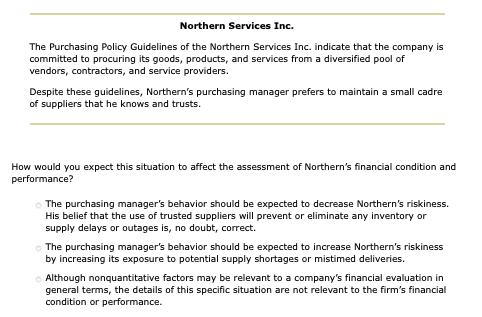

7. More on ratio analysis Analysts and investors often use return on equity (ROE) to compare profitability of a company with other firms in the industry. ROE is considered a very important measure, and managers strive to make the company's ROE numbers look good. If a firm takes steps that increase its expected future ROE, its stock price will increase. Based on your understanding of the uses and limitations of ROE, which of the following projects will a manager likely choose if his or her bonus is solely based on the ROE of the next project? Project X, with 35% ROE and a large investment, generating high expected cash flows Project Y, with 40% ROE and a small investment, generating low expected cash flows Suppose you are trying to decide whether to invest in a company that generates a high expected ROE, and you want to conduct further analysis on the company's performance. If you wanted to conduct a trend analysis, you would: Analyze the firm's financial ratios over time Compare the firm's financial ratios with other firms in the industry for a particular year You decide also to conduct a qualitative analysis based on the factors summarized by the American Association of Individual Investors (AAII). According to your understanding, a company with one key product is considered to be risky than companies with a wide range of products. The American Association of Individual Investors (AAII) has identified several qualitative factors that should also be considered when evaluating a company's likely future financial performance. Consider the scenario and indicate how you would expect the described event or situation to affect the described business organization. Northern Services Inc. The Purchasing Policy Guidelines of the Northern Services Inc. indicate that the company is committed to procuring its goods, products, and services from a diversified pool of vendors, contractors, and service providers. Despite these guidelines, Northern's purchasing manager prefers to maintain a small cadre of suppliers that he knows and trusts. Northern Services Inc. The Purchasing Policy Guidelines of the Northern Services Inc. indicate that the company is committed to procuring its goods, products, and services from a diversified pool of vendors, contractors, and service providers. Despite these guidelines, Northern's purchasing manager prefers to maintain a small cadre of suppliers that he knows and trusts. How would you expect this situation to affect the assessment of Northern's financial condition and performance? The purchasing manager's behavior should be expected to decrease Northern's riskiness. His belief that the use of trusted suppliers will prevent or eliminate any inventory or supply delays or outages is, no doubt, correct. The purchasing manager's behavior should be expected to increase Northern's riskiness by increasing its exposure to potential supply shortages or mistimed deliveries. Although nonquantitative factors may be relevant to a company's financial evaluation in general terms, the details of this specific situation are not relevant to the firm's financial condition or performance