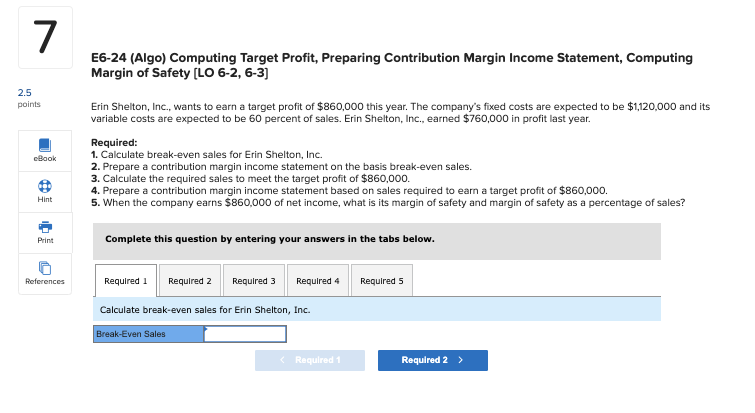

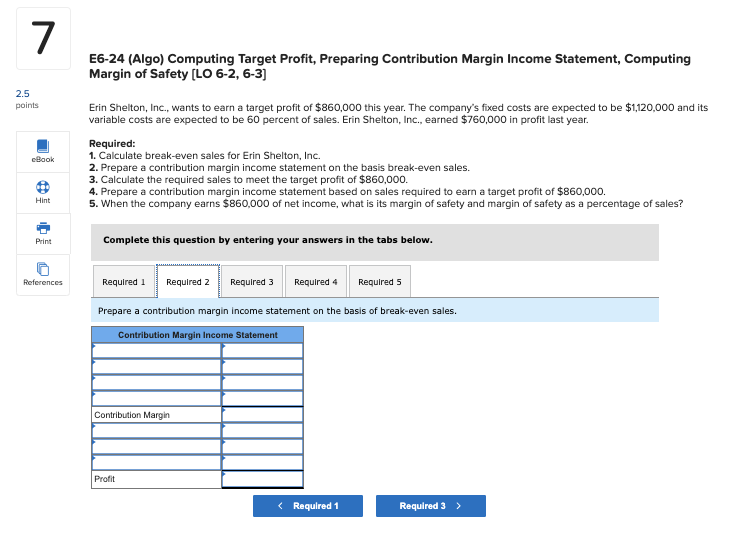

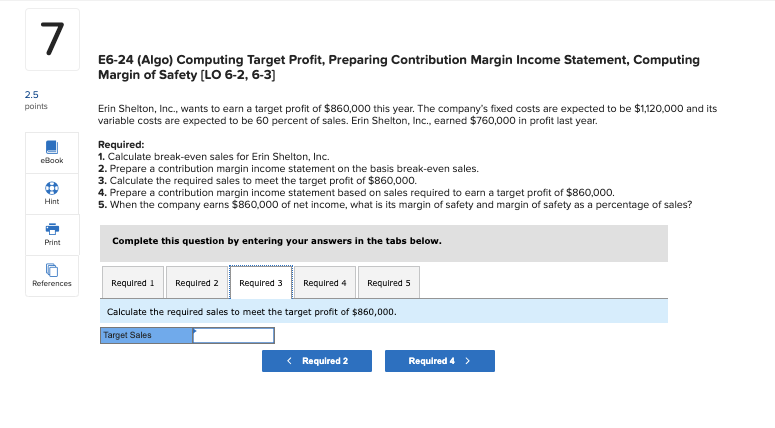

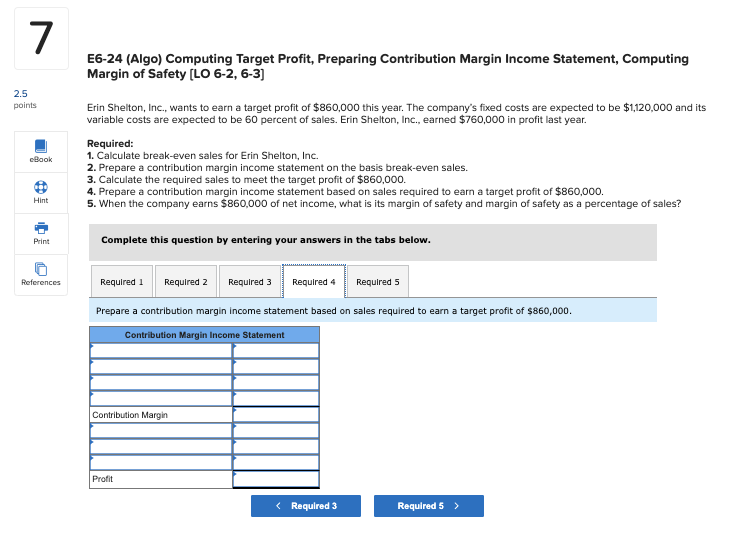

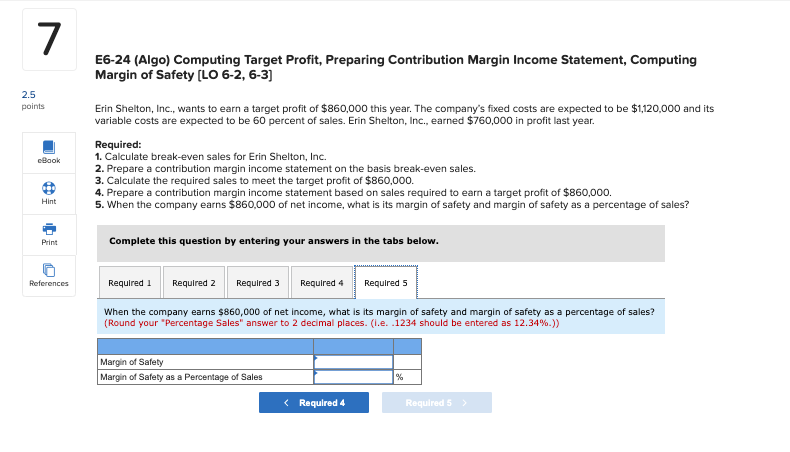

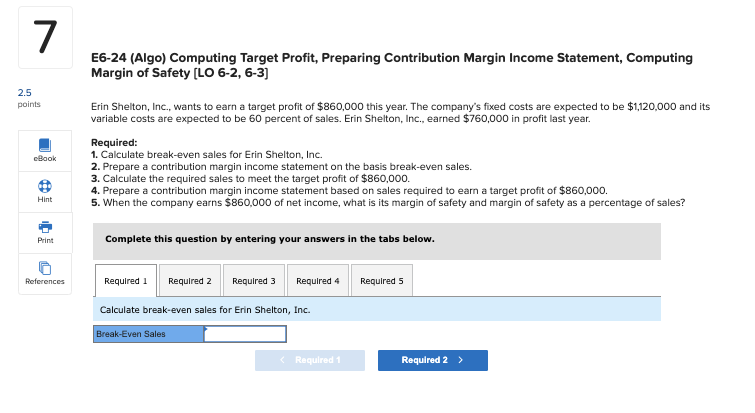

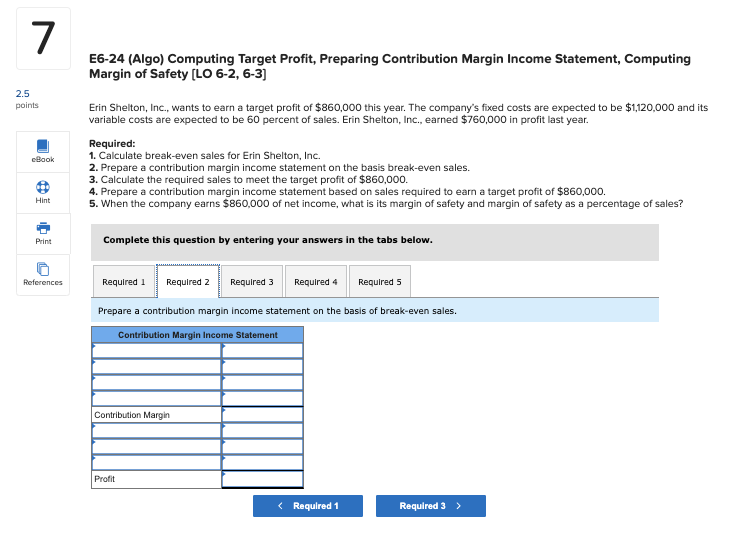

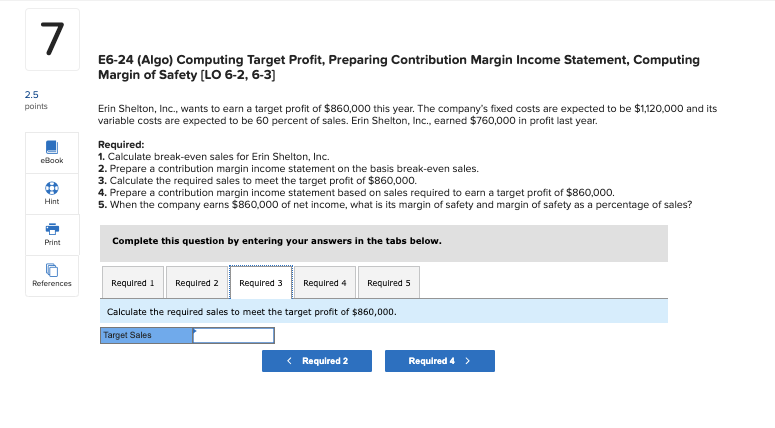

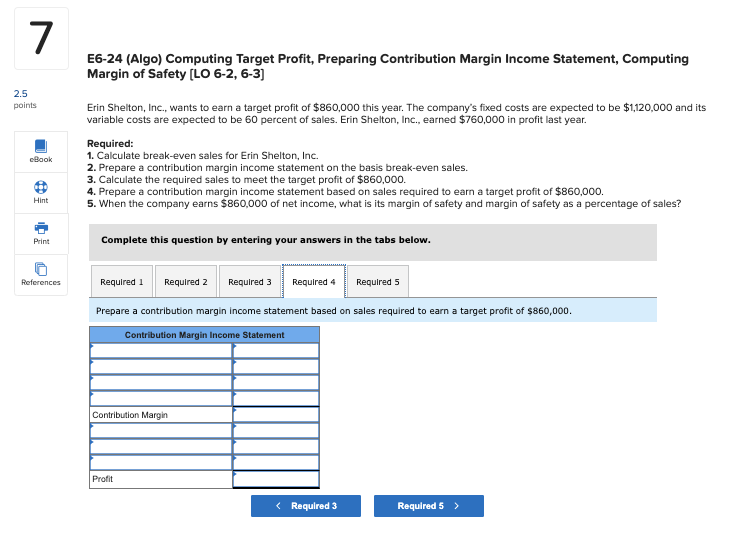

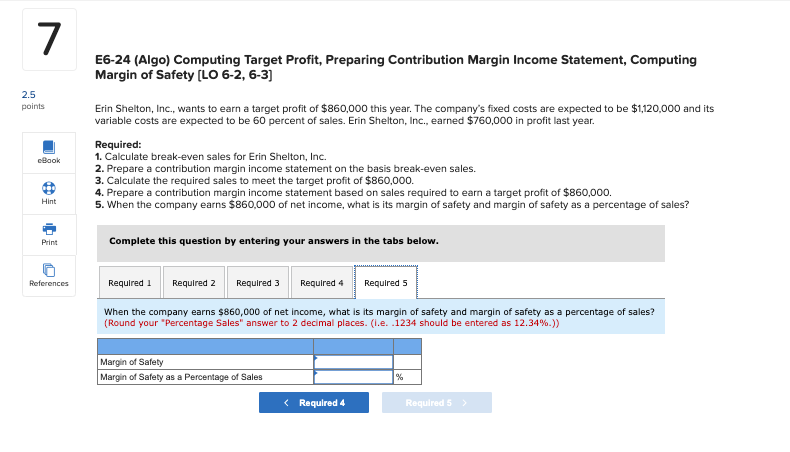

7 E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety [LO 6-2, 6-3) 2.5 points cBook Erin Shelton, Inc., wants to earn a target profit of $860,000 this year. The company's fixed costs are expected to be $1,120,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $760,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $860,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $860,000. 5. When the company earns $860,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Hint Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Required 4 Required 5 Calculate break-even sales for Erin Shelton, Inc. Break-Even Sales Required 1 Required 2 > 7 E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety (LO 6-2, 6-3) 2.5 points cBook Erin Shelton, Inc., wants to earn a target profit of $860,000 this year. The company's fixed costs are expected to be $1,120,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $760,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $860,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $860,000. 