Answered step by step

Verified Expert Solution

Question

1 Approved Answer

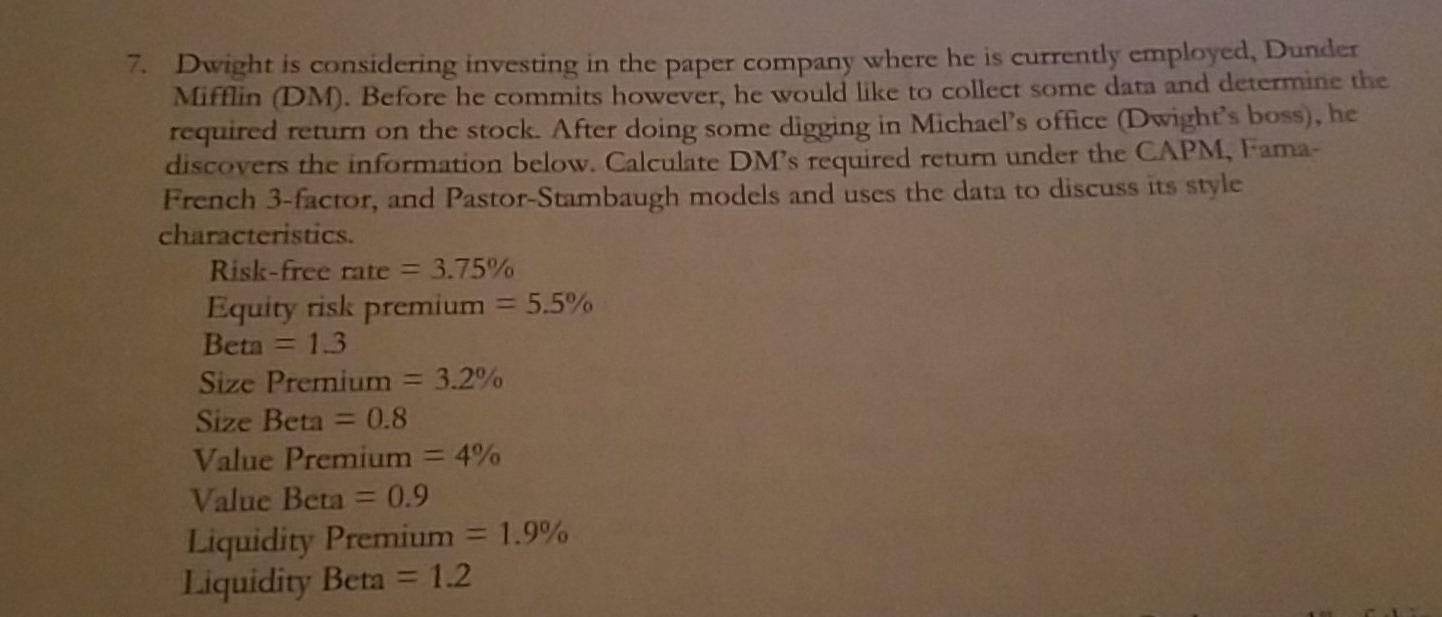

7. Dwight is considering investing in the paper company where he is currently employed, Dunder Mifflin (DM). Before he commits however, he would like to

7. Dwight is considering investing in the paper company where he is currently employed, Dunder Mifflin (DM). Before he commits however, he would like to collect some data and determine the required return on the stock. After doing some digging in Michael's office (Dwight's boss), he discovers the information below. Calculate DM's required return under the CAPM, Fama- French 3-factor, and Pastor-Stambaugh models and uses the data to discuss its style characteristics. Risk-free rate = 3.75% Equity risk premium = 5.5% Beta = 1.3 Size Premium = 3.2% Size Beta = 0.8 Value Premium = 4% Value Beta = 0.9 Liquidity Premium = 1.9% Liquidity Beta = 1.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started