Answered step by step

Verified Expert Solution

Question

1 Approved Answer

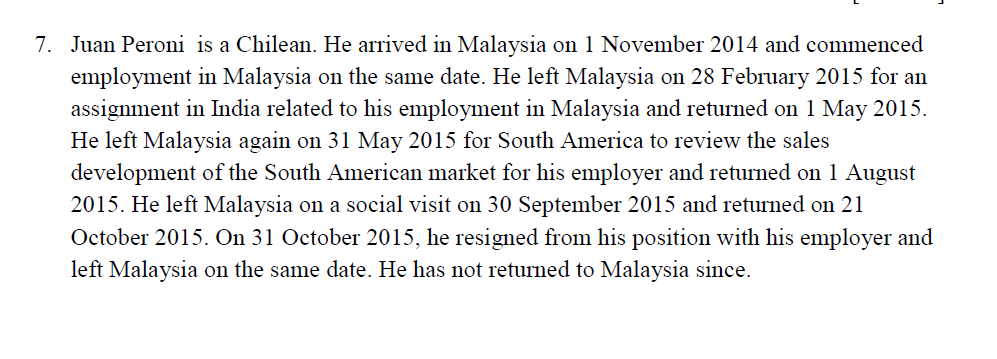

7. Juan Peroni is a Chilean. He arrived in Malaysia on 1 November 2014 and commenced employment in Malaysia on the same date. He left

7. Juan Peroni is a Chilean. He arrived in Malaysia on 1 November 2014 and commenced employment in Malaysia on the same date. He left Malaysia on 28 February 2015 for an assignment in India related to his employment in Malaysia and returned on 1 May 2015. He left Malaysia again on 31 May 2015 for South America to review the sales development of the South American market for his employer and returned on 1 August 2015. He left Malaysia on a social visit on 30 September 2015 and returned on 21 October 2015. On 31 October 2015, he resigned from his position with his employer and left Malaysia on the same date. He has not returned to Malaysia since. 7. Juan Peroni is a Chilean. He arrived in Malaysia on 1 November 2014 and commenced employment in Malaysia on the same date. He left Malaysia on 28 February 2015 for an assignment in India related to his employment in Malaysia and returned on 1 May 2015. He left Malaysia again on 31 May 2015 for South America to review the sales development of the South American market for his employer and returned on 1 August 2015. He left Malaysia on a social visit on 30 September 2015 and returned on 21 October 2015. On 31 October 2015, he resigned from his position with his employer and lelt Malaysia on the same date. He has not returned to Malaysia since. Required: a) State, with reasons, Juan Peroni 's resident status for each of the years of assessment 2014 and 2015. [10 marks] Note : Subsections b and care independent from each other. b) ASSUME that Juan Peroni IS a resident of Malaysia for both years of assessment, state the notifications which should be made to the Director General of the Inland Revenue (DGIR) regarding Juan Peroni's chargeability to income tax, including by whom the notifications should be made and by when. [10 marks] c) ASSUME that Juan Peroni IS NOT a resident of Malaysia for both years of assessment, state how this will affect the computation of his income tax liability in Malaysia and the action which can be taken against Juan Peroni by the DGIR to recover any taxes, sums or debts due by him. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started