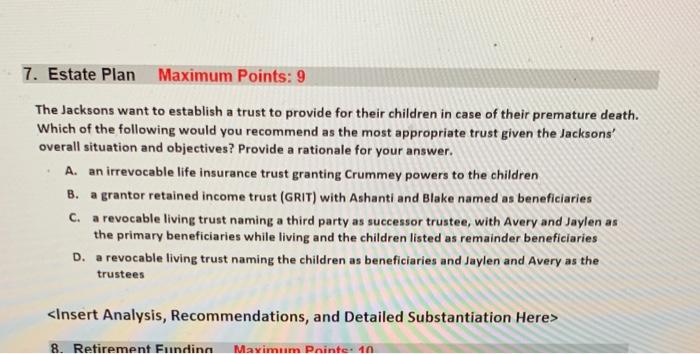

7. Estate Plan Maximum Points: 9 The Jacksons want to establish a trust to provide for their children in case of their premature death. Which of the following would you recommend as the most appropriate trust given the Jacksons' overall situation and objectives? Provide a rationale for your answer. A. an irrevocable life insurance trust granting Crummey powers to the children B. a grantor retained income trust (GRIT) with Ashanti and Blake named as beneficiaries c. a revocable living trust naming a third party as successor trustee, with Avery and Jaylen as the primary beneficiaries while living and the children listed as remainder beneficiaries D. a revocable living trust naming the children as beneficiaries and Jaylen and Avery as the trustees

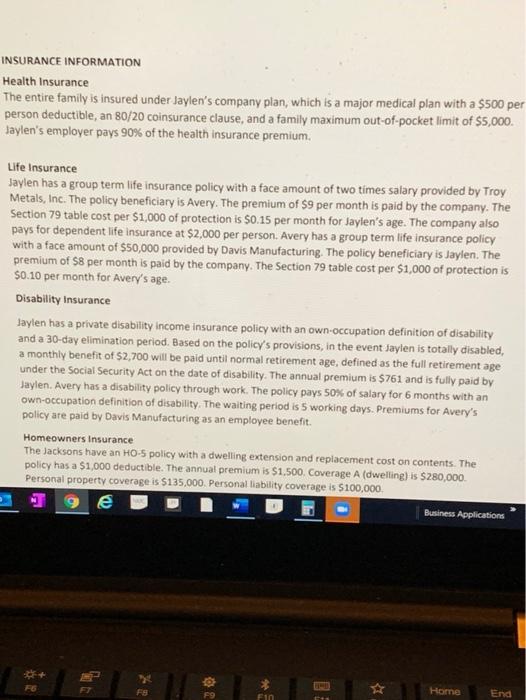

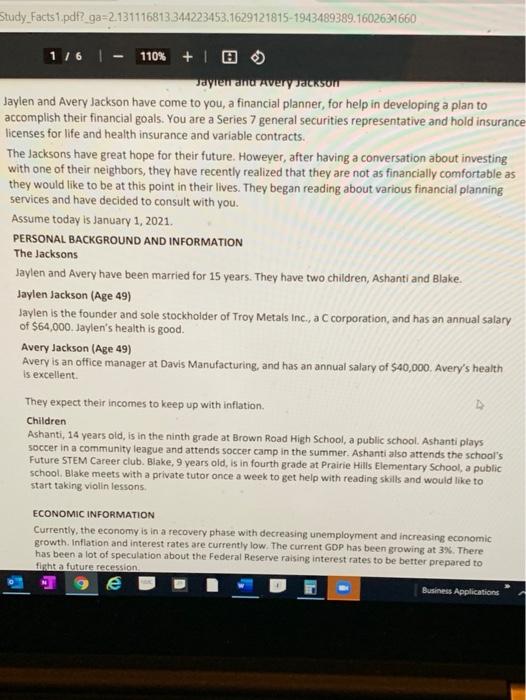

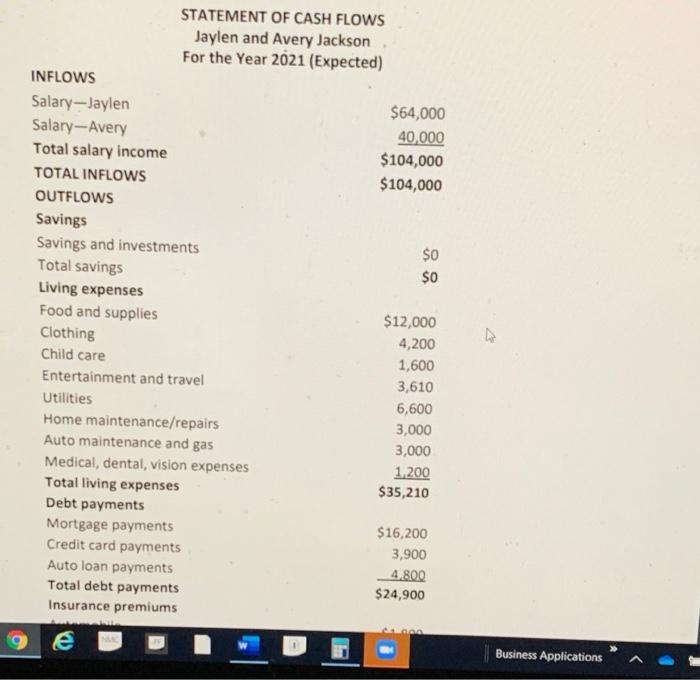

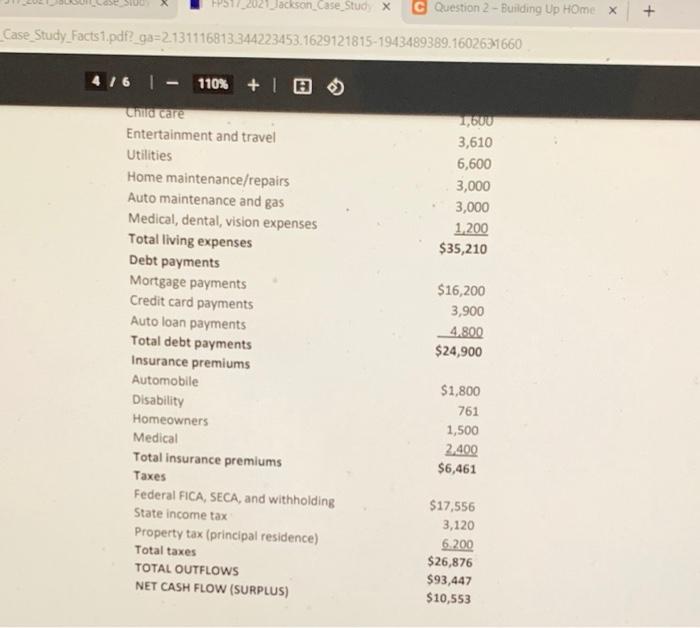

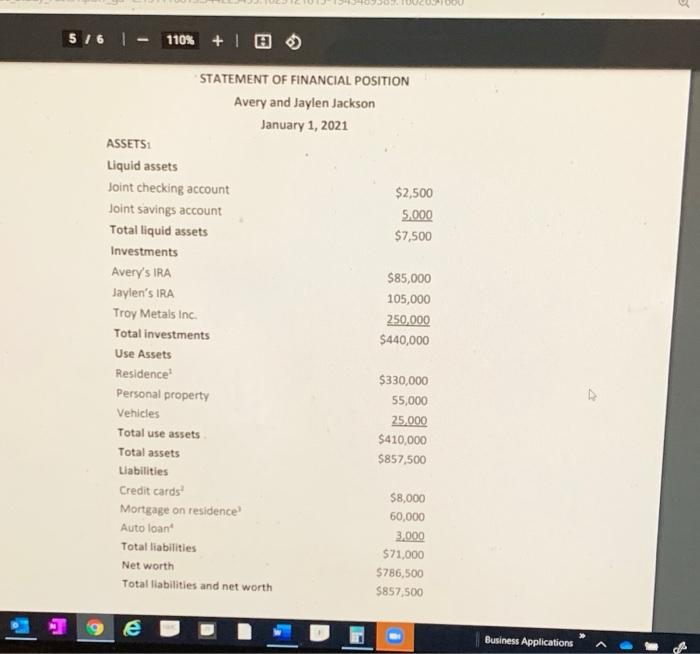

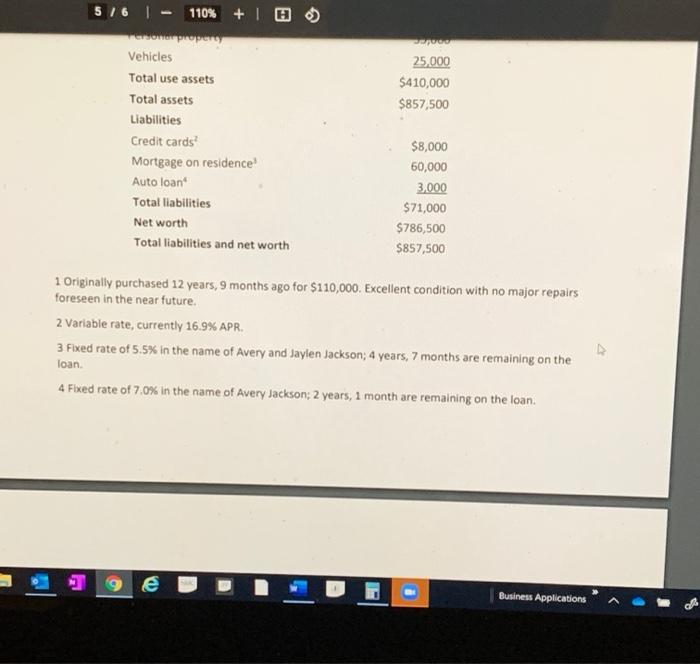

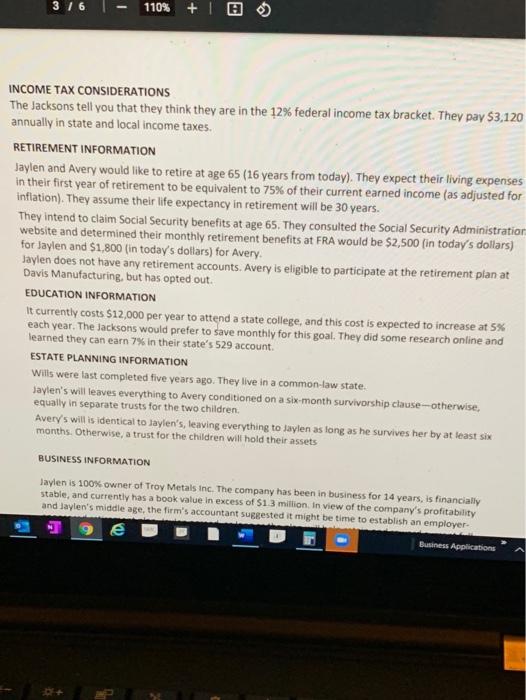

8. Retirement Fundina Maximum Pointe: 10 INSURANCE INFORMATION Health Insurance The entire family is insured under Jaylen's company plan, which is a major medical plan with a $500 per person deductible, an 80/20 coinsurance clause, and a family maximum out-of-pocket limit of $5,000. Jaylen's employer pays 90% of the health insurance premium. Life Insurance Jaylen has a group term life insurance policy with a face amount of two times salary provided by Troy Metals, Inc. The policy beneficiary is Avery. The premium of $9 per month is paid by the company. The Section 79 table cost per $1,000 of protection is $0.15 per month for Jaylen's age. The company also pays for dependent life insurance at $2,000 per person. Avery has a group term life insurance policy with a face amount of $50,000 provided by Davis Manufacturing. The policy beneficiary is Jaylen. The premium of $8 per month is paid by the company. The Section 79 table cost per $1,000 of protection is $0.10 per month for Avery's age. Disability Insurance Jaylen has a private disability Income insurance policy with an own-occupation definition of disability and a 30-day elimination period. Based on the policy's provisions, in the event Jaylen is totally disabled, a monthly benefit of $2,700 will be paid until normal retirement age, defined as the full retirement age under the Social Security Act on the date of disability. The annual premium is $761 and is fully paid by Jaylen. Avery has a disability policy through work. The policy pays 50% of salary for 6 months with an own-occupation definition of disability. The waiting period is 5 working days. Premiums for Avery's policy are paid by Davis Manufacturing as an employee benefit. Homeowners Insurance The Jacksons have an HO-5 policy with a dwelling extension and replacement cost on contents. The policy has a $1,000 deductible. The annual premium is $1,500. Coverage A (dwelling) is $280,000 Personal property coverage is $135.000. Personal liability coverage is $100,000 T9e Business Applications 34 Home F9 Fin End Study Facts1.pdf?