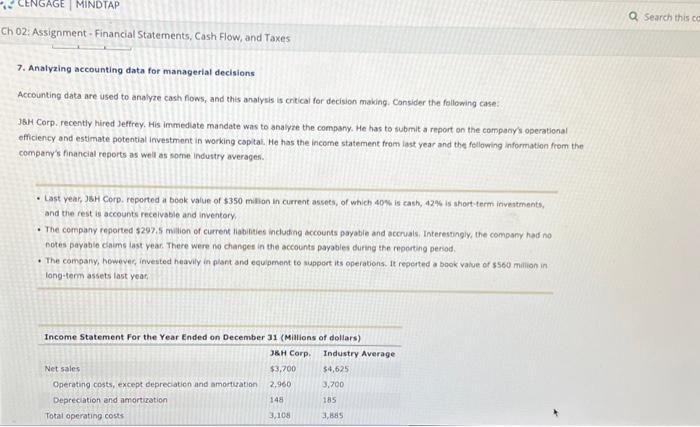

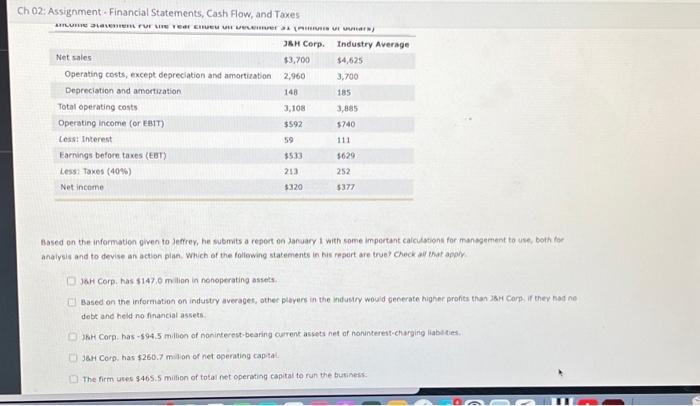

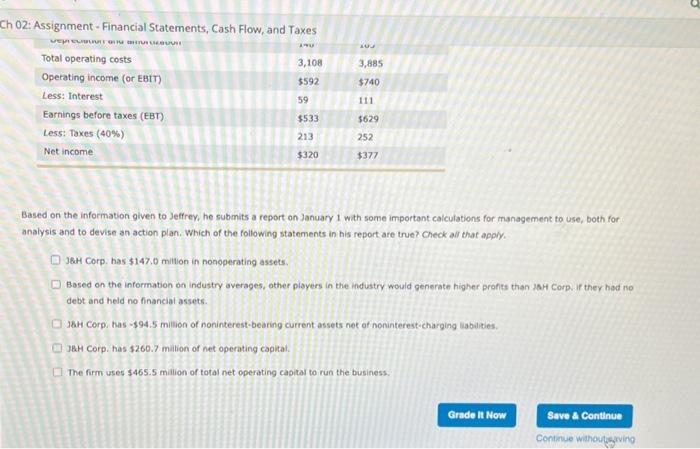

7. Analyzing accounting data for managerial decisions Accounting data are used to analyze cash fows, and this analysis is critical for decision making. Cansider the following case: j8H Corp. recently hired Jeffrey. His immediate mandate was to analyze the compsny. He has to submit a report on the compacy's operational efficiency and estimate potential investment in working capial. He has the income statement from last year and the fellowing information from the company's financial reports as weil as some industry averages. - Last year, Jah Corp, reported a book value of $350 milion in current assets, of which 40% is cash, 42% is ahort-term investments, and the fest is accounts receivable and inventory, - The company reported \$297,5 milion of current liabinties incluting accounts payable and accruals, Interestingly, the compamy had no notes payabio cinims last year. There were no changes in the accounts payables during the reporting persod. - The comparyy, however, invested heavily in plant and equpmam to support its operations, it reperted a bogi value of ss6e milion in. long-term assets last year Ch 02: Assignment . Financial Statements, Cash Flow, and Taxes Based on the information given to Jefrer, he submits a report on ancuary i with some impertant calcuations for management to use, both tor analysis and to devise an action plan. Which of the follewing statements in his repart are true? check af ehat apar Jah Corp, has $147,0m ilion in nonoperating assets. Based on the informistion on industy averages, other plavers in the industry wouid gecerate nigner profits than 26 ir Corp, if they nad no debt and held no financial assets. WhH Corp. has - 594.5 mition of noninerestbearing carrent assets net of honinteret-charging liabsties. Jart Corp. has $260.7 milan of net operating cap tal. The firm ules 3465.5 milion of total net operating capital to run the business: h 02: Assignment - Financial Statements, Cash Flow, and Taxes Based on the information given to Jeffrey, he submits a report on January 1 with some important calculations for management to use, both for analysis and to devise an action plan. Which of the following statements in his report are true? Check afl that appiy. J6H Corp. has $147,0 million in nonoperating assets. Based on the intormation on industry averages, other players in the industry would generate higher profts than anH Corp. If ther had no debt and held no financial assets. 18H Corp has - $94.5 million of noninterest-bearing current assets not of noninterest-charging liabilities. Jut Corp. has $260.7 milition of net operating capital. The firm uses 5465.5 million of total net operating capital to run the business