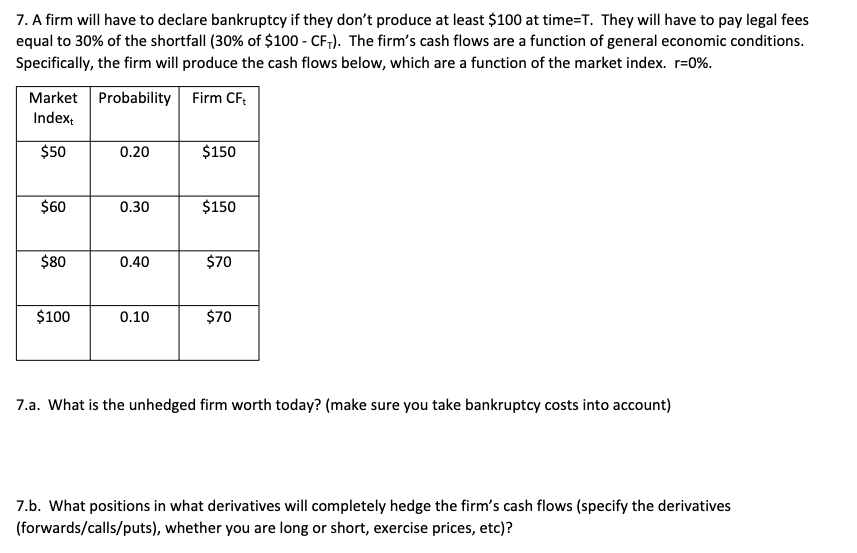

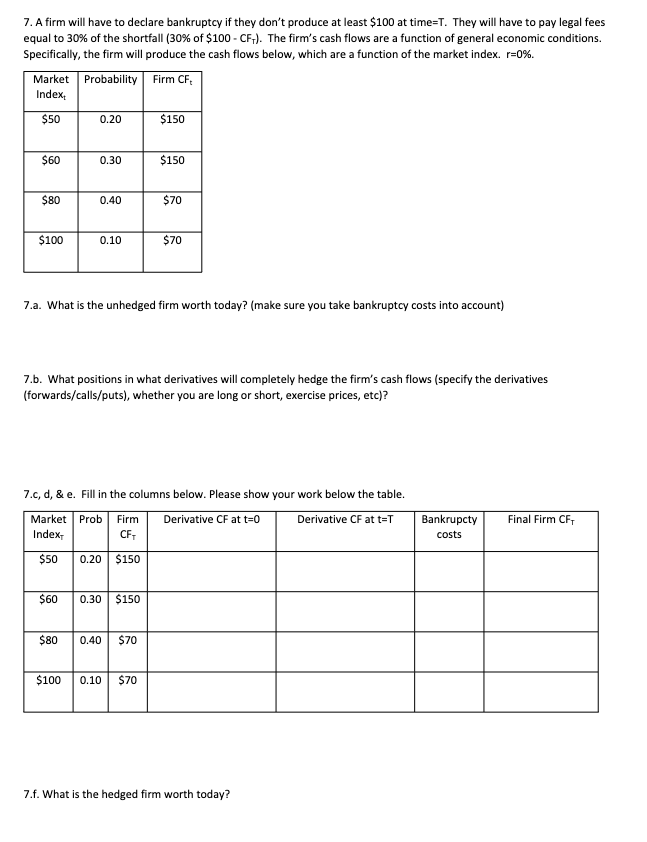

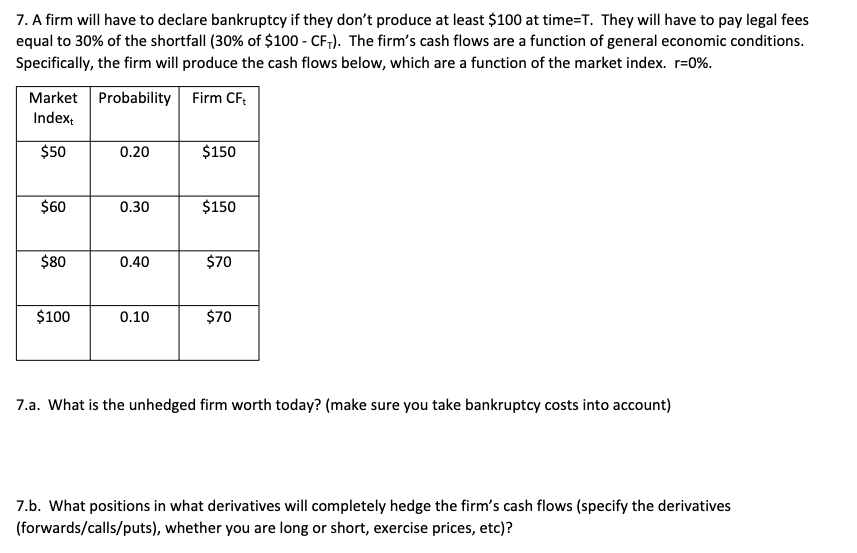

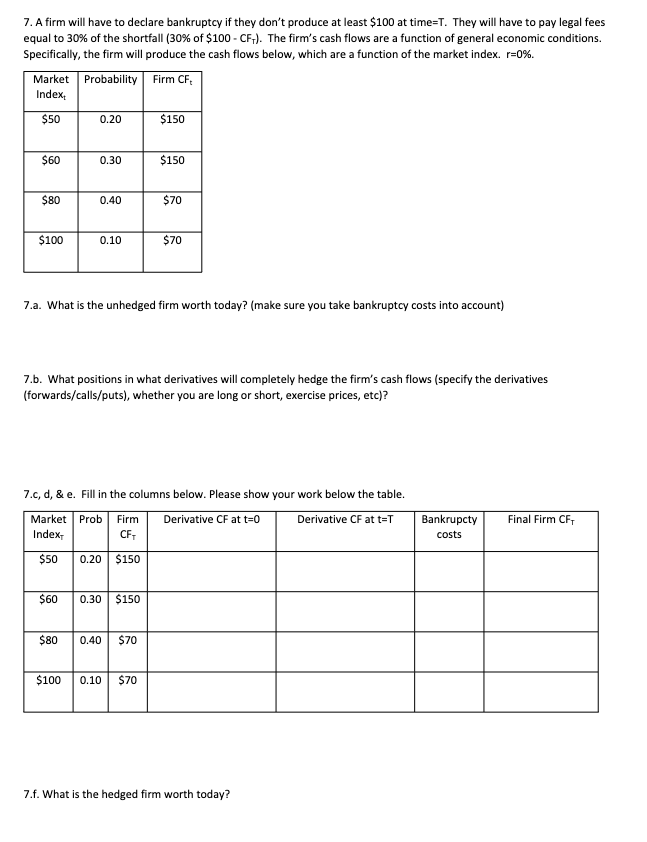

7. A firm will have to declare bankruptcy if they don't produce at least $100 at time=T. They will have to pay legal fees equal to 30% of the shortfall (30% of $100 - CF-). The firm's cash flows are a function of general economic conditions. Specifically, the firm will produce the cash flows below, which are a function of the market index. r=0%. Market Probability Firm CF Indext $50 0.20 $150 $60 0.30 $150 $80 0.40 $70 $100 0.10 $70 7.a. What is the unhedged firm worth today? (make sure you take bankruptcy costs into account) 7.b. What positions in what derivatives will completely hedge the firm's cash flows (specify the derivatives (forwards/calls/puts), whether you are long or short, exercise prices, etc)? 7. A firm will have to declare bankruptcy if they don't produce at least $100 at time=T. They will have to pay legal fees equal to 30% of the shortfall (30% of $100 - CF-). The firm's cash flows are a function of general economic conditions. Specifically, the firm will produce the cash flows below, which are a function of the market index. r=0%. Market Probability Firm CF Index $50 0.20 $150 $60 0.30 $150 $80 0.40 $70 $100 0.10 $70 7.a. What is the unhedged firm worth today? (make sure you take bankruptcy costs into account) 7.b. What positions in what derivatives will completely hedge the firm's cash flows (specify the derivatives (forwards/calls/puts), whether you are long or short, exercise prices, etc)? 7.c, d, & e. Fill in the columns below. Please show your work below the table. Market Prob Firm Derivative CF at t=0 Derivative CF at t=T Index CF Final Firm CFT Bankrupety costs $50 0.20 $150 $60 0.30 $150 $80 0.40 $70 $100 0.10 $70 7.f. What is the hedged firm worth today? 