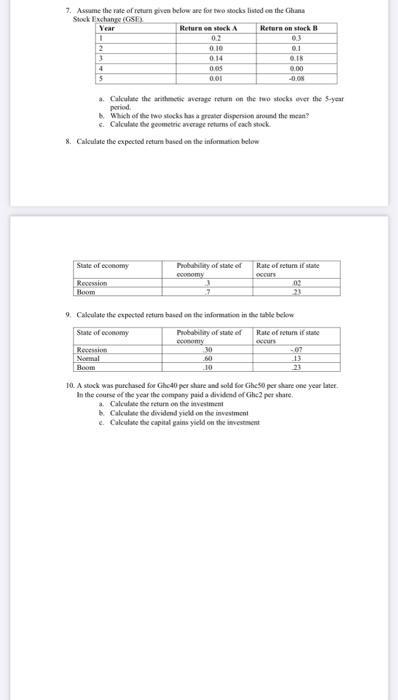

7. Assume the rate of return given below are for two stocks listed on the Ghana Stock Exchange (GSE) Year 1 2 3 4

7. Assume the rate of return given below are for two stocks listed on the Ghana Stock Exchange (GSE) Year 1 2 3 4 5 State of economy Recession Return on stock A 0.2 0.10 0.14 0.05 0.01 a. Calculate the arithmetic average return on the two stocks over the 5-year period. & Which of the two stocks has a greater dispersion around the mean? e. Calculate the geometric average returns of each stock. 8. Calculate the expected return based on the information below State of economy Recession Normal Boom Probability of state of economy Return on stock B 0.3 0.1 0.18 0.00 -0.08 9. Calculate the expected return based on the information in the table below 30 Rate of return if state occurs 60 10 Probability of state of Rate of return if state economy 02 21 b. Calculate the dividend yield on the investment e. Calculate the capital gains yield on the investment -07 13 23 10. A stock was purchased for Gho40 per share and sold for Ghe50 per share one year later In the course of the year the company paid a dividend of Ghe2 per share. a. Calculate the return on the investment

Step by Step Solution

3.42 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The expected return of a security is the weighted average of possible returns with each return being weighted by its probability of occurrence The expected return is calculated by multiplying ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started