Answered step by step

Verified Expert Solution

Question

1 Approved Answer

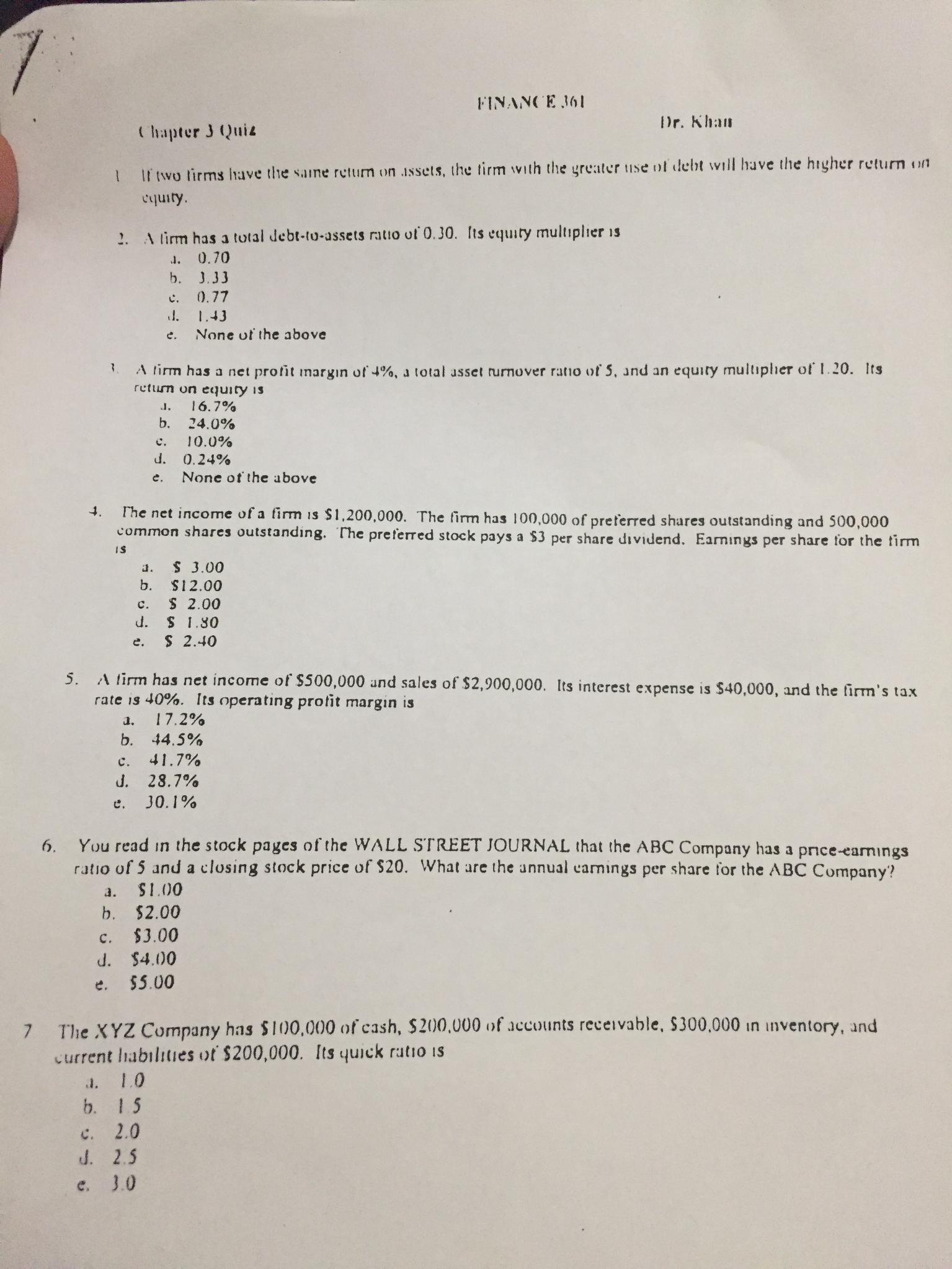

7 C. J. t. 2. A firm has a total debt-to-assets ratio of 0.30. Its equity multiplier is J. 0.70 b. 3.33 0.77 1.43

7 C. J. t. 2. A firm has a total debt-to-assets ratio of 0.30. Its equity multiplier is J. 0.70 b. 3.33 0.77 1.43 None of the above IS Chapter 3 Quiz If two firms have the same return on assets, the firm with the greater use of debt will have the higher return on equity. 1. A firm has a net profit margin of 4%, a total asset turnover ratio of 5, and an equity multiplier of 1.20. Its return on equity is b. C. d. 2. 3. b. J. e. The net income of a firm is $1,200,000. The firm has 100,000 of preferred shares outstanding and 500,000 common shares outstanding. The preferred stock pays a $3 per share dividend. Earnings per share for the firm J. b. 16.7% 24.0% 10.0% d. 0.24% c. None of the above FINANCE 361 5. A firm has net income of $500,000 and sales of $2,900,000. Its interest expense is $40,000, and the firm's tax rate is 40%. Its operating profit margin is a. 1.0 b. 1.5 17.2% 44.5% C. 41.7% J. 28.7% e. 30.1% c. 2.0 J. 2.5 e. 3.0 Dr. Khan $ 3.00 $12.00 $ 2.00 $ 1.80 $ 2.40 6. You read in the stock pages of the WALL STREET JOURNAL that the ABC Company has a price-earnings ratio of 5 and a closing stock price of $20. What are the annual camings per share for the ABC Company? a. $1.00 b. $2.00 $3.00 $4.00 $5.00 7 The XYZ Company has $100,000 of cash, $200,000 of accounts receivable, $300,000 in inventory, and current liabilities of $200,000. Its quick ratio is

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1This statement is correct Return on equity is a measure of a companys profitability that takes into account both its profits and the amount of equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started