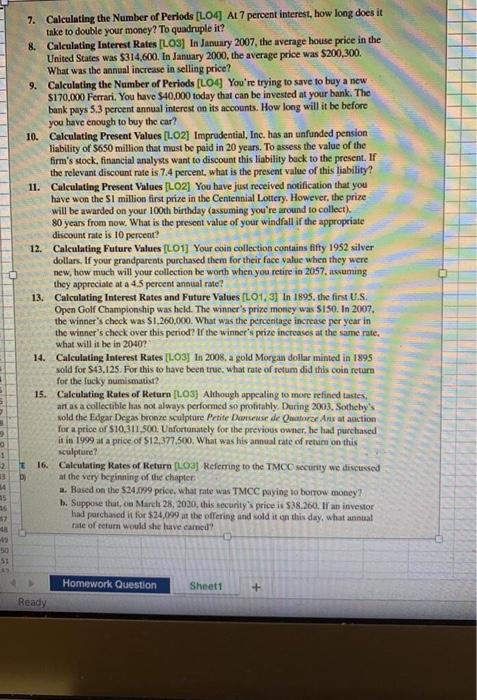

7. Calculating the Number of Periods (L04 At 7 percent interest, how long does it take to double your money? To quadruple it? 8. Calculating Interest Rates (L03] In January 2007, the average house price in the United States was $314,600. In January 2000, the average price was $200,300. What was the annual increase in selling price? 9. Calculating the Number of Periods (L04 You're trying to save to buy a new $170,000 Ferrari. You have $40,000 today that can be invested at your bank. The bank pays 5.3 percent annual interest on its accounts. How long will it be before you have enough to buy the car? 10. Calculating Present Values (LO2] Imprudential, Inc. has an unfunded pension liability of S650 million that must be paid in 20 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 7.4 percent, what is the present value of this liability? 11. Calculating Present Values LO2] You have just received notification that you have won the Si million first prize in the Centennial Lottery. However, the prize will be awarded on your 100th birthday (assuming you're around to collect), 80 years from now. What is the present value of your windfall if the appropriate discount rate is 10 percent? 12. Calculating Future Values (L01) Your coin collection contains Hifty 1952 silver dollars. If your grandparents purchased them for their face value when they were new, how much will your collection be worth when you retire in 2057, assuming they appreciate at a 4.5 percent annual rate? 13. Calculating Interest Rates and Future Values (L01.3) In 1895, the first U.S. Open Golf Championship was held. The winner's prize money was SISO. In 2007. the winner's check was $1,260,000. What was the percentage increase per year in the winner's check over this period? If the winner's prize increases at the same rate. what will it be in 2040? 14. Calculating Interest Rates [103] In 2008. a gold Morgan dollar minted in 1895 sold for $43.125. For this to have been true, what rate of retum did this coin return for the lucky numismatis? 15. Calculating Rates of Return (03) Although appealing to more refined tastes, art as a collectible has not always performed o profitably. During 2003. Sotheby's sold the Edgar Degas bronze sculpture Petite Danseuse de Ouators Arus at anction for a price of $10,311,500. Unfortunately for the previous owner, he had purchased it in 1999 at a price of $12,377,500. What was his annual rate of return on this sculpture? 16. Calculating Rates of Return (L03) Referring to the TMCC security we discussed at the very beginning of the chapter a. Based on the $24.099 price, what rate was TMCC paying to borrow money? 1. Suppose that, on March 28, 2030, this security's price is $38.260. If an investor had purchased it for $24,099 at the offering and sold it on this day, what annual rate of return would shelve camed? E 1 2 3 14 25 19 50 5: Homework Question Sheet1 + Ready