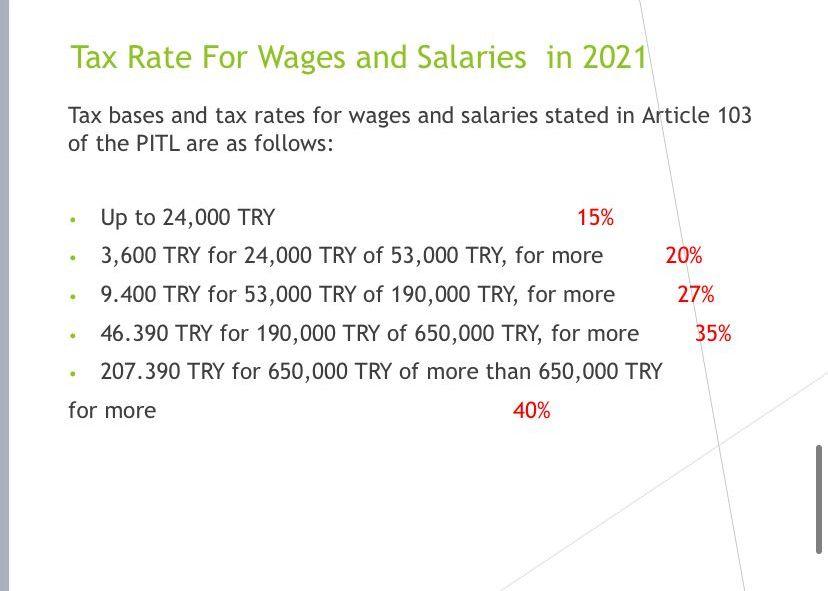

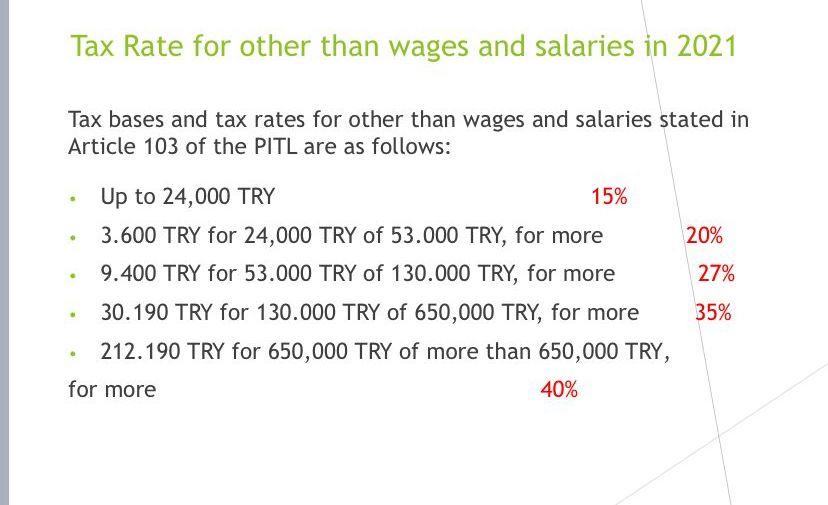

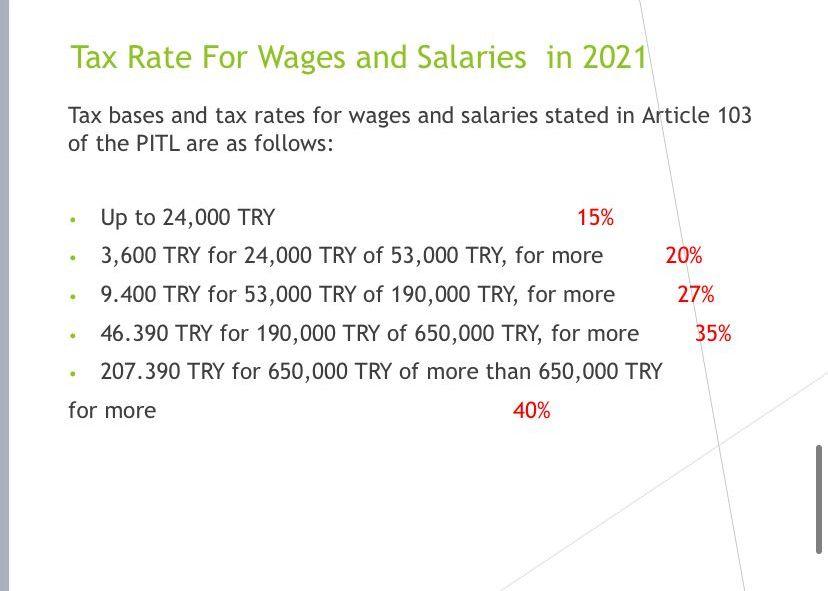

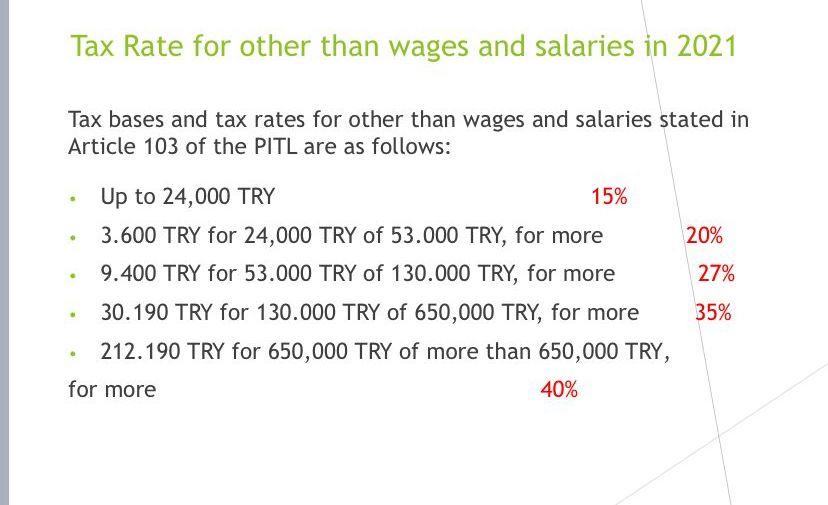

7. Mr. C died 15.01.2021 in Slovenia. He has only one daughter who lives in Turkey. The daughter inherit 2.000.000 TRY land, 500.000 TRY car, 700.000 TRY gold, and 1.400.000 TRY bank deposits. She paid 350.000 TRY depth for his father. Note: The exclusion amount the inheritance tax and tax schedule for the year 2021 are in the Slides. Required: When the daughter will make declaration? Calculate tax base and taxable inheritance tax (10 Points? Tax Rate For Wages and Salaries in 2021 Tax bases and tax rates for wages and salaries stated in Article 103 of the PITL are as follows: . Up to 24,000 TRY 15% 20% 27% 3,600 TRY for 24,000 TRY of 53,000 TRY, for more 9.400 TRY for 53,000 TRY of 190,000 TRY, for more 46.390 TRY for 190,000 TRY of 650,000 TRY, for more 207.390 TRY for 650,000 TRY of more than 650,000 TRY for more 40% 35% Tax Rate for other than wages and salaries in 2021 Tax bases and tax rates for other than wages and salaries stated in Article 103 of the PITL are as follows: Up to 24,000 TRY 15% 3.600 TRY for 24,000 TRY of 53.000 TRY, for more 20% . 9.400 TRY for 53.000 TRY of 130.000 TRY, for more . 