Answered step by step

Verified Expert Solution

Question

1 Approved Answer

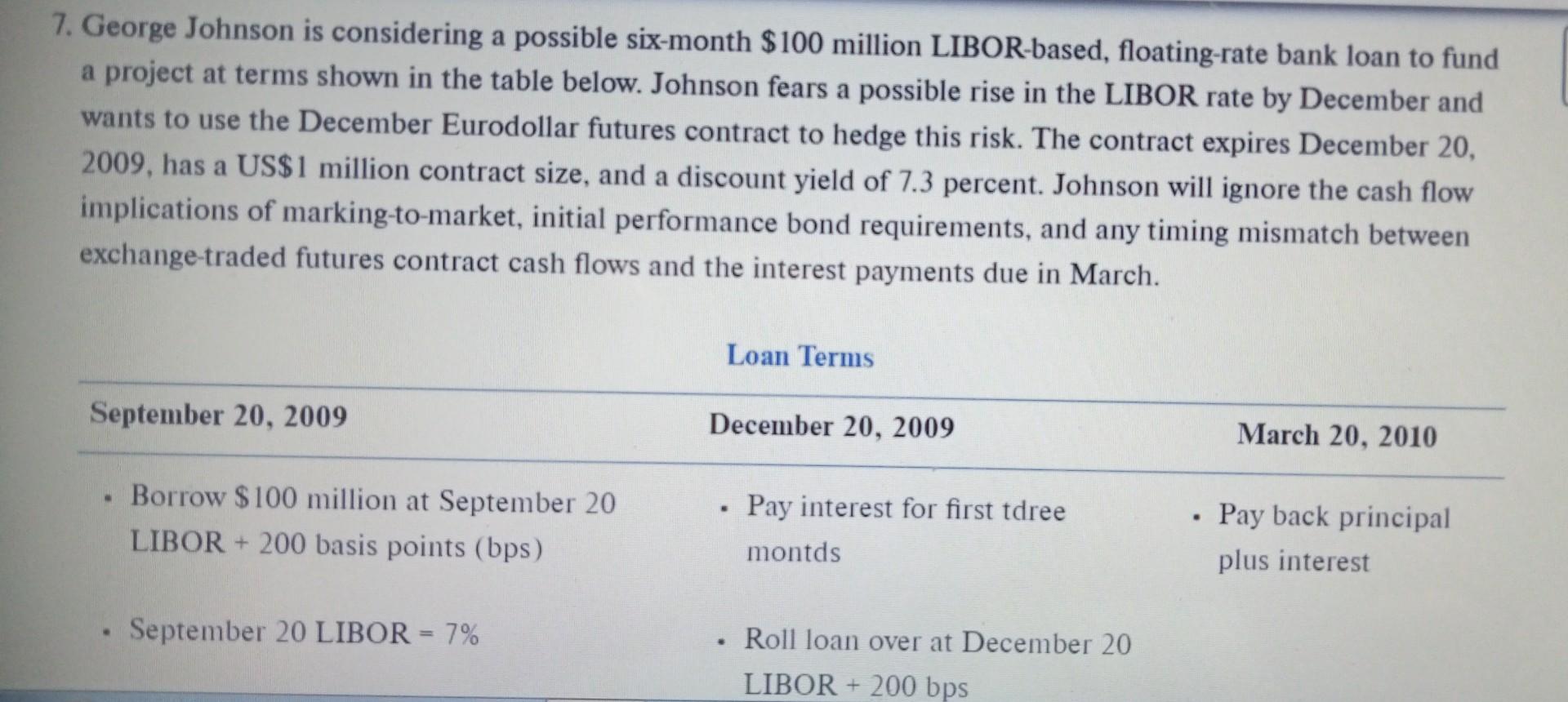

7. George Johnson is considering a possible six-month $100 million LIBOR-based, floating-rate bank loan to fund a project at terms shown in the table below.

