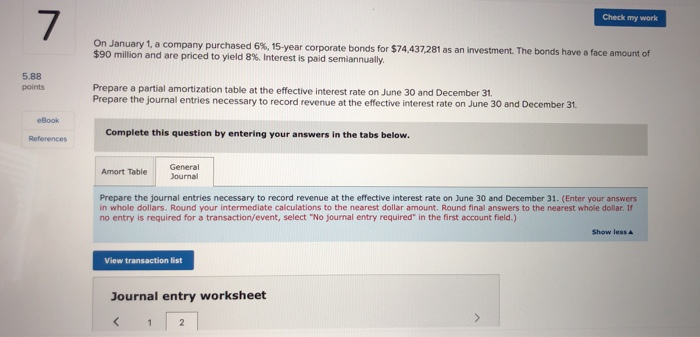

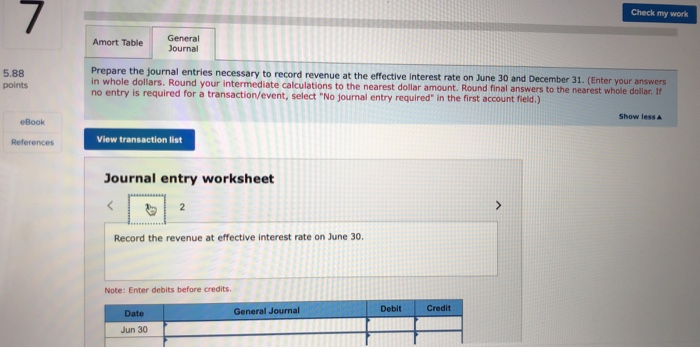

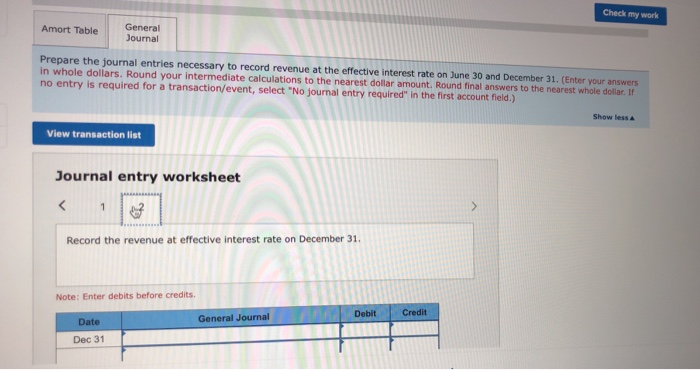

7 Check my work On January 1, a company purchased 6%, 15-year corporate bonds for $74,437,281 as an investment. The bonds have a face amount of $90 million and are priced to yield 8%. Interest is paid semiannually. 5.88 points Prepare a partial amortization table at the effective interest rate on June 30 and December 31 Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31 eBook Complete this question by entering your answers in the tabs below. References Amort Table General Journal Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31. (Enter your answers in whole dollars. Round your intermediate calculations to the nearest dollar amount. Round final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Show less View transaction list Journal entry worksheet 1 2. 7 Check my work Amort Table General Journal 5.88 points Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31. (Enter your answers in whole dollars. Round your intermediate calculations to the nearest dollar amount. Round final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Show less eBook References View transaction list Journal entry worksheet Record the revenue at effective interest rate on June 30. Note: Enter debits before credits General Journal Debit Credit Date Jun 30 Check my work Amort Table General Journal Prepare the journal entries necessary to record revenue at the effective interest rate on June 30 and December 31. (Enter your answers in whole dollars. Round your intermediate calculations to the nearest dollar amount. Round final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet 1 > Record the revenue at effective interest rate on December 31. Note: Enter debits before credits. Debit Credit Date General Journal Dec 31