30.190 TRY for 130.000 TRY of 650,000 TRY, for more 212.190 TRY for 650,000 TRY of more than 650,000 TRY, for more 40% 27% 35% 7. Mr. C died 15.01.2021 in Slovenia. He has only one daughter who lives in Turkey. The daughter inherit 2.000.000 TRY land, 500.000 TRY car, 700.000 TRY gold, and 1.400.000 TRY bank deposits. She paid 350.000 TRY depth for his father. Note: The exclusion amount the inheritance tax and tax schedule for the year 2021 are in the Slides. Required: When the daughter will make declaration? Calculate tax base and taxable inheritance tax (10 Points? Tax Rate For Wages and Salaries in 2021 Tax bases and tax rates for wages and salaries stated in Article 103 of the PITL are as follows: . Up to 24,000 TRY 15% 20% 27% 3,600 TRY for 24,000 TRY of 53,000 TRY, for more 9.400 TRY for 53,000 TRY of 190,000 TRY, for more 46.390 TRY for 190,000 TRY of 650,000 TRY, for more 207.390 TRY for 650,000 TRY of more than 650,000 TRY for more 40% 35% Tax Rate for other than wages and salaries in 2021 Tax bases and tax rates for other than wages and salaries stated in Article 103 of the PITL are as follows: Up to 24,000 TRY 15% 3.600 TRY for 24,000 TRY of 53.000 TRY, for more 20% . 9.400 TRY for 53.000 TRY of 130.000 TRY, for more . 30.190 TRY for 130.000 TRY of 650,000 TRY, for more 212.190 TRY for 650,000 TRY of more than 650,000 TRY, for more 40% 27% 35%