Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given that your bank has just implemented the internal ratings based (IRB) foundation approach of determining probability of default. Suppose your credit risk manager

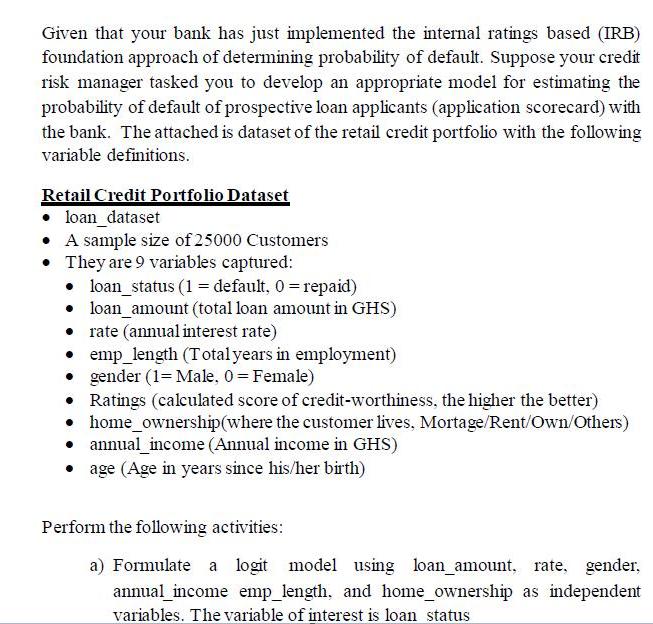

Given that your bank has just implemented the internal ratings based (IRB) foundation approach of determining probability of default. Suppose your credit risk manager tasked you to develop an appropriate model for estimating the probability of default of prospective loan applicants (application scorecard) with the bank. The attached is dataset of the retail credit portfolio with the following variable definitions. Retail Credit Portfolio Dataset loan_dataset A sample size of 25000 Customers They are 9 variables captured: loan_status (1 = default, 0 = repaid) loan_amount (total loan amount in GHS) rate (annual interest rate) emp_length (Totalyears in employment) gender (1= Male, 0= Female) Ratings (calculated score of credit-worthiness, the higher the better) home_ownership(where the customer lives, Mortage/Rent/Own/Others) annual_income (Annual income in GHS) age (Age in years since his/her birth) Perform the following activities: a) Formulate a logit model using loan amount, rate, gender, annual_income emp_length, and home_ownership as independent variables. The variable of interest is loan status

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

p probty of default mode...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started