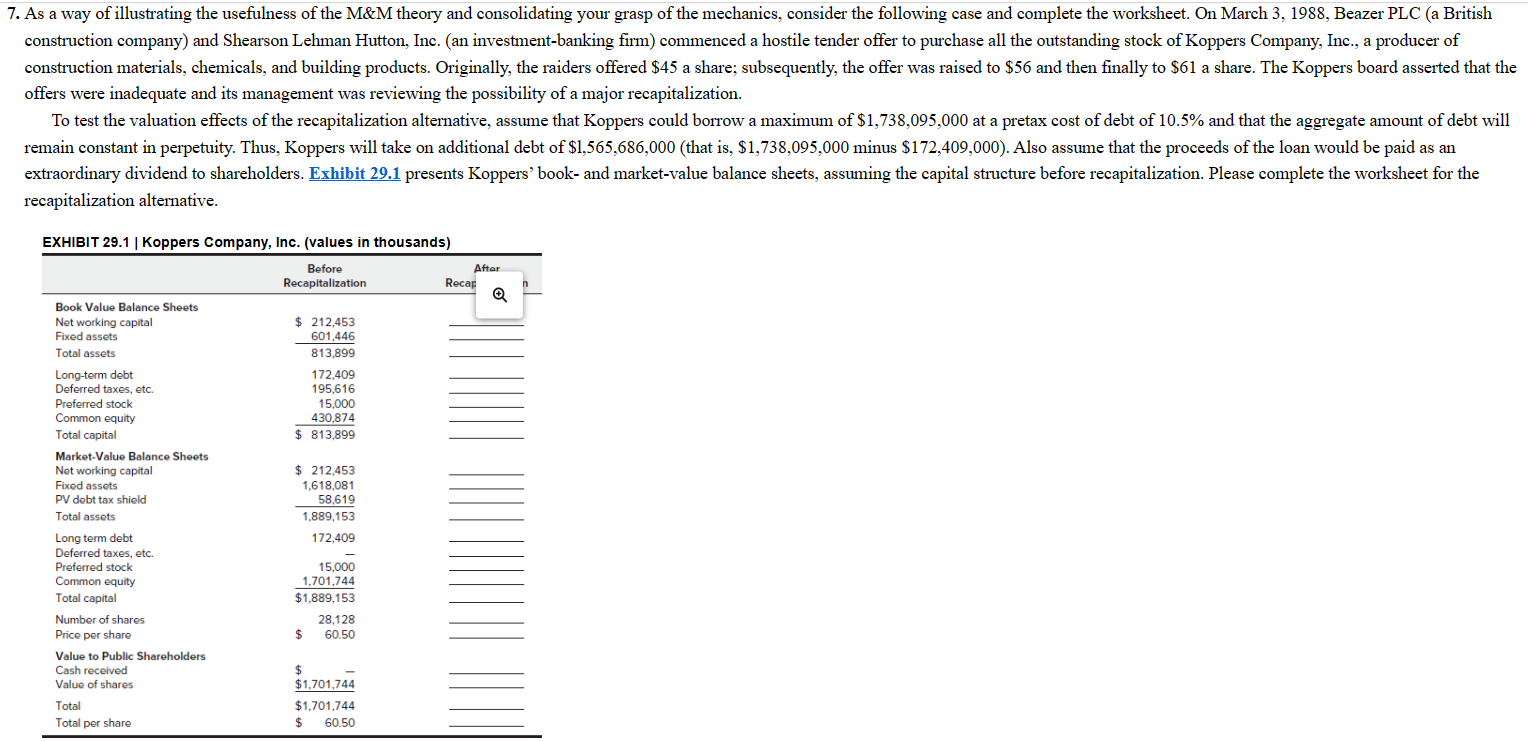

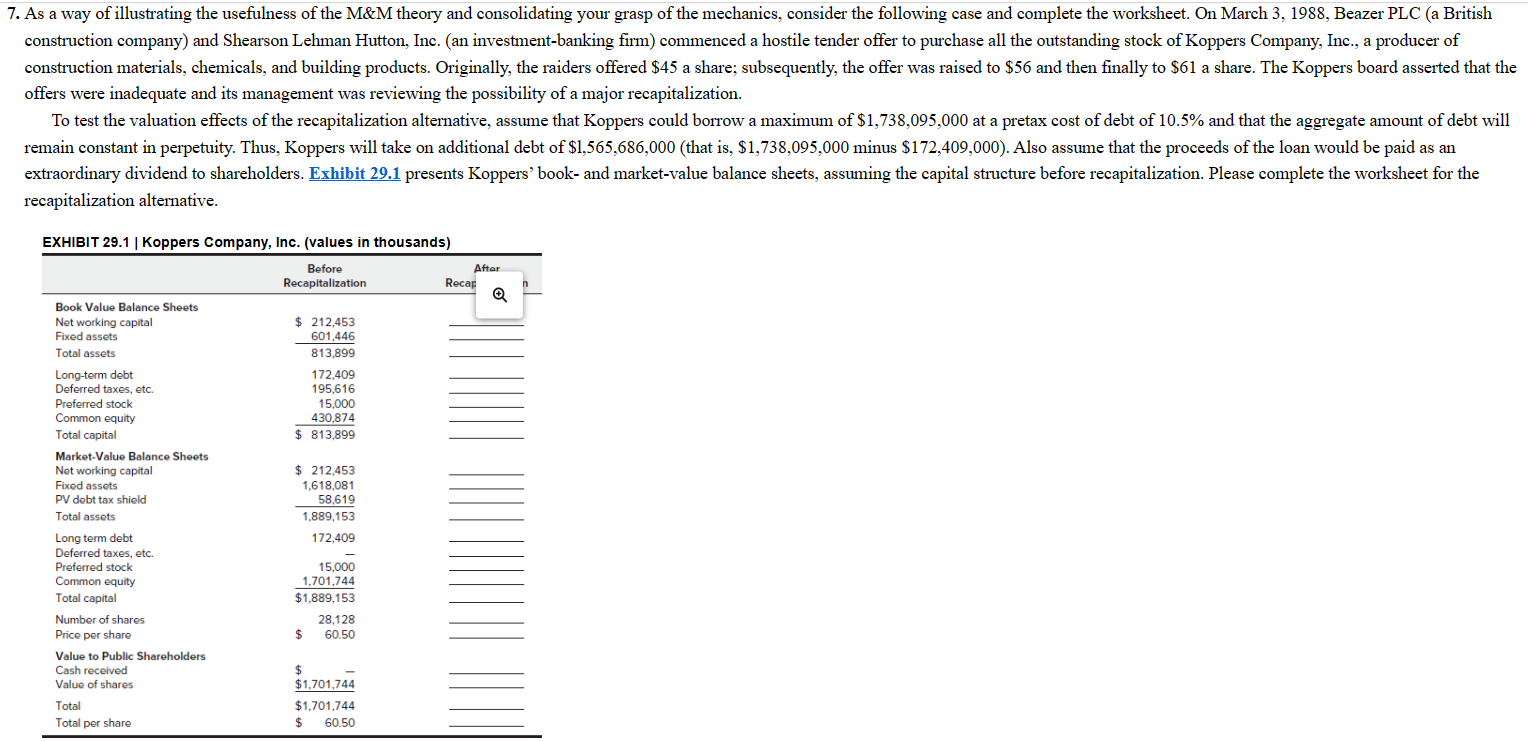

7. As a way of illustrating the usefulness of the M\&M theory and consolidating your grasp of the mechanics, consider the following case and complete the worksheet. On March 3,1988 , Beazer PLC (a British construction company) and Shearson Lehman Hutton, Inc. (an investment-banking firm) commenced a hostile tender offer to purchase all the outstanding stock of Koppers Company, Inc., a producer of construction materials, chemicals, and building products. Originally, the raiders offered $45 a share; subsequently, the offer was raised to $56 and then finally to $61 a share. The Koppers board asserted that the offers were inadequate and its management was reviewing the possibility of a major recapitalization. To test the valuation effects of the recapitalization alternative, assume that Koppers could borrow a maximum of $1,738,095,000 at a pretax cost of debt of 10.5% and that the aggregate amount of debt will remain constant in perpetuity. Thus, Koppers will take on additional debt of $1,565,686,000 (that is, $1,738,095,000 minus $172,409,000 ). Also assume that the proceeds of the loan would be paid as an extraordinary dividend to shareholders. presents Koppers' book- and market-value balance sheets, assuming the capital structure before recapitalization. Please complete the worksheet for the recapitalization alternative. 7. As a way of illustrating the usefulness of the M\&M theory and consolidating your grasp of the mechanics, consider the following case and complete the worksheet. On March 3,1988 , Beazer PLC (a British construction company) and Shearson Lehman Hutton, Inc. (an investment-banking firm) commenced a hostile tender offer to purchase all the outstanding stock of Koppers Company, Inc., a producer of construction materials, chemicals, and building products. Originally, the raiders offered $45 a share; subsequently, the offer was raised to $56 and then finally to $61 a share. The Koppers board asserted that the offers were inadequate and its management was reviewing the possibility of a major recapitalization. To test the valuation effects of the recapitalization alternative, assume that Koppers could borrow a maximum of $1,738,095,000 at a pretax cost of debt of 10.5% and that the aggregate amount of debt will remain constant in perpetuity. Thus, Koppers will take on additional debt of $1,565,686,000 (that is, $1,738,095,000 minus $172,409,000 ). Also assume that the proceeds of the loan would be paid as an extraordinary dividend to shareholders. presents Koppers' book- and market-value balance sheets, assuming the capital structure before recapitalization. Please complete the worksheet for the recapitalization alternative