_ga=2131116813344223453.1629121815-1943489389.160262660 - 110% + 10 Jayler anu Avery ICRSON Jaylen and Avery Jackson have come to you, a financial planner, for help in developing a plan to accomplish their financial goals. You are a Series 7 general securities representative and hold insurance licenses for life and health insurance and variable contracts. The Jacksons have great hope for their future. However, after having a conversation about investing with one of their neighbors, they have recently realized that they are not as financially comfortable as they would like to be at this point in their lives. They began reading about various financial planning services and have decided to consult with you. Assume today is January 1, 2021. PERSONAL BACKGROUND AND INFORMATION The Jacksons Jaylen and Avery have been married for 15 years. They have two children, Ashanti and Blake. Jaylen Jackson (Age 49) Jaylen is the founder and sole stockholder of Troy Metals Inc., a corporation, and has an annual salary of $64,000. Jaylen's health is good. Avery Jackson (Age 49) Avery is an office manager at Davis Manufacturing and has an annual salary of $40,000. Avery's health is excellent They expect their incomes to keep up with inflation Children Ashanti, 14 years old, is in the ninth grade at Brown Road High School, a public school. Ashanti plays soccer in a community league and attends soccer camp in the summer. Ashanti also attends the school's Future STEM Career club. Blake, 9 years old, is in fourth grade at Prairie Hills Elementary School, a public school, Blake meets with a private tutor once a week to get help with reading skills and would like to start taking violin lessons ECONOMIC INFORMATION Currently, the economy is in a recovery phase with decreasing unemployment and increasing economic growth. Inflation and interest rates are currently low. The current GDP has been growing at 3%. There has been a lot of speculation about the Federal Reserve raising interest rates to be better prepared to fight a future recession e Business Applications STATEMENT OF CASH FLOWS Jaylen and Avery Jackson For the Year 2021 (Expected) INFLOWS Salary-Jaylen $64,000 Salary-Avery 40,000 Total salary income $104,000 TOTAL INFLOWS $104,000 OUTFLOWS Savings Savings and investments $0 Total savings $0 Living expenses Food and supplies $12,000 Clothing 4,200 Child care 1,600 Entertainment and travel 3,610 Utilities 6,600 Home maintenance/repairs 3,000 Auto maintenance and gas 3,000 Medical, dental, vision expenses 1,200 Total living expenses $35,210 Debt payments Mortgage payments $16,200 Credit card payments 3,900 Auto loan payments 4.800 Total debt payments $24,900 Insurance premiums 9 e 1 Business Applications Jackson Case Study X C Question 2 - Building Up Home X + Case Study Facts1.pdf?