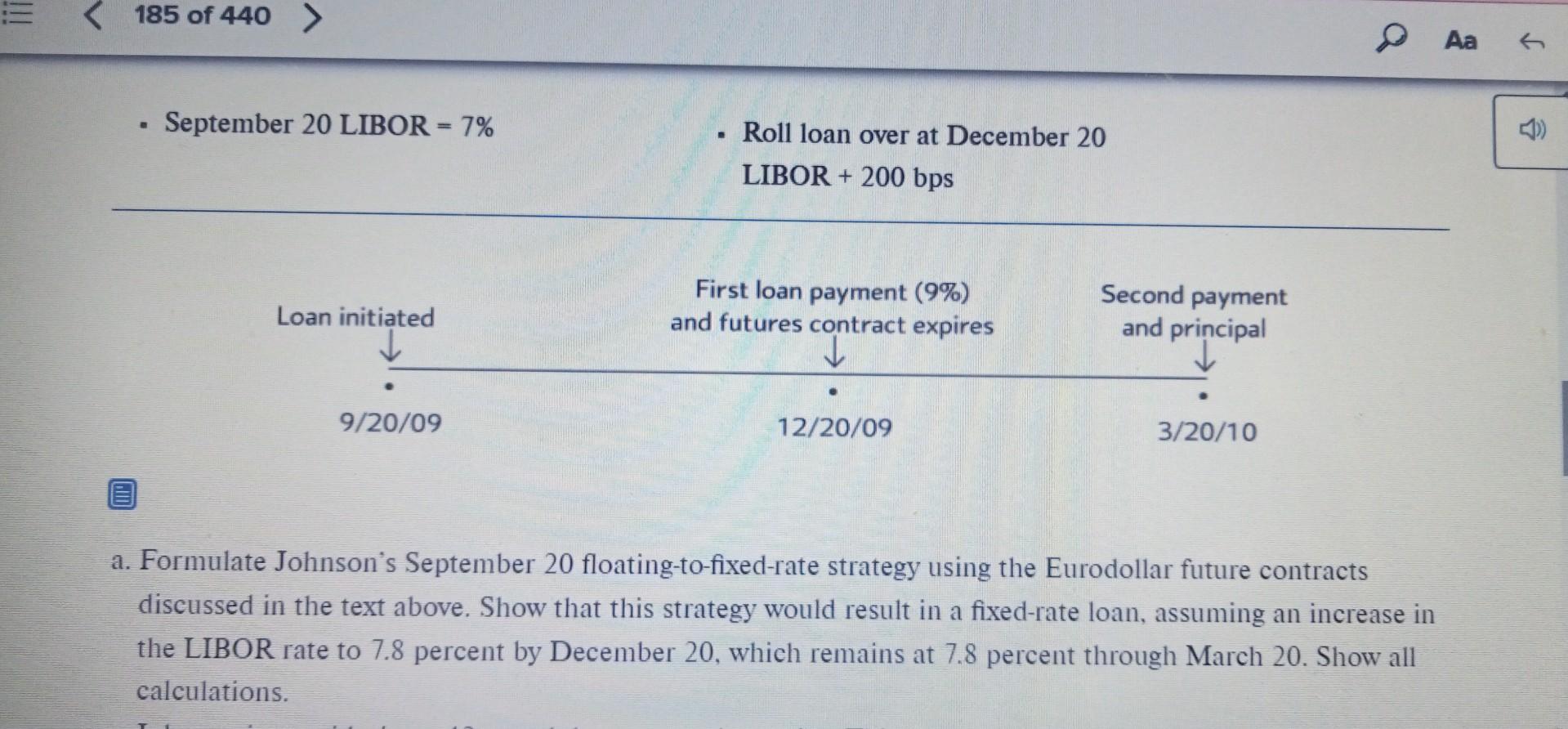

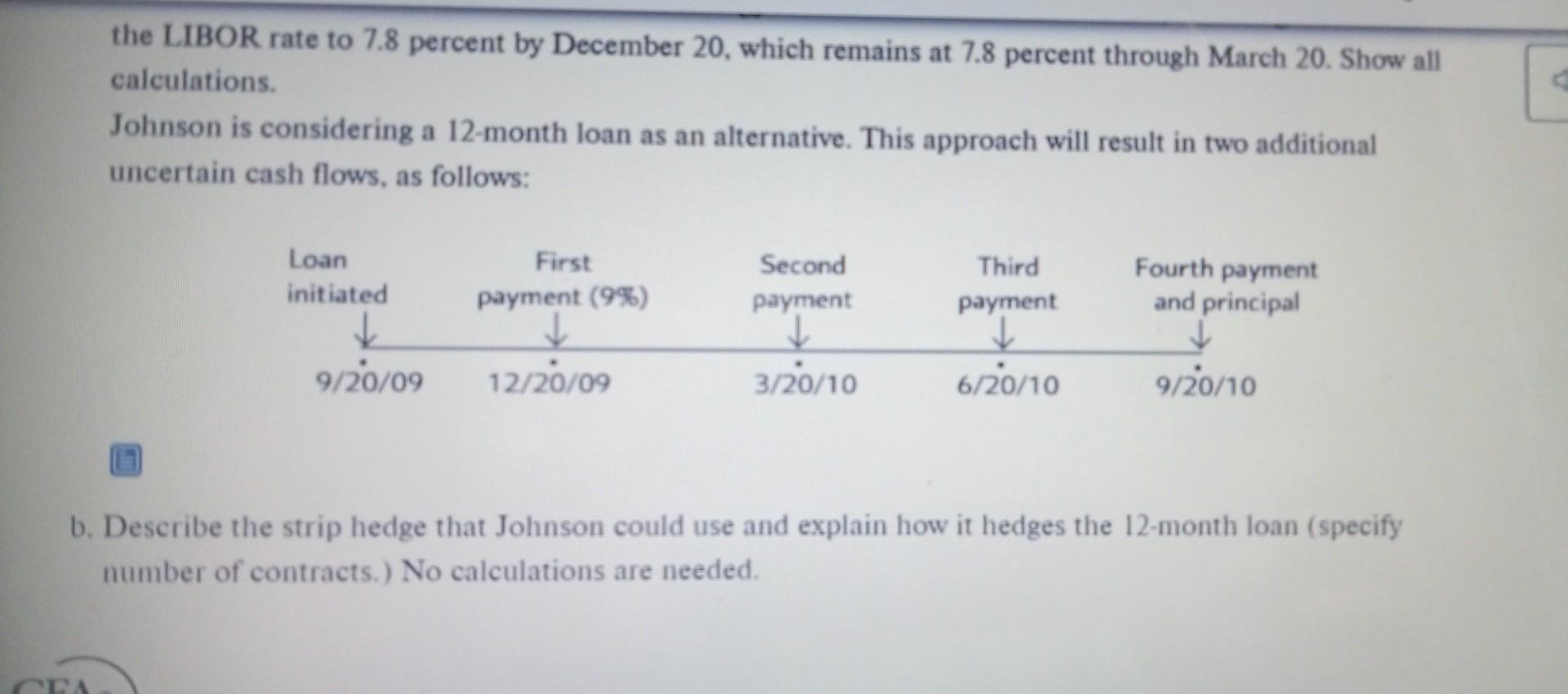

7. George Johnson is considering a possible six-month $100 million LIBOR-based, floating-rate bank loan to fund a project at terms shown in the table below. Johnson fears a possible rise in the LIBOR rate by December and wants to use the December Eurodollar futures contract to hedge this risk. The contract expires December 20 , 2009, has a US\$1 million contract size, and a discount yield of 7.3 percent. Johnson will ignore the cash flow implications of marking-to-market, initial performance bond requirements, and any timing mismatch between exchange-traded futures contract cash flows and the interest payments due in March. a. Formulate Johnson's September 20 floating-to-fixed-rate strategy using the Eurodollar future contracts discussed in the text above. Show that this strategy would result in a fixed-rate loan, assuming an increase in the LIBOR rate to 7.8 percent by December 20 , which remains at 7.8 percent through March 20 . Show all calculations. the LIBOR rate to 7.8 percent by December 20 , which remains at 7.8 percent through March 20 . Show all calculations. Johnson is considering a 12-month loan as an alternative. This approach will result in two additional uncertain cash flows, as follows: b. Describe the strip hedge that Johnson could use and explain how it hedges the 12 -month loan (specify number of contracts.) No calculations are needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started