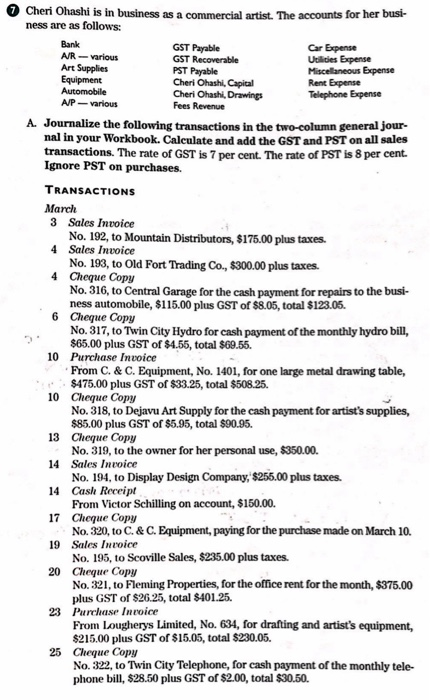

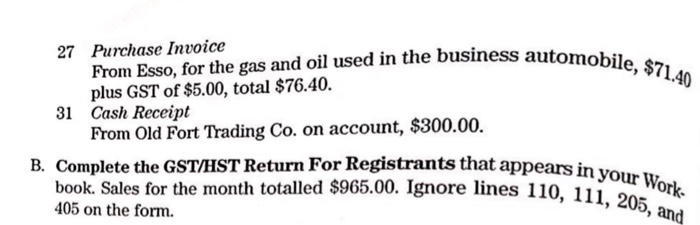

7 Cheri Ohashi is in business as a commercial artist. The accounts for her busi- ness are as follows: Bank GST Payable Car Expense A/R - various GST Recoverable Utilities Expense Art Supplies PST Payable Miscellaneous Expense Equipment Cheri Ohashi, Capital Rent Expense Automobile Cheri Ohashi, Drawings Telephone Expense AP-various Fees Revenue A. Journalize the following transactions in the two-column general jour nal in your Workbook. Calculate and add the GST and PST on all sales transactions. The rate of GST is 7 per cent. The rate of PST is 8 per cent. Ignore PST on purchases. TRANSACTIONS March 3 Sales Invoice No. 192, to Mountain Distributors, $175.00 plus taxes. 4 Sales Invoice No. 193, to Old Fort Trading Co., $300.00 plus taxes. 4 Cheque Copy No. 316, to Central Garage for the cash payment for repairs to the busi- ness automobile, $115.00 plus GST of $8.05, total $123.05. 6 Chegue Copy No. 317, to Twin City Hydro for cash payment of the monthly hydro bill, $65.00 plus GST of $4.55, total $69.55. 10 Purchase invoice From C. & C. Equipment, No. 1401, for one large metal drawing table, $475.00 plus GST of $33.25, total $508.25. 10 Cheque Copy No. 318, to Dejavu Art Supply for the cash payment for artist's supplies, $85.00 plus GST of $5.95, total $90.95. 13 Cheque Copy No. 319, to the owner for her personal use, $350.00 14 Sales Invoice No. 194, to Display Design Company, $255.00 plus taxes. 14 Cash Receipt From Victor Schilling on account, $150.00. 17 Cheque Copy No. 320,to C. &C. Equipment, paying for the purchase made on March 10. 19 Sales Invoice No. 195, to Scoville Sales, $235.00 plus taxes. 20 Cheque Copy No. 321, to Fleming Properties, for the office rent for the month, $375.00 plus GST of $26.25, total $401.25. 23 Purchase Invoice From Lougherys Limited, No. 634, for drafting and artist's equipment, $215.00 plus GST of $15.05, total $230.05. 25 Cheque Copy No. 322, to Twin City Telephone, for cash payment of the monthly tele- phone bill, $28.50 plus GST of $2.00, total $30.50. ss automobile, $71.40 27 Purchase Invoice From Esso, for the gas and oil used in the business autom plus GST of $5.00, total $76.40. 31 Cash Receipt From Old Fort Trading Co. on account, $300.00. B. Complete the GST/HST Return For Registrants that appears in von book. Sales for the month totalled $965.00. Ignore lines 110. 11 405 on the form. pears in your Work- 110, 111, 205, and