,753 852.78 1,100.13 1,402.45 1,100.16 8 6 2018 2019 77,467 $ 59,676 $ 1,421.89 1,165.36 4 0.2 2 0 -2 2009 -379.729 14478.067 -2.6% 2009 33,088 890.55 1,277.25 4.5 3.5 2000 -401.918 10250.952 -3.9% 3.6 2000 10,181 481.45 1,130.36 2018 2019 2020 2021 -472.146 -616.095 -846.354 -438.236 20,527.16 21,372.58 20,893.75 23,315.08 -2.1% -2.2% -2.9% -3.6% 1.8 2010 -432.009 15048.97 -2.9% 2010 27,951 977.19 1,156.46 2.4 2001 -394.082 10581.929 -3.7% 2020 75,902 $ 1,433.88 1,180.27 4.6 2001 2,165 522.37 1,290.79 0.4 2011 -455.302 15599.731 -2.9% 2011 16,638 1,026.20 1,108.23 1.3 2002 -456.110 10929.108 -4.2% 2002 4,066 579.80 1,251.60 0.6 2003 -522.289 11456.45 -4.6% 2003 11,308 618.68 1,191.65. 1.6 2012 -418.115 16,253.97 -2.6% 2021 85,228 $ 29,831 1,530.62 1,588.92 1,291.45 1,143.95 4.7 1.8 2012 48,791 1,064.01 1,126.81 3.8 2004 -635.890 12217.196 -5.2% 2004 29,290 671.19 1,146.25 2013 -339.456 16,843.20 -2.0% 2013 77,259 1,108.86 1,094.98 5.6 3.7 2014 -369.987 17,550.69 -2.1% 2005 -749.232 13039.197 -5.7% 2014 83,030 1,154.75 1,052.84 5.6 TT T T T T T T T TT T T T T T T T T 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2005 12,209 707.40 1,024.33 1.3 2006 -816.646 13815.583 -5.9% 2015 -408.889 18,206.02 -2.2% 2015 105,119 1,225.01 1,130.95 7.2 2006 2,095 742.97 955.34 0.2 2016 -397.571 18,695.11 -2.1% 2016 97,924 1,286.15 1,160.77 6.5 US CA as % of GDP Your Country CA as % of GDP 2007 -736.550 14474.228 -5.1% 2007 10,473 805.08 929.38 0.9 2017 -361.705 19,479.62 -1.9% 2017 75,231 1,356.28 1,131.00 4.6

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started