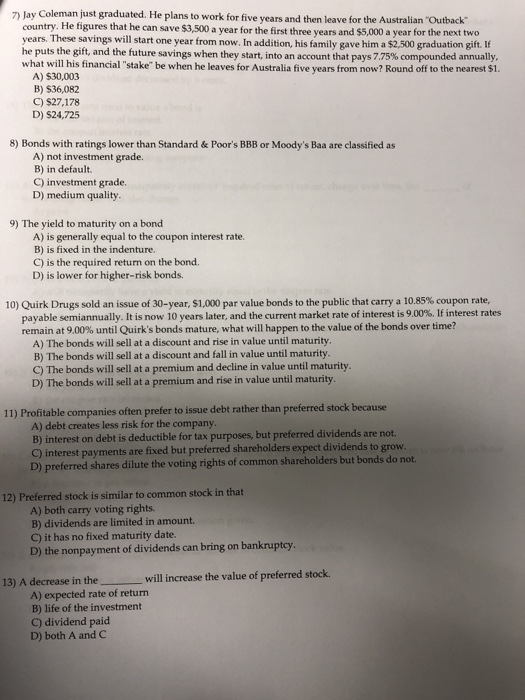

7) Jay Coleman just graduated. He plans to work for five years and then leave for the Australian "Outback country. He figures that he can save $3,500 a year for the first three years and $5,000 a year for the next two years. These savings will start one year from now. In addition, his family gave him a $2.500 graduation gift f he puts the gift, and the future savings when they start, into an account that pays 7.75% compounded annually what will his financial "stake" be when he leaves for Australia five years from now? Round off to the nearest $1. A) $30,003 B) S36,082 C) $27,178 D) $24,725 8) Bonds with ratings lower than Standard & Poor's BBB or Moody's Baa are classified as A) not investment grade. B) in default C) investment grade. D) medium quality. 9) The yield to maturity on a bond A) is generally equal to the coupon interest rate. B) is fixed in the indenture. C) is the required return on the bond D) is lower for higher-risk bonds. 10) Quirk Drugs sold an issue of 30-year, $1,000 par value bonds to the public that carry a 10.85% coupon rate, payable semiannually. It is now 10 years later, and the current market rate of interest is 9.00%. If interest rates remain at 9.00% until Quirk's bonds mature, what will happen to the value of the bonds over time? A) The bonds will sell at a discount and rise in value until maturity. B) The bonds will sell at a discount and fall in value until maturity. C) The bonds will sell at a premium and decline in value until maturity D) The bonds will sell at a premium and rise in value until maturity 11) Profitable companies often prefer to issue debt rather than preferred stock because A) debt creates less risk for the company B) interest on debt is deductible for tax purposes, but preferred dividends are not. C) interest payments are fixed but preferred shareholders expect dividends to grow D) preferred shares dilute the voting rights of common shareholders but bonds do not. 12) Preferred stock is similar to common stock in that A) both carry voting rights B) dividends are limited in amount. C) it has no fixed maturity date. D) the nonpayment of dividends can bring on bankrup 13) A decrease in the_ will increase the value of preferred stock. A) expected rate of return B) life of the investment C) dividend paid D) both A and C