Answered step by step

Verified Expert Solution

Question

1 Approved Answer

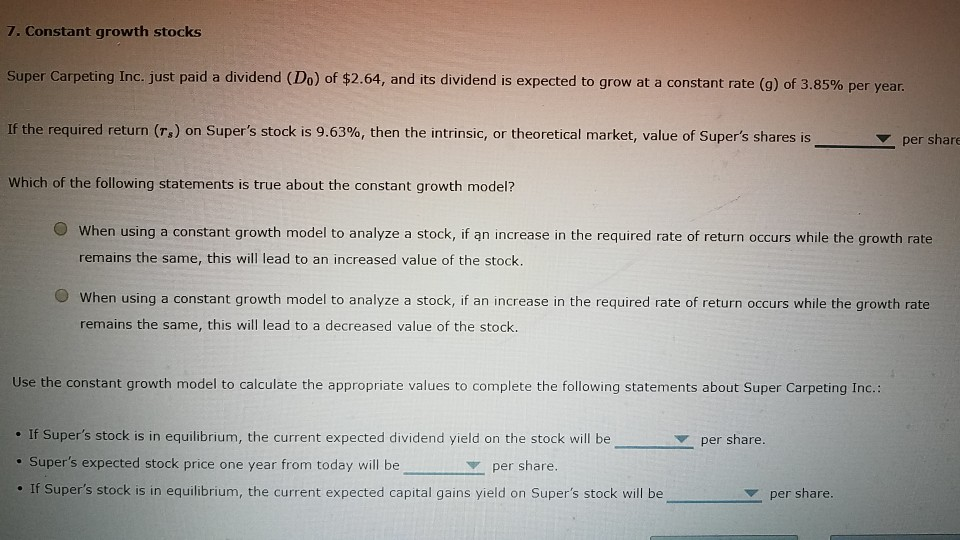

7. Constant growth stocks Super Carpeting Inc. just paid a dividend (D) of $2.64, and its dividend is expected to grow at a constant rate