5. When the company earns $860,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Hint Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement on the basis of break-even sales. Contribution Margin Income Statement Contribution Margin Profit 7 E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety (LO 6-2, 6-3) 2.5 points cBook Erin Shelton, Inc., wants to earn a target profit of $860,000 this year. The company's fixed costs are expected to be $1,120,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $760,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $860,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $860,000. 5. When the company earns $860,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Hint Print Complete this question by entering your answers in the tabs below. 0 References Required 1 Required 2 Required 3 Required 4 Required 5 Calculate the required sales to meet the target profit of $860,000. Target Sales 7 E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety (LO 6-2, 6-3) 2.5 points cBook Erin Shelton, Inc., wants to earn a target profit of $860,000 this year. The company's fixed costs are expected to be $1,120,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $760,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $860,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $860,000. 5. When the company earns $860,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Hint Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement based on sales required to earn a target profit of $860,000. Contribution Margin Income Statement Contribution Margin Profit 7 E6-24 (Algo) Computing Target Profit, Preparing Contribution Margin Income Statement, Computing Margin of Safety (LO 6-2, 6-3] 2.5 points cBook Erin Shelton, Inc., wants to earn a target profit of $860,000 this year. The company's fixed costs are expected to be $1,120,000 and its variable costs are expected to be 60 percent of sales. Erin Shelton, Inc., earned $760,000 in profit last year. Required: 1. Calculate break-even sales for Erin Shelton, Inc. 2. Prepare a contribution margin income statement on the basis break-even sales. 3. Calculate the required sales to meet the target profit of $860,000. 4. Prepare a contribution margin income statement based on sales required to earn a target profit of $860,000. 5. When the company earns $860,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? Hint Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Required 4 Required 5 When the company earns $860,000 of net income, what is its margin of safety and margin of safety as a percentage of sales? (Round your "Percentage Sales" answer to 2 decimal places. (l.e. .1234 should be entered as 12.34%.)) Margin of Safety Margin of Safety as a Percentage of Sales %