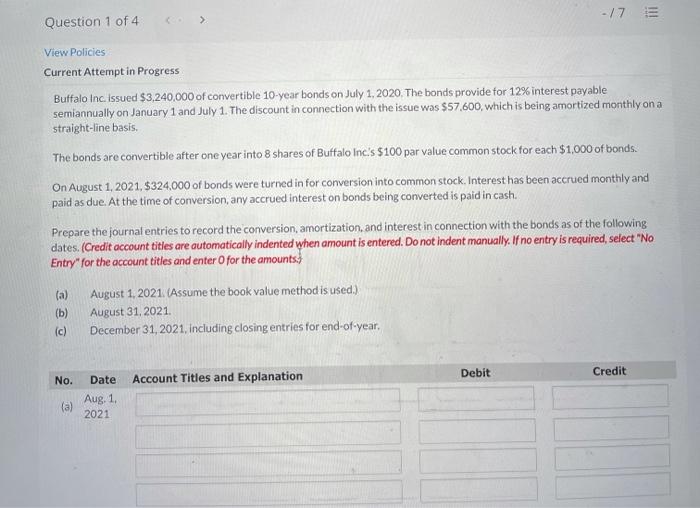

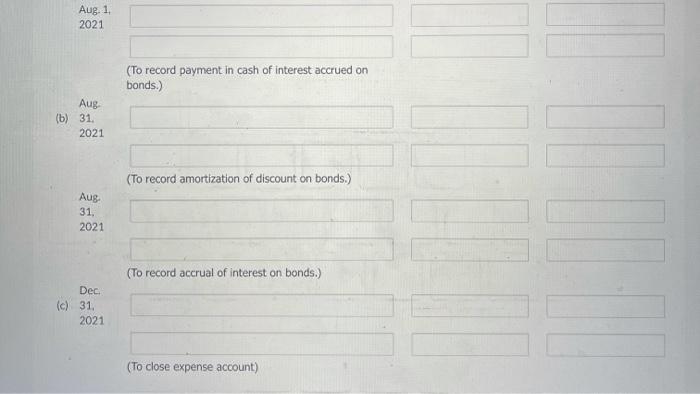

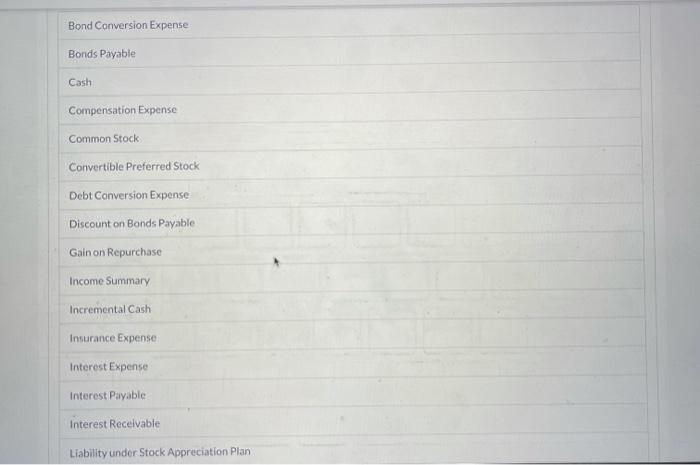

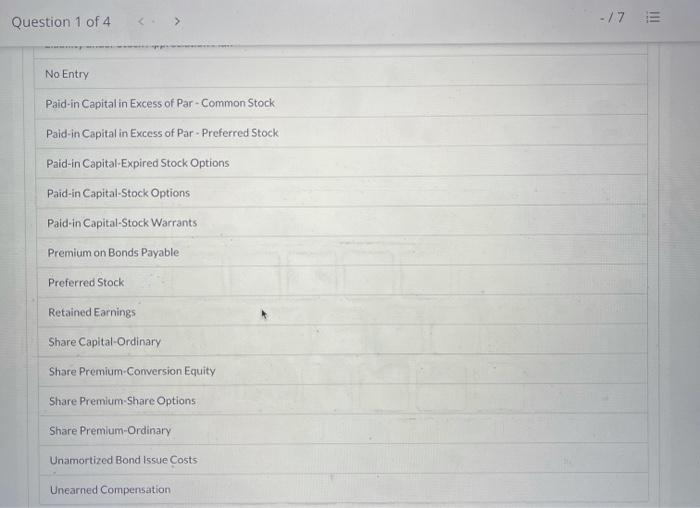

-/7 E Question 1 of 4 > View Policies Current Attempt in Progress Buffalo Inc issued $3,240.000 of convertible 10-year bonds on July 1, 2020. The bonds provide for 12% interest payable semiannually on January 1 and July 1. The discount in connection with the issue was $57,600, which is being amortized monthly on a straight-line basis. The bonds are convertible after one year into 8 shares of Buffalo Inc's $100 par value common stock for each $1,000 of bonds. On August 1, 2021,$324,000 of bonds were turned in for conversion into common stock, Interest has been accrued monthly and paid as due. At the time of conversion, any accrued interest on bonds being converted is paid in cash. Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as of the following dates. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts: (a) (b) (c) August 1, 2021. (Assume the book value method is used.) August 31, 2021 December 31, 2021, including closing entries for end-of-year, Debit Credit No. Account Titles and Explanation Date Aug. 1 2021 (a) Aug. 1 2021 (To record payment in cash of interest accrued on bonds.) Aug (b) 31. 2021 (To record amortization of discount on bonds.) Aug 31, 2021 (To record accrual of interest on bonds.) Dec (c) 31 2021 (To close expense account) Bond Conversion Expense Bonds Payable Cash Compensation Expense Common Stock Convertible Preferred Stock Debt Conversion Expense Discount on Bonds Payable Gain on Repurchase Income Summary Incremental Cash Insurance Expense Interest Expense Interest Payable Interest Receivable Liability under Stock Appreciation Plan Question 1 of 4 -/7 E No Entry Paid-in Capital in Excess of Par - Common Stock Paid in Capital in Excess of Par-Preferred Stock Paid-in Capital-Expired Stock Options Paid-in Capital-Stock Options Paid-in Capital-Stock Warrants Premium on Bonds Payable Preferred Stock Retained Earnings Share Capital-Ordinary Share Premium-Conversion Equity Share Premium Share Options Share Premium-Ordinary Unamortized Bond Issue Costs Unearned Compensation