_ga=2131116813344223453.1629121815-1943489389.1602671660 - 1,600 3,610 6,600 3,000 3,000 1,200 $35,210 416 | 110% + ma care Entertainment and travel Utilities Home maintenance/repairs Auto maintenance and gas Medical, dental, vision expenses Total living expenses Debt payments Mortgage payments Credit card payments Auto loan payments Total debt payments Insurance premiums Automobile Disability Homeowners Medical Total insurance premiums Taxes Federal FICA, SECA, and withholding State income tax Property tax (principal residence) Total taxes TOTAL OUTFLOWS NET CASH FLOW (SURPLUS) $16,200 3,900 4.800 $24,900 $1,800 761 1,500 2,400 $6,461 $17,556 3,120 6.200 $26,876 $93,447 $10,553 5/6 | 110% + 10 STATEMENT OF FINANCIAL POSITION Avery and Jaylen Jackson January 1, 2021 ASSETS Liquid assets Joint checking account $2,500 Joint savings account 5.000 Total liquid assets $7,500 Investments Avery's IRA $85,000 Jaylen's IRA 105,000 Troy Metals Inc 250,000 Total investments $440,000 Use Assets Residence $330,000 Personal property 55,000 Vehicles 25.000 Total use assets $410,000 Total assets $857,500 Liabilities Credit cards $8,000 Mortgage on residence 60,000 Auto loan 3,000 Total liabilities $71,000 Net worth $786,500 Total liabilities and net worth $857.500 e Business Applications 25,000 $410,000 $857,500 5/6 1 110% + 10 Conor property Vehicles Total use assets Total assets Liabilities Credit cards Mortgage on residence Auto loan Total liabilities Net worth Total liabilities and net worth $8,000 60,000 3.000 $71,000 $786,500 $857,500 1 Originally purchased 12 years, 9 months ago for $110,000. Excellent condition with no major repairs foreseen in the near future. 2 Variable rate, currently 16.9% APR. 3 Fixed rate of 5.5% in the name of Avery and Jaylen Jackson; 4 years, 7 months are remaining on the loan 4 Fixed rate of 7.0% in the name of Avery Jackson: 2 years, 1 month are remaining on the loan. 9 e Business Applications 3 16 - 110% + 10 INCOME TAX CONSIDERATIONS The Jacksons tell you that they think they are in the 12% federal income tax bracket. They pay $3,120 annually in state and local income taxes. RETIREMENT INFORMATION Jaylen and Avery would like to retire at age 65 (16 years from today). They expect their living expenses in their first year of retirement to be equivalent to 75% of their current earned income (as adjusted