Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Georg Schrempp is the CFO of Bayern Chemicals KgaA, a large German manufacturer of industrial, commercial, and consumer chemical products. Bayern Chemicals is privately

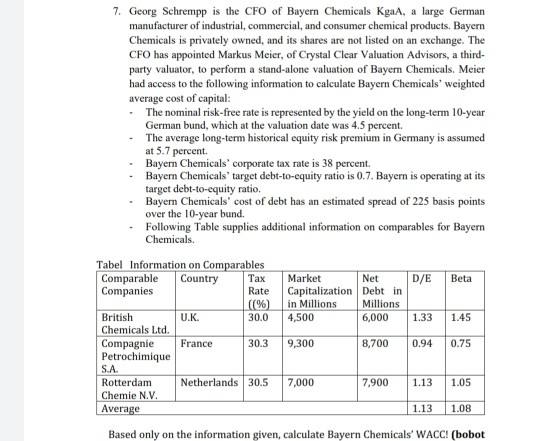

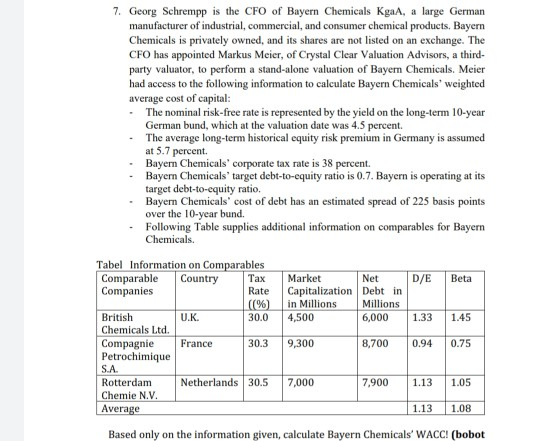

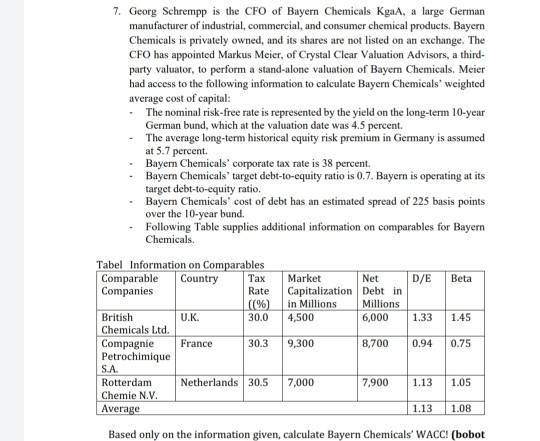

7. Georg Schrempp is the CFO of Bayern Chemicals KgaA, a large German manufacturer of industrial, commercial, and consumer chemical products. Bayern Chemicals is privately owned, and its shares are not listed on an exchange. The CFO has appointed Markus Meier, of Crystal Clear Valuation Advisors, a third- party valuator, to perform a stand-alone valuation of Bayern Chemicals. Meier had access to the following information to calculate Bayern Chemicals weighted average cost of capital: . The nominal risk-free rate is represented by the yield on the long-term 10-year German bund, which at the valuation date was 4.5 percent. The average long-term historical equity risk premium in Germany is assumed at 5.7 percent. Bayern Chemicals' corporate tax rate is 38 percent. Bayern Chemicals" target debt-to-equity ratio is 0.7. Bayern is operating at its target debt-to-equity ratio. Bayern Chemicals' cost of debt has an estimated spread of 225 basis points over the 10-year bund. . Following Table supplies additional information on comparables for Bayern Chemicals. D/E Beta Market Net Capitalization Debt in in Millions Millions 4,500 6,000 1.33 1.45 Tabel Information on Comparables Comparable Country Tax Companies Rate ((%) British U.K. 30.0 Chemicals Ltd. Compagnie France 30.3 Petrochimique S.A. Rotterdam Netherlands 30.5 Chemie N.V. Average 9,300 8,700 0.94 0.75 7,000 7,900 1.13 1.05 1.13 1.08 Based only on the information given, calculate Bayern Chemicals' WACC! (bobot 7. Georg Schrempp is the CFO of Bayern Chemicals KgaA, a large German manufacturer of industrial, commercial, and consumer chemical products. Bayern Chemicals is privately owned, and its shares are not listed on an exchange. The CFO has appointed Markus Meier, of Crystal Clear Valuation Advisors, a third- party valuator, to perform a stand-alone valuation of Bayern Chemicals. Meier had access to the following information to calculate Bayern Chemicals weighted average cost of capital: . The nominal risk-free rate is represented by the yield on the long-term 10-year German bund, which at the valuation date was 4.5 percent. The average long-term historical equity risk premium in Germany is assumed at 5.7 percent. Bayern Chemicals' corporate tax rate is 38 percent. Bayern Chemicals" target debt-to-equity ratio is 0.7. Bayern is operating at its target debt-to-equity ratio. Bayern Chemicals' cost of debt has an estimated spread of 225 basis points over the 10-year bund. . Following Table supplies additional information on comparables for Bayern Chemicals. D/E Beta Market Net Capitalization Debt in in Millions Millions 4,500 6,000 1.33 1.45 Tabel Information on Comparables Comparable Country Tax Companies Rate ((%) British U.K. 30.0 Chemicals Ltd. Compagnie France 30.3 Petrochimique S.A. Rotterdam Netherlands 30.5 Chemie N.V. Average 9,300 8,700 0.94 0.75 7,000 7,900 1.13 1.05 1.13 1.08 Based only on the information given, calculate Bayern Chemicals' WACC! (bobot 7. Georg Schrempp is the CFO of Bayern Chemicals KgaA, a large German manufacturer of industrial, commercial, and consumer chemical products. Bayern Chemicals is privately owned, and its shares are not listed on an exchange. The CFO has appointed Markus Meier, of Crystal Clear Valuation Advisors, a third- party valuator, to perform a stand-alone valuation of Bayern Chemicals. Meier had access to the following information to calculate Bayern Chemicals weighted average cost of capital: . The nominal risk-free rate is represented by the yield on the long-term 10-year German bund, which at the valuation date was 4.5 percent. The average long-term historical equity risk premium in Germany is assumed at 5.7 percent. Bayern Chemicals' corporate tax rate is 38 percent. Bayern Chemicals" target debt-to-equity ratio is 0.7. Bayern is operating at its target debt-to-equity ratio. Bayern Chemicals' cost of debt has an estimated spread of 225 basis points over the 10-year bund. . Following Table supplies additional information on comparables for Bayern Chemicals. D/E Beta Market Net Capitalization Debt in in Millions Millions 4,500 6,000 1.33 1.45 Tabel Information on Comparables Comparable Country Tax Companies Rate ((%) British U.K. 30.0 Chemicals Ltd. Compagnie France 30.3 Petrochimique S.A. Rotterdam Netherlands 30.5 Chemie N.V. Average 9,300 8,700 0.94 0.75 7,000 7,900 1.13 1.05 1.13 1.08 Based only on the information given, calculate Bayern Chemicals' WACC! (bobot

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started