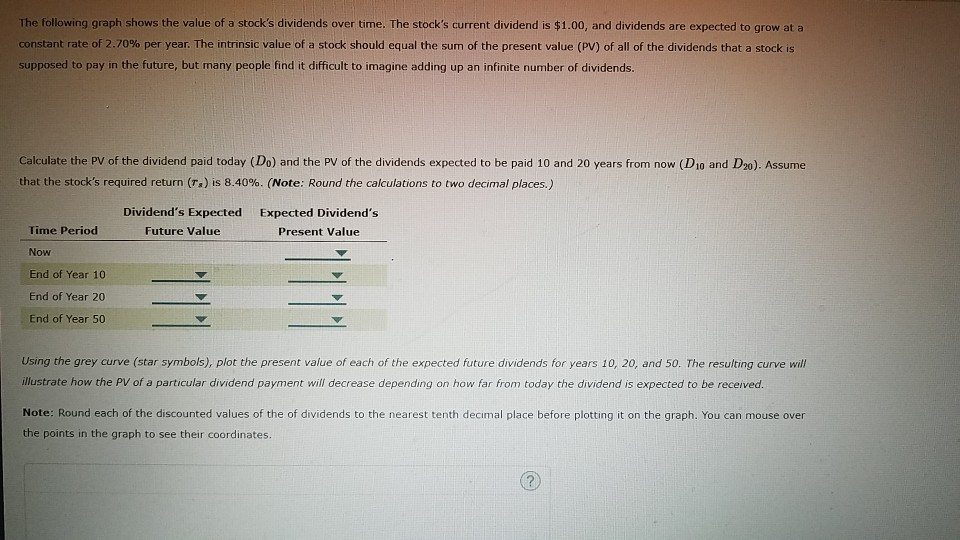

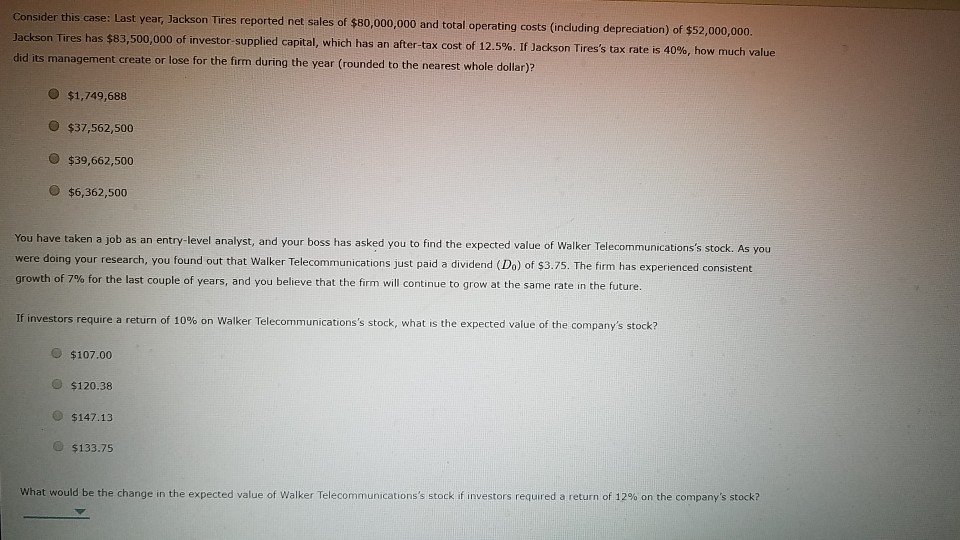

7. Constant growth stocks Super Carpeting Inc. just paid a dividend (D) of $2.64, and its dividend is expected to grow at a constant rate (9) of 3.85% per year. If the required return (Ts) on Super's stock is 9.63%, then the intrinsic, or theoretical market, value of Super's shares is per share Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a decreased value of the stock. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc.: per share. If Super's stock is in equilibrium, the current expected dividend yield on the stock will be Super's expected stock price one year from today will be per share. If Super's stock is in equilibrium, the current expected capital gains yield on Super's stock will be per share. The following graph shows the value of a stock's dividends over time. The stock's current dividend is $1.00, and dividends are expected to grow at a constant rate of 2.70% per year. The intrinsic value of a stock should equal the sum of the present value (PV) of all of the dividends that a stock is supposed to pay in the future, but many people find it difficult to imagine adding up an infinite number of dividends. Calculate the PV of the dividend paid today (Do) and the PV of the dividends expected to be paid 10 and 20 years from now (Dio and D20). Assume that the stock's required return (r.) is 8.40%. (Note: Round the calculations to two decimal places.) Dividend's Expected Future Value Expected Dividend's Present Value Time Period Now End of Year 10 End of Year 20 End of Year 50 Using the grey curve (star symbols), plot the present value of each of the expected future dividends for years 10, 20, and 50. The resulting curve will illustrate how the PV of a particular dividend payment will decrease depending on how far from today the dividend is expected to be received. Note: Round each of the discounted values of the of dividends to the nearest tenth decimal place before plotting it on the graph. You can mouse over the points in the graph to see their coordinates. Consider this case: Last year, Jackson Tires reported net sales of $80,000,000 and total operating costs (including depreciation) of $52,000,000 Jackson fires has $83,500,000 of investor supplied capital, which has an after-tax cost of 12.5%. If Jackson Tires's tax rate is 40%, how much value did its management create or lose for the firm during the year (rounded to the nearest whole dollar)? $1,749,688 $37,562,500 $39,662,500 $6,362,500 You have taken a job as an entry-level analyst, and your boss has asked you to find the expected value of Walker Telecommunications's stock. As you were doing your research, you found out that Walker Telecommunications just paid a dividend (Do) of $3.75. The firm has experienced consistent growth of 7% for the last couple of years, and you believe that the firm will continue to grow at the same rate in the future. If investors require a return of 10% on Walker Telecommunications's stock, what is the expected value of the company's stock? $107.00 $120.38 $147.13 $133.75 What would be the change in the expected value of Walker Telecommunications's stock if investors required a return of 12% on the company's stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started