for inflation). They assume their life expectancy in retirement will be 30 years. They intend to claim Social Security benefits at age 65. They consulted the Social Security Administration website and determined their monthly retirement benefits at FRA would be $2,500 (in today's dollars) for Jaylen and $1,800 (in today's dollars) for Avery Jaylen does not have any retirement accounts. Avery is eligible to participate at the retirement plan at Davis Manufacturing, but has opted out. EDUCATION INFORMATION It currently costs $12,000 per year to attend a state college, and this cost is expected to increase at 5% each year. The Jacksons would prefer to save monthly for this goal. They did some research online and learned they can earn 7% in their state's 529 account. ESTATE PLANNING INFORMATION Wilts were tast completed five years ago. They live in a common-law state, Jaylen's will leaves everything to Avery conditioned on a six-month survivorship clause-otherwise, equally in separate trusts for the two children. Avery's will is identical to Jaylen's, leaving everything to Jaylen as long as he survives her by at least six months. Otherwise, a trust for the children will hold their assets BUSINESS INFORMATION Jaylen is 100% owner of Troy Metals inc. The company has been in business for 14 years, is financially stable, and currently has a book value in excess of $1 3 million. In view of the company's profitability and Jaylen's middle age, the firm's accountant suggested it might be time to establish an employer. e Business Applications 7. Estate Plan Maximum Points: 9 The Jacksons want to establish a trust to provide for their children in case of their premature death. Which of the following would you recommend as the most appropriate trust given the Jacksons' overall situation and objectives? Provide a rationale for your answer. A. an irrevocable life insurance trust granting Crummey powers to the children B. a grantor retained income trust (GRIT) with Ashanti and Blake named as beneficiaries c. a revocable living trust naming a third party as successor trustee, with Avery and Jaylen as the primary beneficiaries while living and the children listed as remainder beneficiaries D. a revocable living trust naming the children as beneficiaries and Jaylen and Avery as the trustees 8. Retirement Fundina Maximum Pointe: 10 INSURANCE INFORMATION Health Insurance The entire family is insured under Jaylen's company plan, which is a major medical plan with a $500 per person deductible, an 80/20 coinsurance clause, and a family maximum out-of-pocket limit of $5,000. Jaylen's employer pays 90% of the health insurance premium. Life Insurance Jaylen has a group term life insurance policy with a face amount of two times salary provided by Troy