Answered step by step

Verified Expert Solution

Question

1 Approved Answer

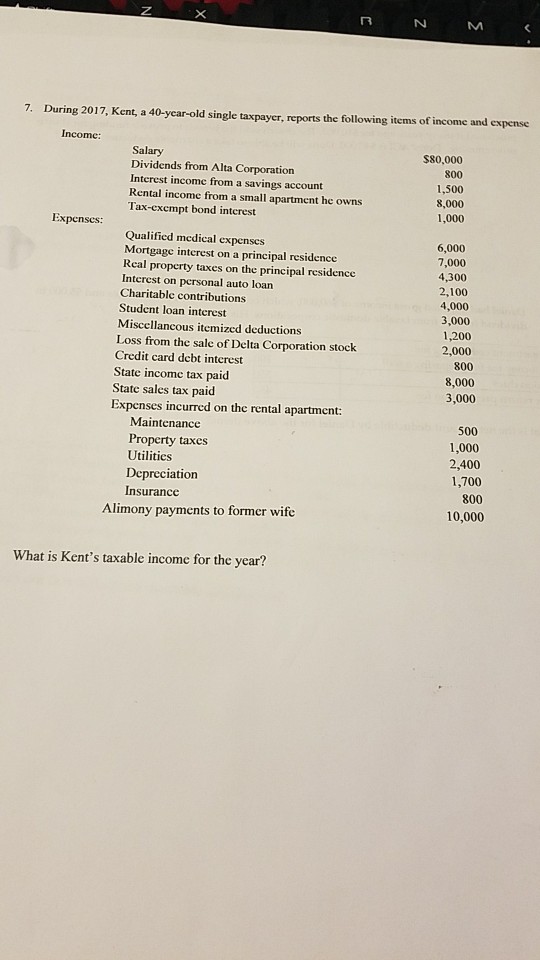

7. During 2017, Kent, a 40-ycar-old single taxpayer, reports the following items of income and expense Income: $80,000 Salary Dividends from Alta Corporation Interest income

7. During 2017, Kent, a 40-ycar-old single taxpayer, reports the following items of income and expense Income: $80,000 Salary Dividends from Alta Corporation Interest income from a savings account Rental income from a small apartment he owns Tax-exempt bond interest 1,500 8,000 1,000 Expenscs: Qualified medical expenscs Mortgage interest on a principal residence Real property taxes on the principal residence Interest on personal auto loan Charitable contributions Student loan interest Misccllancous itemized deductions 6,000 4,300 2,100 3,000 1,200 2,000 Loss from the sale of Delta Corporation stock Credit card debt interest 8,000 State income tax paid State sales tax paid Expenses incurred on the rental apartment Maintenance Property taxes Utilitics Depreciation Insurance 500 1,000 2,400 1,700 800 10,000 Alimony payments to former wife What is Kent's taxable income for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started