Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Cross Company reported the following results for the year ended December 31, 2021, its first year of operations: 2021 Income (per books before income

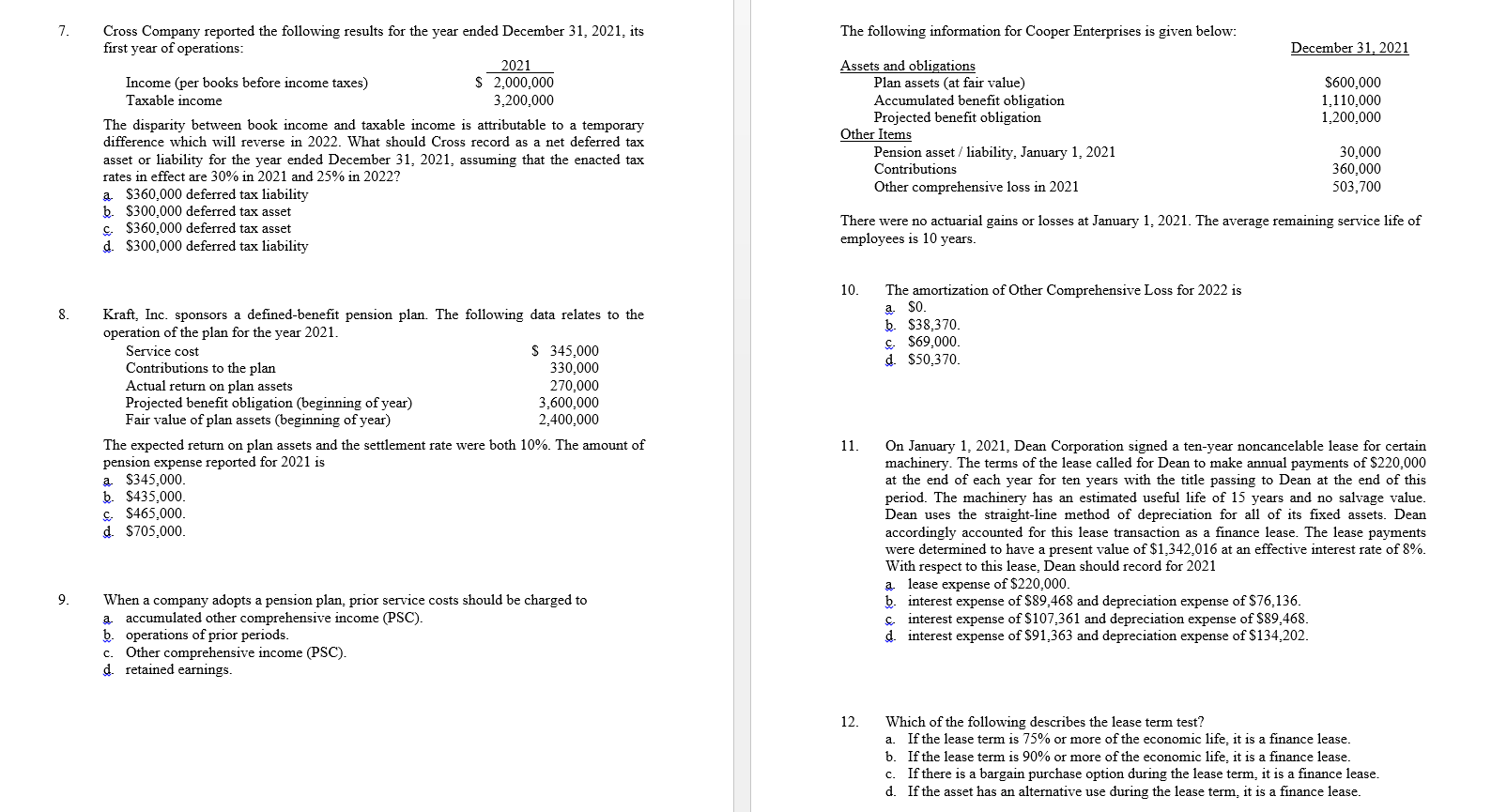

7. Cross Company reported the following results for the year ended December 31, 2021, its first year of operations: 2021 Income (per books before income taxes) $ 2,000,000 Taxable income 3,200,000 The disparity between book income and taxable income is attributable to a temporary difference which will reverse in 2022. What should Cross record as a net deferred tax asset or liability for the year ended December 31, 2021, assuming that the enacted tax rates in effect are 30% in 2021 and 25% in 20227 a $360,000 deferred tax liability b. $300,000 deferred tax asset c. $360,000 deferred tax asset d. $300.000 deferred tax liability The following information for Cooper Enterprises is given below: December 31, 2021 Assets and obligations Plan assets (at fair value) $600,000 Accumulated benefit obligation 1.110,000 Projected benefit obligation 1,200,000 Other Items Pension asset / liability, January 1, 2021 30,000 Contributions 360,000 Other comprehensive loss in 2021 503.700 There were no actuarial gains or losses at January 1, 2021. The average remaining service life of employees is 10 years. 10. 8. The amortization of Other Comprehensive Loss for 2022 is a. SO. b. $38,370. $ $69,000. d $50,370. Kraft, Inc. sponsors a defined-benefit pension plan. The following data relates to the operation of the plan for the year 2021. Service cost S 345,000 Contributions to the plan 330,000 Actual return on plan assets 270.000 Projected benefit obligation (beginning of year) 3,600,000 Fair value of plan assets (beginning of year) 2,400,000 The expected return on plan assets and the settlement rate were both 10%. The amount of pension expense reported for 2021 is a $345.000 b. $435,000. $ $465,000. d. $705,000. 11. On January 1, 2021, Dean Corporation signed a ten-year noncancelable lease for certain machinery. The terms of the lease called for Dean to make annual payments of $220,000 at the end of each year for ten years with the title passing to Dean at the end of this period. The machinery has an estimated useful life of 15 years and no salvage value. Dean uses the straight-line method of depreciation for all of its fixed assets. Dean accordingly accounted for this lease transaction as a finance lease. The lease payments were determined to have a present value of $1,342,016 at an effective interest rate of 8%. With respect to this lease, Dean should record for 2021 a. lease expense of $220,000. b. interest expense of $89,468 and depreciation expense of $76,136. interest expense of $107,361 and depreciation expense of $89.468. d interest expense of $91,363 and depreciation expense of $134,202. 9. a. When a company adopts a pension plan, prior service costs should be charged to accumulated other comprehensive income (PSC). b. operations of prior periods. Other comprehensive income (PSC). d retained earnings. c. 12. a Which of the following describes the lease term test? If the lease term is 75% or more of the economic life, it is a finance lease. b. If the lease term is 90% or more of the economic life, it is a finance lease. c. If there is a bargain purchase option during the lease term, it is a finance lease. d. If the asset has an alternative use during the lease term, it is a finance lease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started