Metals, Inc. The policy beneficiary is Avery. The premium of $9 per month is paid by the company. The Section 79 table cost per $1,000 of protection is $0.15 per month for Jaylen's age. The company also pays for dependent life insurance at $2,000 per person. Avery has a group term life insurance policy with a face amount of $50,000 provided by Davis Manufacturing. The policy beneficiary is Jaylen. The premium of $8 per month is paid by the company. The Section 79 table cost per $1,000 of protection is $0.10 per month for Avery's age. Disability Insurance Jaylen has a private disability Income insurance policy with an own-occupation definition of disability and a 30-day elimination period. Based on the policy's provisions, in the event Jaylen is totally disabled, a monthly benefit of $2,700 will be paid until normal retirement age, defined as the full retirement age under the Social Security Act on the date of disability. The annual premium is $761 and is fully paid by Jaylen. Avery has a disability policy through work. The policy pays 50% of salary for 6 months with an own-occupation definition of disability. The waiting period is 5 working days. Premiums for Avery's policy are paid by Davis Manufacturing as an employee benefit. Homeowners Insurance The Jacksons have an HO-5 policy with a dwelling extension and replacement cost on contents. The policy has a $1,000 deductible. The annual premium is $1,500. Coverage A (dwelling) is $280,000 Personal property coverage is $135.000. Personal liability coverage is $100,000 T9e Business Applications 34 Home F9 Fin End Study Facts1.pdf?_ga=2131116813344223453.1629121815-1943489389.160262660 - 110% + 10 Jayler anu Avery ICRSON Jaylen and Avery Jackson have come to you, a financial planner, for help in developing a plan to accomplish their financial goals. You are a Series 7 general securities representative and hold insurance licenses for life and health insurance and variable contracts. The Jacksons have great hope for their future. However, after having a conversation about investing with one of their neighbors, they have recently realized that they are not as financially comfortable as they would like to be at this point in their lives. They began reading about various financial planning services and have decided to consult with you. Assume today is January 1, 2021. PERSONAL BACKGROUND AND INFORMATION The Jacksons Jaylen and Avery have been married for 15 years. They have two children, Ashanti and Blake. Jaylen Jackson (Age 49) Jaylen is the founder and sole stockholder of Troy Metals Inc., a corporation, and has an annual salary of $64,000. Jaylen's health is good. Avery Jackson (Age 49) Avery is an office manager at Davis Manufacturing and has an annual salary of $40,000. Avery's health