Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Guarantees We issue guarantees to certain lenders and hotel owners, chiefly to obtain long-term management contracts. The guarantees generally have a stated maximum funding

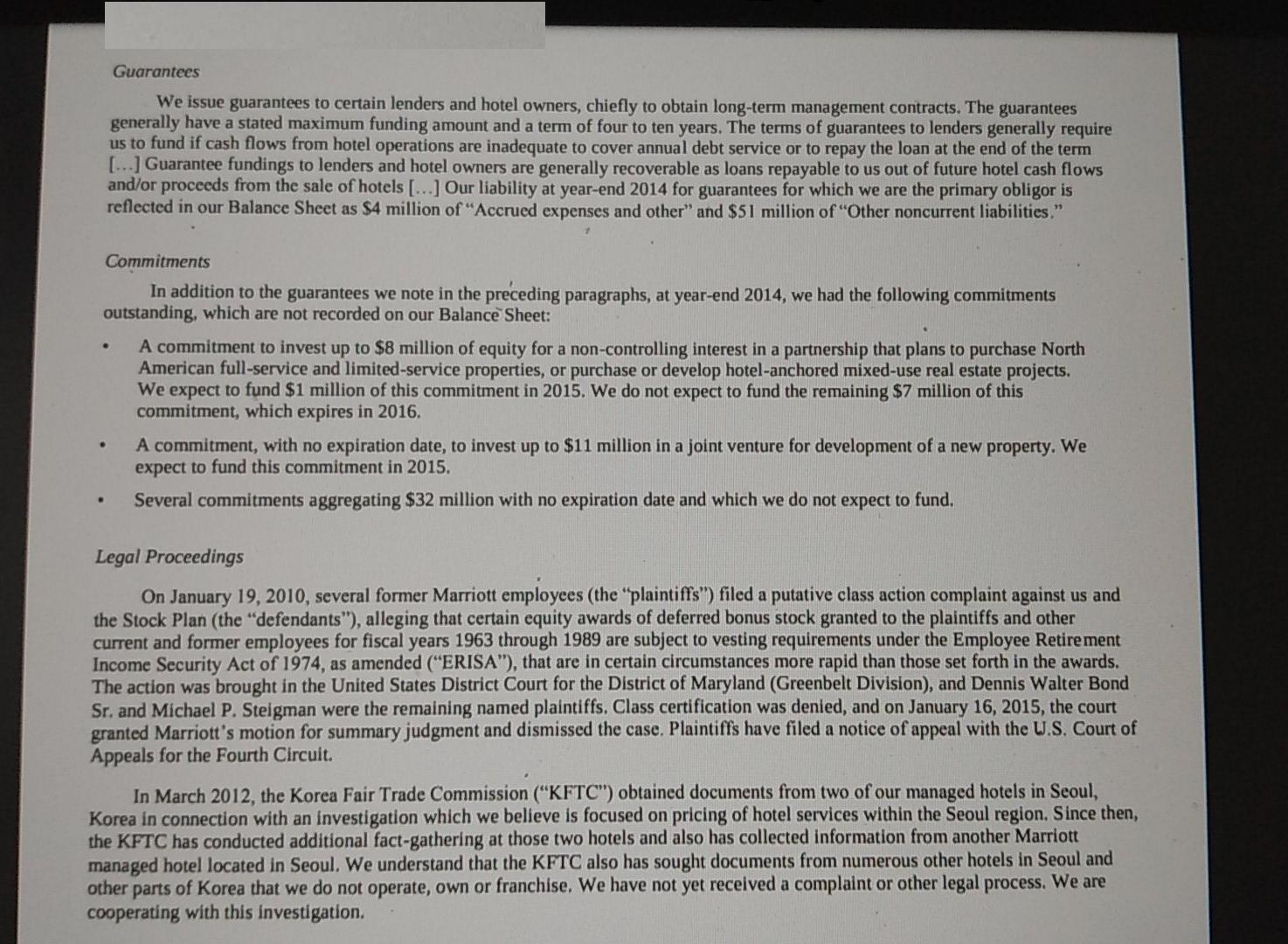

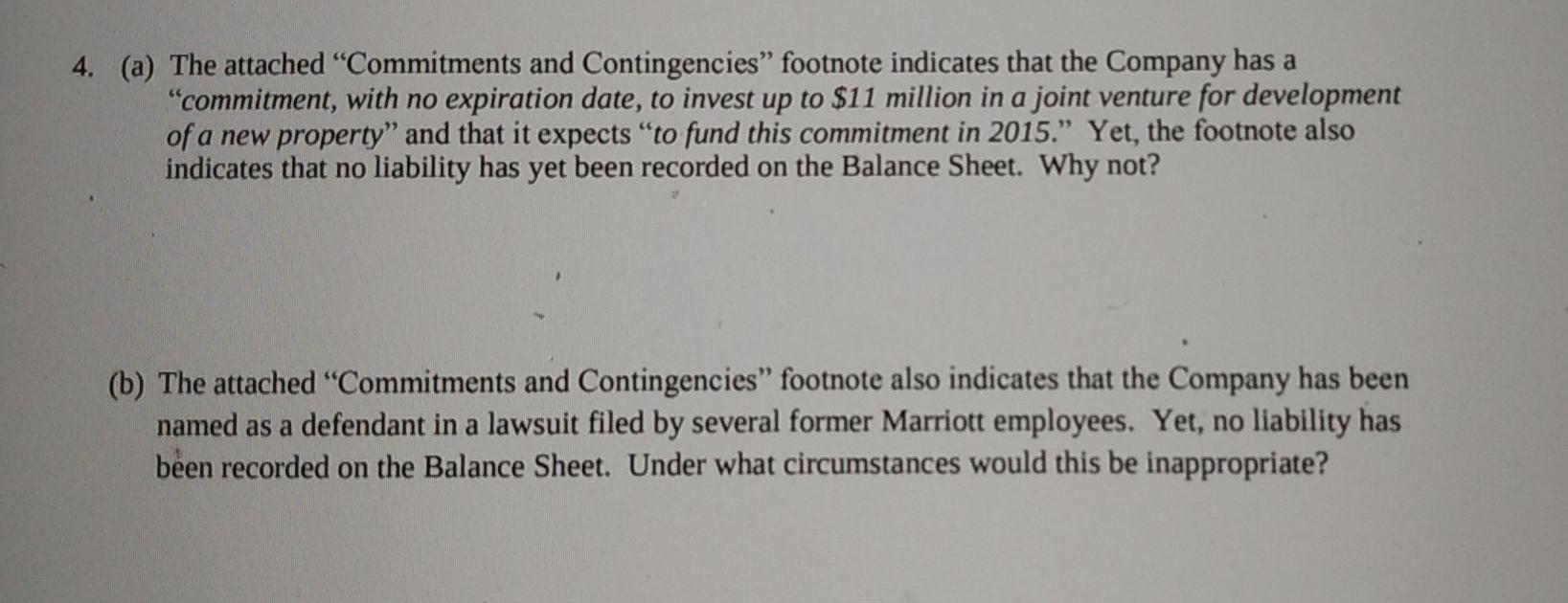

Guarantees We issue guarantees to certain lenders and hotel owners, chiefly to obtain long-term management contracts. The guarantees generally have a stated maximum funding amount and a term of four to ten years. The terms of guarantees to lenders generally require us to fund if cash flows from hotel operations are inadequate to cover annual debt service or to repay the loan at the end of the term [...] Guarantee fundings to lenders and hotel owners are generally recoverable as loans repayable to us out of future hotel cash flows and/or proceeds from the sale of hotels [...] Our liability at year-end 2014 for guarantees for which we are the primary obligor is reflected in our Balance Sheet as $4 million of "Accrued expenses and other" and $51 million of "Other noncurrent liabilities." Commitments In addition to the guarantees we note in the preceding paragraphs, at year-end 2014, we had the following commitments outstanding, which are not recorded on our Balance Sheet: A commitment to invest up to $8 million of equity for a non-controlling interest in a partnership that plans to purchase North American full-service and limited-service properties, or purchase or develop hotel-anchored mixed-use real estate projects. We expect to fund $1 million of this commitment in 2015. We do not expect to fund the remaining $7 million of this commitment, which expires in 2016. A commitment, with no expiration date, to invest up to $11 million in a joint venture for development of a new property. We expect to fund this commitment in 2015, Several commitments aggregating $32 million with no expiration date and which we do not expect to fund. Legal Proceedings On January 19, 2010, several former Marriott employees (the "plaintiffs") filed a putative class action complaint against us and the Stock Plan (the "defendants"), alleging that certain equity awards of deferred bonus stock granted to the