Answered step by step

Verified Expert Solution

Question

1 Approved Answer

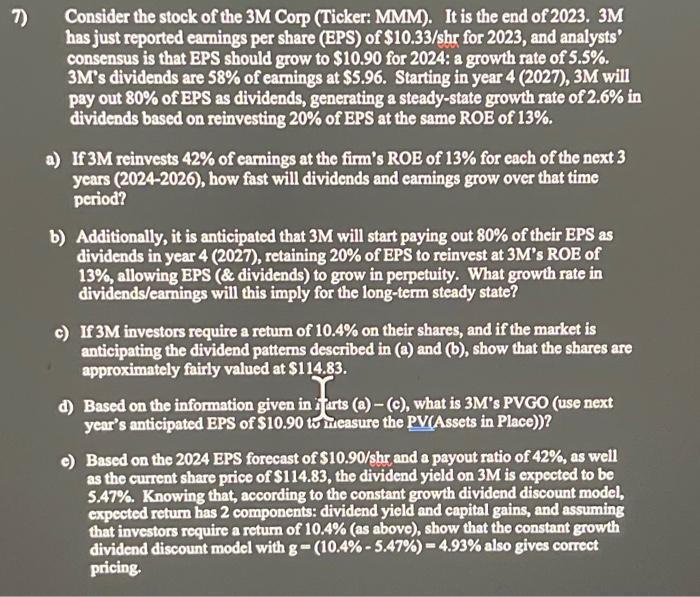

7) Consider the stock of the 3M Corp (Ticker: MMM). It is the end of 2023. 3M has just reported earnings per share (EPS)

7) Consider the stock of the 3M Corp (Ticker: MMM). It is the end of 2023. 3M has just reported earnings per share (EPS) of $10.33/shr for 2023, and analysts' consensus is that EPS should grow to $10.90 for 2024: a growth rate of 5.5%. 3M's dividends are 58% of earnings at $5.96. Starting in year 4 (2027), 3M will pay out 80% of EPS as dividends, generating a steady-state growth rate of 2.6% in dividends based on reinvesting 20% of EPS at the same ROE of 13%. a) If 3M reinvests 42% of earnings at the firm's ROE of 13% for each of the next 3 years (2024-2026), how fast will dividends and carnings grow over that time period? b) Additionally, it is anticipated that 3M will start paying out 80% of their EPS as dividends in year 4 (2027), retaining 20% of EPS to reinvest at 3M's ROE of 13%, allowing EPS (& dividends) to grow in perpetuity. What growth rate in dividends/earnings will this imply for the long-term steady state? c) If 3M investors require a return of 10.4% on their shares, and if the market is anticipating the dividend patterns described in (a) and (b), show that the shares are approximately fairly valued at $114.83. d) Based on the information given in arts (a)-(c), what is 3M's PVGO (use next year's anticipated EPS of $10.90 to measure the PV(Assets in Place))? e) Based on the 2024 EPS forecast of $10.90/shr and a payout ratio of 42%, as well as the current share price of $114.83, the dividend yield on 3M is expected to be 5.47%. Knowing that, according to the constant growth dividend discount model, expected return has 2 components: dividend yield and capital gains, and assuming that investors require a return of 10.4% (as above), show that the constant growth dividend discount model with g-(10.4% -5.47%)-4.93% also gives correct pricing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a If 3M reinvests 42 of earnings at the firms ROE of 13 for each of the next 3 years 20242026 the growth rate of earnings over that period can be calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started