is excellent They expect their incomes to keep up with inflation Children Ashanti, 14 years old, is in the ninth grade at Brown Road High School, a public school. Ashanti plays soccer in a community league and attends soccer camp in the summer. Ashanti also attends the school's Future STEM Career club. Blake, 9 years old, is in fourth grade at Prairie Hills Elementary School, a public school, Blake meets with a private tutor once a week to get help with reading skills and would like to start taking violin lessons ECONOMIC INFORMATION Currently, the economy is in a recovery phase with decreasing unemployment and increasing economic growth. Inflation and interest rates are currently low. The current GDP has been growing at 3%. There has been a lot of speculation about the Federal Reserve raising interest rates to be better prepared to fight a future recession e Business Applications STATEMENT OF CASH FLOWS Jaylen and Avery Jackson For the Year 2021 (Expected) INFLOWS Salary-Jaylen $64,000 Salary-Avery 40,000 Total salary income $104,000 TOTAL INFLOWS $104,000 OUTFLOWS Savings Savings and investments $0 Total savings $0 Living expenses Food and supplies $12,000 Clothing 4,200 Child care 1,600 Entertainment and travel 3,610 Utilities 6,600 Home maintenance/repairs 3,000 Auto maintenance and gas 3,000 Medical, dental, vision expenses 1,200 Total living expenses $35,210 Debt payments Mortgage payments $16,200 Credit card payments 3,900 Auto loan payments 4.800 Total debt payments $24,900 Insurance premiums 9 e 1 Business Applications Jackson Case Study X C Question 2 - Building Up Home X + Case Study Facts1.pdf?_ga=2131116813344223453.1629121815-1943489389.1602671660 - 1,600 3,610 6,600 3,000 3,000 1,200 $35,210 416 | 110% + ma care Entertainment and travel Utilities Home maintenance/repairs Auto maintenance and gas Medical, dental, vision expenses Total living expenses Debt payments Mortgage payments Credit card payments Auto loan payments Total debt payments Insurance premiums Automobile Disability Homeowners Medical Total insurance premiums Taxes Federal FICA, SECA, and withholding State income tax Property tax (principal residence) Total taxes TOTAL OUTFLOWS NET CASH FLOW (SURPLUS) $16,200 3,900 4.800 $24,900 $1,800 761 1,500 2,400 $6,461 $17,556 3,120 6.200 $26,876 $93,447 $10,553 5/6 | 110% + 10 STATEMENT OF FINANCIAL POSITION Avery and Jaylen Jackson January 1, 2021 ASSETS Liquid assets Joint checking account $2,500 Joint savings account 5.000 Total liquid assets $7,500 Investments Avery's IRA $85,000 Jaylen's IRA 105,000 Troy Metals Inc 250,000 Total investments $440,000 Use Assets Residence $330,000 Personal property 55,000 Vehicles 25.000 Total use assets $410,000 Total assets $857,500 Liabilities Credit cards $8,000 