Question

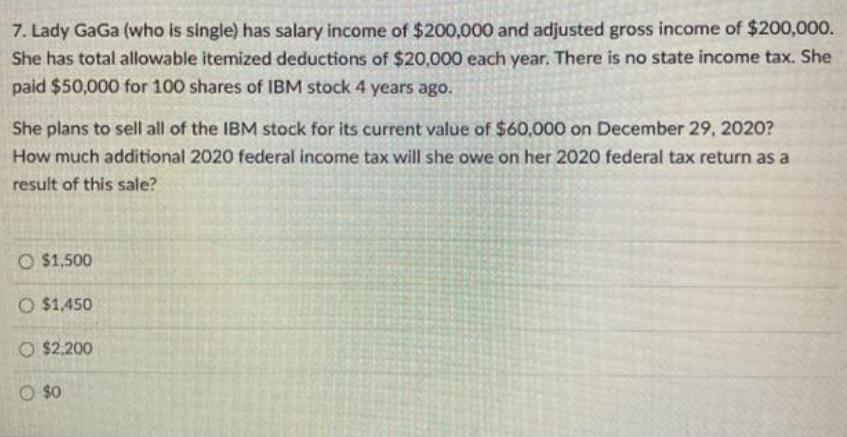

7. Lady GaGa (who is single) has salary income of $200,000 and adjusted gross income of $200,000. She has total allowable itemized deductions of

7. Lady GaGa (who is single) has salary income of $200,000 and adjusted gross income of $200,000. She has total allowable itemized deductions of $20,000 each year. There is no state income tax. She paid $50,000 for 100 shares of IBM stock 4 years ago. She plans to sell all of the IBM stock for its current value of $60,000 on December 29, 2020? How much additional 2020 federal income tax will she owe on her 2020 federal tax return as a result of this sale? O $1,500 O $1,450 O $2.200 O so

Step by Step Solution

3.28 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

7 Lady GaGa single Adjusted gross income 200000 Itemized deductions 20000 Taxable Income 200000 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation For Decision Makers 2014

Authors: Shirley Dennis Escoffier, Karen Fortin

6th Edition

978-1118654545

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App