7. A firm will have to declare bankruptcy if they don't produce at least $100 at time=T. They will have to pay legal fees equal to 30% of the shortfall (30% of $100 - CF-). The firm's cash flows are a function of general economic conditions. Specifically, the firm will produce the cash flows below, which are a function of the market index. r=0%. Market Probability Firm CF Indext $50 0.20 $150 $60 0.30 $150 $80 0.40 $70 $100 0.10 $70 7.a. What is the unhedged firm worth today? (make sure you take bankruptcy costs into account) 7.b. What positions in what derivatives will completely hedge the firm's cash flows (specify the derivatives (forwards/calls/puts), whether you are long or short, exercise prices, etc)? 7. A firm will have to declare bankruptcy if they don't produce at least $100 at time=T. They will have to pay legal fees equal to 30% of the shortfall (30% of $100 - CF-). The firm's cash flows are a function of general economic conditions. Specifically, the firm will produce the cash flows below, which are a function of the market index. r=0%. Market Probability Firm CF Index $50 0.20 $150 $60 0.30 $150 $80 0.40 $70 $100 0.10 $70 7.a. What is the unhedged firm worth today? (make sure you take bankruptcy costs into account) 7.b. What positions in what derivatives will completely hedge the firm's cash flows (specify the derivatives (forwards/calls/puts), whether you are long or short, exercise prices, etc)? 7.c, d, & e. Fill in the columns below. Please show your work below the table. Market Prob Firm Derivative CF at t=0 Derivative CF at t=T Index CF Final Firm CFT Bankrupety costs $50 0.20 $150 $60 0.30 $150 $80 0.40 $70 $100 0.10 $70 7.f. What is the hedged firm worth today