Mortgage on residence 60,000 Auto loan 3,000 Total liabilities $71,000 Net worth $786,500 Total liabilities and net worth $857.500 e Business Applications 25,000 $410,000 $857,500 5/6 1 110% + 10 Conor property Vehicles Total use assets Total assets Liabilities Credit cards Mortgage on residence Auto loan Total liabilities Net worth Total liabilities and net worth $8,000 60,000 3.000 $71,000 $786,500 $857,500 1 Originally purchased 12 years, 9 months ago for $110,000. Excellent condition with no major repairs foreseen in the near future. 2 Variable rate, currently 16.9% APR. 3 Fixed rate of 5.5% in the name of Avery and Jaylen Jackson; 4 years, 7 months are remaining on the loan 4 Fixed rate of 7.0% in the name of Avery Jackson: 2 years, 1 month are remaining on the loan. 9 e Business Applications 3 16 - 110% + 10 INCOME TAX CONSIDERATIONS The Jacksons tell you that they think they are in the 12% federal income tax bracket. They pay $3,120 annually in state and local income taxes. RETIREMENT INFORMATION Jaylen and Avery would like to retire at age 65 (16 years from today). They expect their living expenses in their first year of retirement to be equivalent to 75% of their current earned income (as adjusted for inflation). They assume their life expectancy in retirement will be 30 years. They intend to claim Social Security benefits at age 65. They consulted the Social Security Administration website and determined their monthly retirement benefits at FRA would be $2,500 (in today's dollars) for Jaylen and $1,800 (in today's dollars) for Avery Jaylen does not have any retirement accounts. Avery is eligible to participate at the retirement plan at Davis Manufacturing, but has opted out. EDUCATION INFORMATION It currently costs $12,000 per year to attend a state college, and this cost is expected to increase at 5% each year. The Jacksons would prefer to save monthly for this goal. They did some research online and learned they can earn 7% in their state's 529 account. ESTATE PLANNING INFORMATION Wilts were tast completed five years ago. They live in a common-law state, Jaylen's will leaves everything to Avery conditioned on a six-month survivorship clause-otherwise, equally in separate trusts for the two children. Avery's will is identical to Jaylen's, leaving everything to Jaylen as long as he survives her by at least six months. Otherwise, a trust for the children will hold their assets BUSINESS INFORMATION Jaylen is 100% owner of Troy Metals inc. The company has been in business for 14 years, is financially stable, and currently has a book value in excess of $1 3 million. In view of the company's profitability and Jaylen's middle age, the firm's accountant suggested it might be time to establish an employer. e Business Applications