Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. If goods in transit are shipped FOB destination the seller has legal title to the goods until they are delivered. b. the buyer has

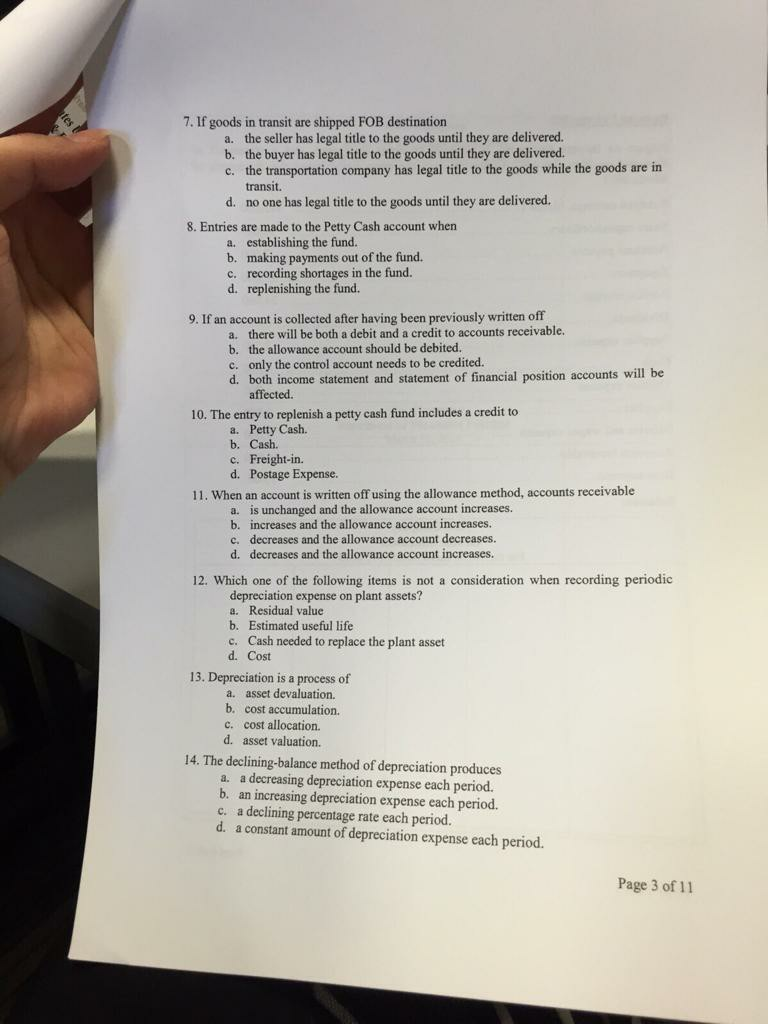

7. If goods in transit are shipped FOB destination the seller has legal title to the goods until they are delivered. b. the buyer has legal title to the goods until they are delivered. c. the transportation company has legal title to the goods while the goods are in transit. d. no one has legal title to the goods until they are delivered. a. 8. Entries are made to the Petty Cash account when a. establishing the fund. b. making payments out of the fund. c. recording shortages in the fund. d. replenishing the fund. 9. If an account is collected after having been previously written off a. there will be both a debit and a credit to accounts receivable. b. the allowance account should be debited. c. only the control account needs to be credited. d. both income statement and statement of financial position accounts will be affected. 10. The entry to replenish a petty cash fund includes a credit to a. Petty Cash. b. Cash. c. Freight-in. d. Postage Expense. 11. When an account is written off using the allowance method, accounts receivable a. is unchanged and the allowance account increases. b. increases and the allowance account increases. c. decreases and the allowance account decreases. d. decreases and the allowance account increases. 12. Which one of the following items is not a consideration when recording periodic depreciation expense on plant assets? a. Residual value b. Estimated useful life c. Cash needed to replace the plant asset d. Cost 13. Depreciation is a process of asset devaluation b. cost accumulation. c. cost allocation. d. asset valuation. a. 14. The declining-balance method of depreciation produces a. a decreasing depreciation expense each period. b. an increasing depreciation expense each period. c. a declining percentage rate each period. d. a constant amount of depreciation expense each period. Page 3 of 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started