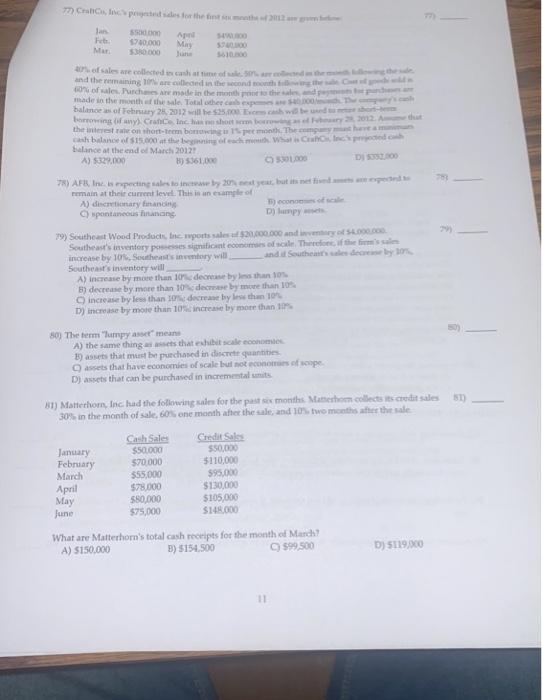

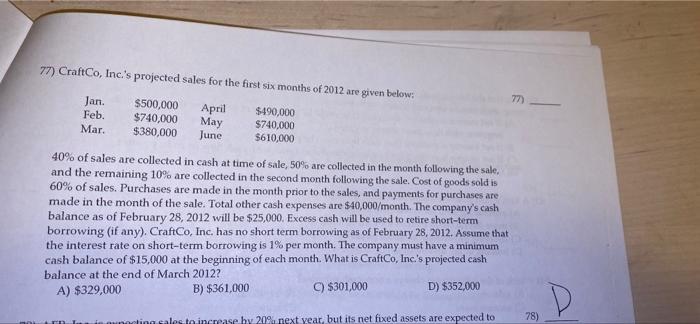

7) Crates the Ft DO 300.000 May Mar of sales are collected in case of the and the remaining are collected in the second to the morale. Purch a made in the more the prima made in the month of the sale. Total there balance of February 23, 2012 ile 3.cc bewed LingayCranc Inc. she met 12A the rate on short-term bee monthThe compra cash balance of $15.000 at the begin to balance at the end of March 2012 A) 5329.000 H) 5610 DISSE 7) AFB, Ines expecting sales to aby 20 year, but its nettpad remain at the current level. This is an esample of A) discretionary financing monol ) spontaneous hranang D) lampy 79) Southeast Wood Products, the parts se 20.000.000 and every of St. Southeast's inventory poes significant economies of scale. There he's increase by 10, Southeast inventory will and Southeast 10 Southeast's inventory will A) increase by more than 10 decrease by than 10 B) decrease by more than 10% decay more than 10 increase by less than to decrease by less than 10 D) increase by more than 105 increase by more than 10 80) The term "lumpy at means A) the same thing as that exhibit scale con B) assets that must be purchased in disce quantities assets that have economies of scale but not comes tope D) assets that can be purchased in incrementalis 81 1) Matterhorn, Inched the following sales for the past six months Maestom collects its credit sales 30% in the month of sale, 60% one month after the sale, and 10% two months after the sale January February March April May June Cash Sales 550.000 570.000 355.000 $78000 550.000 $75,000 Credit Sals $50,000 5110,000 $95.000 $130,000 $105,000 $14.000 What are Matterhorn's total cash receipts for the month of March A) 5150.000 B) 5154,500 $99.500 D) 5119.00 11 77) CraftCo, Inc.'s projected sales for the first six months of 2012 are given below: 77) Jan. $500,000 April $490,000 Feb. $740,000 May $740,000 Mar. $380,000 June $610,000 40% of sales are collected in cash at time of sale, 50% are collected in the month following the sale. and the remaining 10% are collected in the second month following the sale. Cost of goods sold is 60% of sales. Purchases are made in the month prior to the sales, and payments for purchases are made in the month of the sale. Total other cash expenses are $40,000/month. The company's cash balance as of February 28, 2012 will be $25,000. Excess cash will be used to retire short-term borrowing (if any). CraftCo, Inc. has no short term borrowing as of February 28, 2012. Assume that the interest rate on short-term borrowing is 1% per month. The company must have a minimum cash balance of $15,000 at the beginning of each month. What is CraftCo, Inc.'s projected cash balance at the end of March 2012? C) $301,000 D) $352,000 A) $329,000 B) $361,000 78) acting sales to increase hy 20 next year but its net fixed assets are expected to D 7) Crates the Ft DO 300.000 May Mar of sales are collected in case of the and the remaining are collected in the second to the morale. Purch a made in the more the prima made in the month of the sale. Total there balance of February 23, 2012 ile 3.cc bewed LingayCranc Inc. she met 12A the rate on short-term bee monthThe compra cash balance of $15.000 at the begin to balance at the end of March 2012 A) 5329.000 H) 5610 DISSE 7) AFB, Ines expecting sales to aby 20 year, but its nettpad remain at the current level. This is an esample of A) discretionary financing monol ) spontaneous hranang D) lampy 79) Southeast Wood Products, the parts se 20.000.000 and every of St. Southeast's inventory poes significant economies of scale. There he's increase by 10, Southeast inventory will and Southeast 10 Southeast's inventory will A) increase by more than 10 decrease by than 10 B) decrease by more than 10% decay more than 10 increase by less than to decrease by less than 10 D) increase by more than 105 increase by more than 10 80) The term "lumpy at means A) the same thing as that exhibit scale con B) assets that must be purchased in disce quantities assets that have economies of scale but not comes tope D) assets that can be purchased in incrementalis 81 1) Matterhorn, Inched the following sales for the past six months Maestom collects its credit sales 30% in the month of sale, 60% one month after the sale, and 10% two months after the sale January February March April May June Cash Sales 550.000 570.000 355.000 $78000 550.000 $75,000 Credit Sals $50,000 5110,000 $95.000 $130,000 $105,000 $14.000 What are Matterhorn's total cash receipts for the month of March A) 5150.000 B) 5154,500 $99.500 D) 5119.00 11 77) CraftCo, Inc.'s projected sales for the first six months of 2012 are given below: 77) Jan. $500,000 April $490,000 Feb. $740,000 May $740,000 Mar. $380,000 June $610,000 40% of sales are collected in cash at time of sale, 50% are collected in the month following the sale. and the remaining 10% are collected in the second month following the sale. Cost of goods sold is 60% of sales. Purchases are made in the month prior to the sales, and payments for purchases are made in the month of the sale. Total other cash expenses are $40,000/month. The company's cash balance as of February 28, 2012 will be $25,000. Excess cash will be used to retire short-term borrowing (if any). CraftCo, Inc. has no short term borrowing as of February 28, 2012. Assume that the interest rate on short-term borrowing is 1% per month. The company must have a minimum cash balance of $15,000 at the beginning of each month. What is CraftCo, Inc.'s projected cash balance at the end of March 2012? C) $301,000 D) $352,000 A) $329,000 B) $361,000 78) acting sales to increase hy 20 next year but its net fixed assets are expected to D