Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Locate Codification guidance describing how inventory should initially be measured, and present the excerpt in a guidance sandwich. Assume you are answering the

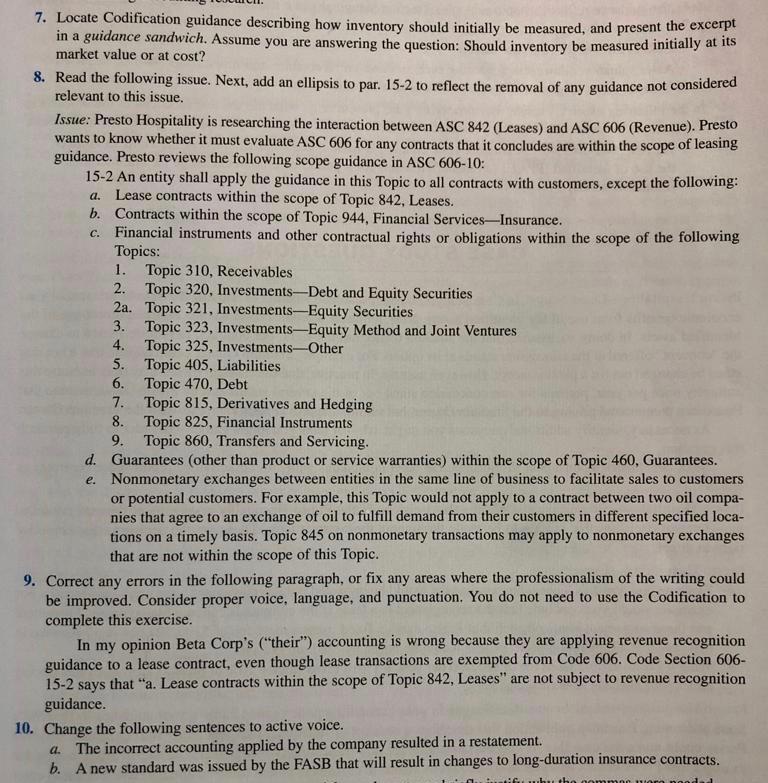

7. Locate Codification guidance describing how inventory should initially be measured, and present the excerpt in a guidance sandwich. Assume you are answering the question: Should inventory be measured initially at its market value or at cost? 8. Read the following issue. Next, add an ellipsis to par. 15-2 to reflect the removal of any guidance not considered relevant to this issue. Issue: Presto Hospitality is researching the interaction between ASC 842 (Leases) and ASC 606 (Revenue). Presto wants to know whether it must evaluate ASC 606 for any contracts that it concludes are within the scope of leasing guidance. Presto reviews the following scope guidance in ASC 606-10: 15-2 An entity shall apply the guidance in this Topic to all contracts with customers, except the following: a. Lease contracts within the scope of Topic 842, Leases. b. Contracts within the scope of Topic 944, Financial Services Insurance. C. Financial instruments and other contractual rights or obligations within the scope of the following Topics: d. e. 1. Topic 310, Receivables 2. Topic 320, Investments-Debt and Equity Securities 2a. Topic 321, Investments-Equity Securities 3. Topic 323, Investments-Equity Method and Joint Ventures 4. Topic 325, Investments-Other 5. 6. 7. 8. Topic 405, Liabilities Topic 470, Debt Topic 815, Derivatives and Hedging Topic 825, Financial Instruments 9. Topic 860, Transfers and Servicing. Guarantees (other than product or service warranties) within the scope of Topic 460, Guarantees. Nonmonetary exchanges between entities in the same line of business to facilitate sales to customers or potential customers. For example, this Topic would not apply to a contract between two oil compa- nies that agree to an exchange of oil to fulfill demand from their customers in different specified loca- tions on a timely basis. Topic 845 on nonmonetary transactions may apply to nonmonetary exchanges that are not within the scope of this Topic. 9. Correct any errors in the following paragraph, or fix any areas where the professionalism of the writing could be improved. Consider proper voice, language, and punctuation. You do not need to use the Codification to complete this exercise. In my opinion Beta Corp's ("their") accounting is wrong because they are applying revenue recognition. guidance to a lease contract, even though lease transactions are exempted from Code 606. Code Section 606- 15-2 says that "a. Lease contracts within the scope of Topic 842, Leases" are not subject to revenue recognition guidance. 10. Change the following sentences to active voice. a. The incorrect accounting applied by the company resulted in a restatement. b. A new standard was issued by the FASB that will result in changes to long-duration insurance contracts. C. Corecife why the comm woro poodad

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

General Journal Current Year Accounts Debit Credit March 1 Cash 60000 Capital Stock 60000 2 Drone and Recording Equipment 220000 Cash 40000 Notes Paya...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started