plaintiffs and other current and former employees for fiscal years 1963 through 1989 are subject to vesting requirements under the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), that are in certain circumstances more rapid than those set forth in the awards. The action was brought in the United States District Court for the District of Maryland (Greenbelt Division), and Dennis Walter Bond Sr. and Michael P. Steigman were the remaining named plaintiffs. Class certification was denied, and on January 16, 2015, the court granted Marriott's motion for summary judgment and dismissed the case. Plaintiffs have filed a notice of appeal with the U.S. Court of Appeals for the Fourth Circuit. In March 2012, the Korea Fair Trade Commission ("KFTC") obtained documents from two of our managed hotels in Seoul, Korea in connection with an investigation which we believe is focused on pricing of hotel services within the Seoul region. Since then, the KFTC has conducted additional fact-gathering at those two hotels and also has collected information from another Marriott managed hotel located in Seoul. We understand that the KFTC also has sought documents from numerous other hotels in Seoul and other parts of Korea that we do not operate, own or franchise, We have not yet received a complaint or other legal process. We are cooperating with this investigation. 4. (a) The attached "Commitments and Contingencies" footnote indicates that the Company has a "commitment, with no expiration date, to invest up to $11 million in a joint venture for development of a new property" and that it expects "to fund this commitment in 2015." Yet, the footnote also indicates that no liability has yet been recorded on the Balance Sheet. Why not? (b) The attached "Commitments and Contingencies" footnote also indicates that the Company has been named as a defendant in a lawsuit filed by several former Marriott employees. Yet, no liability has been recorded on the Balance Sheet. Under what circumstances would this be inappropriate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

4 a The commitment to invest in a joint venture for development of property is a capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started