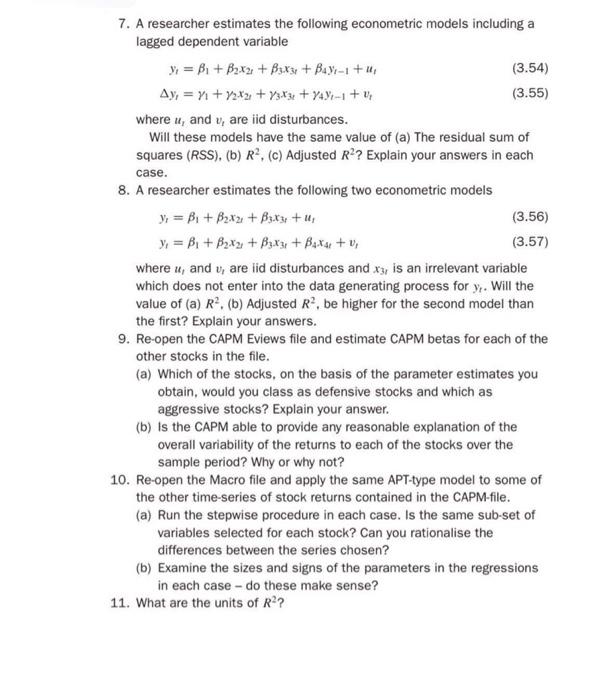

7. A researcher estimates the following econometric models including a lagged dependent variable y = B1 + B2X2 + B3X3 + Bay-1 +u, (3.54) Ay, = n1 +42X2 + 73X34 + 4%-1 + (3.55) where u, and v, are iid disturbances. Will these models have the same value of (a) The residual sum of squares (RSS), (b) R. (c) Adjusted R?? Explain your answers in each case. 8. A researcher estimates the following two econometric models ; = Bi + B2X2 + B3X3 + , (3.56) y = B1 + B2X2 + B3X31 + B4X4 +0, (3.57) where u, and v, are lid disturbances and x3, is an irrelevant variable which does not enter into the data generating process for yr. Will the value of (a) R. (b) Adjusted R2, be higher for the second model than the first? Explain your answers. 9. Re-open the CAPM Eviews file and estimate CAPM betas for each of the other stocks in the file. (a) Which of the stocks, on the basis of the parameter estimates you obtain, would you class as defensive stocks and which as aggressive stocks? Explain your answer. (b) is the CAPM able to provide any reasonable explanation of the overall variability of the returns to each of the stocks over the sample period? Why or why not? 10. Re-open the Macro file and apply the same APT-type model to some of the other time-series of stock returns contained in the CAPM-file. (a) Run the stepwise procedure in each case. Is the same sub-set of variables selected for each stock? Can you rationalise the differences between the series chosen? (b) Examine the sizes and signs of the parameters in the regressions in each case - do these make sense? 11. What are the units of R?? 7. A researcher estimates the following econometric models including a lagged dependent variable y = B1 + B2X2 + B3X3 + Bay-1 +u, (3.54) Ay, = n1 +42X2 + 73X34 + 4%-1 + (3.55) where u, and v, are iid disturbances. Will these models have the same value of (a) The residual sum of squares (RSS), (b) R. (c) Adjusted R?? Explain your answers in each case. 8. A researcher estimates the following two econometric models ; = Bi + B2X2 + B3X3 + , (3.56) y = B1 + B2X2 + B3X31 + B4X4 +0, (3.57) where u, and v, are lid disturbances and x3, is an irrelevant variable which does not enter into the data generating process for yr. Will the value of (a) R. (b) Adjusted R2, be higher for the second model than the first? Explain your answers. 9. Re-open the CAPM Eviews file and estimate CAPM betas for each of the other stocks in the file. (a) Which of the stocks, on the basis of the parameter estimates you obtain, would you class as defensive stocks and which as aggressive stocks? Explain your answer. (b) is the CAPM able to provide any reasonable explanation of the overall variability of the returns to each of the stocks over the sample period? Why or why not? 10. Re-open the Macro file and apply the same APT-type model to some of the other time-series of stock returns contained in the CAPM-file. (a) Run the stepwise procedure in each case. Is the same sub-set of variables selected for each stock? Can you rationalise the differences between the series chosen? (b) Examine the sizes and signs of the parameters in the regressions in each case - do these make sense? 11. What are the units of R