Answered step by step

Verified Expert Solution

Question

1 Approved Answer

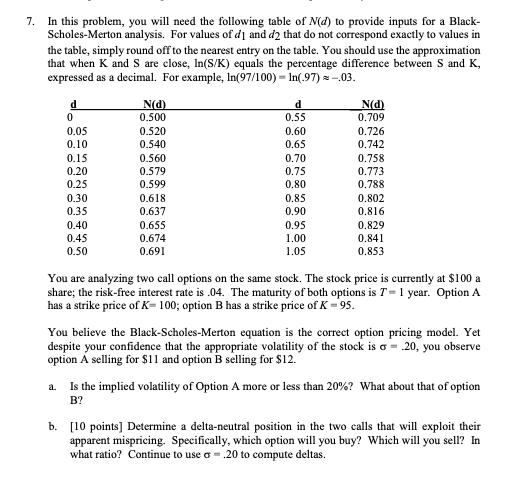

7. In this problem, you will need the following table of N(d) to provide inputs for a Black- Scholes-Merton analysis. For values of d]

7. In this problem, you will need the following table of N(d) to provide inputs for a Black- Scholes-Merton analysis. For values of d] and d2 that do not correspond exactly to values in the table, simply round off to the nearest entry on the table. You should use the approximation that when K and S are close, In(S/K) equals the percentage difference between S and K, expressed as a decimal. For example, In(97/100) - In(97) --.03. d 0 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 N(d) 0.500 0.520 0.540 0.560 0.579 0.599 0.618 0.637 0.655 0.674 0.691 d 0.55 0.60 0.65 0.70 0.75 0.80 0.85 0.90 0.95 1.00 1.05 N(d) 0.709 0.726 0.742 0.758 0.773 0.788 0.802 0.816 0.829 0.841 0.853 You are analyzing two call options on the same stock. The stock price is currently at $100 a share; the risk-free interest rate is .04. The maturity of both options is T = 1 year. Option A has a strike price of K= 100; option B has a strike price of K = 95. You believe the Black-Scholes-Merton equation is the correct option pricing model. Yet despite your confidence that the appropriate volatility of the stock is o = 20, you observe option A selling for $11 and option B selling for $12. a. Is the implied volatility of Option A more or less than 20%? What about that of option B? b. [10 points] Determine a delta-neutral position in the two calls that will exploit their apparent mispricing. Specifically, which option will you buy? Which will you sell? In what ratio? Continue to use a.20 to compute deltas.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Implied volatility of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started