Question

7. Jake wants to purchase a 4 x 4 truck priced at $37,000. A financial institution has offered Jake financing for three years at

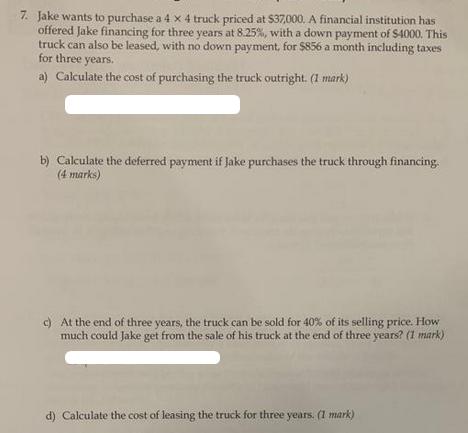

7. Jake wants to purchase a 4 x 4 truck priced at $37,000. A financial institution has offered Jake financing for three years at 8.25%, with a down payment of $4000. This truck can also be leased, with no down payment, for $856 a month including taxes for three years. a) Calculate the cost of purchasing the truck outright. (I mark) b) Calculate the deferred payment if Jake purchases the truck through financing. (4 marks) c) At the end of three years, the truck can be sold for 40% of its selling price. How much could Jake get from the sale of his truck at the end of three years? (1 mark) d) Calculate the cost of leasing the truck for three years. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management

Authors: William J Stevenson, Mehran Hojati

4th Canadian edition

978-1259270154, 1259270157, 978-0071091428

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App