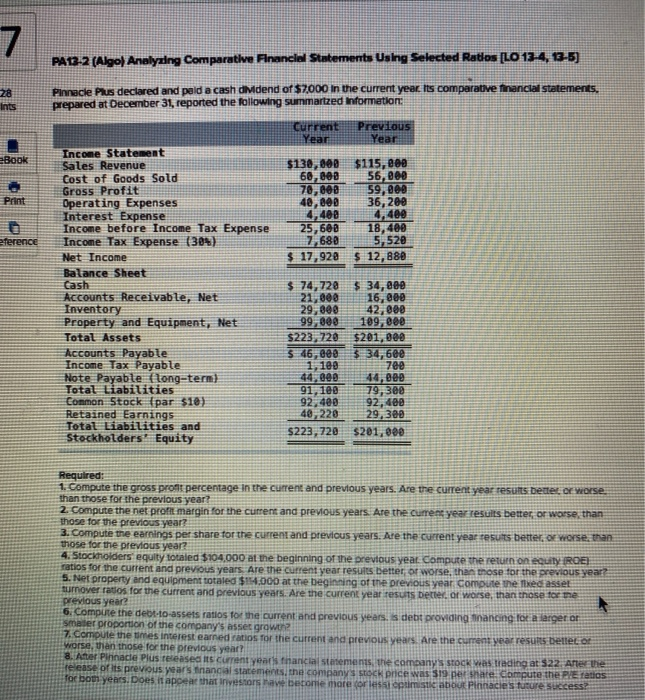

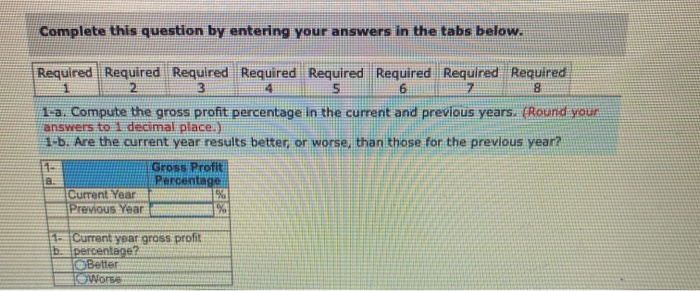

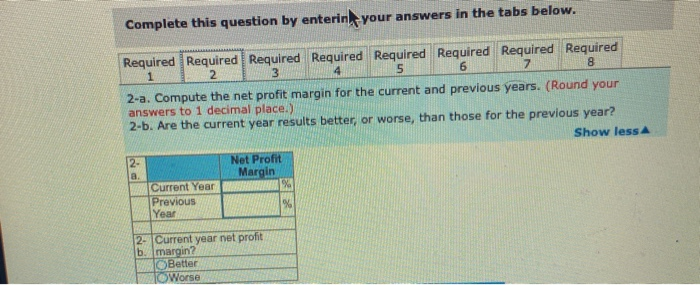

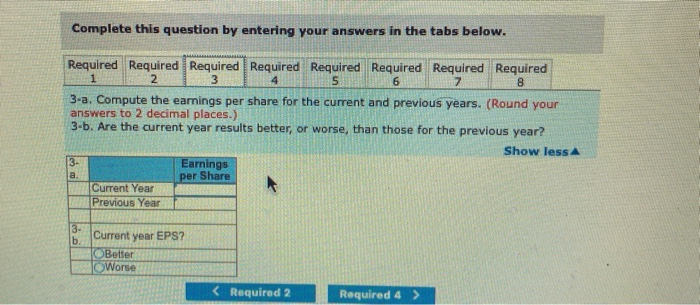

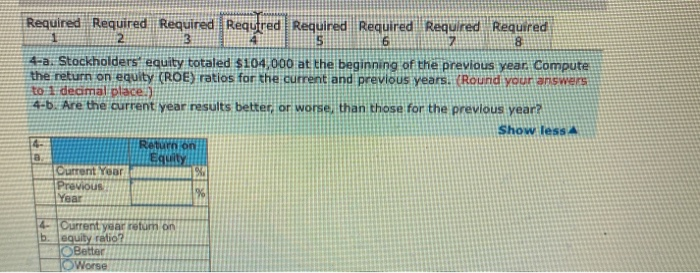

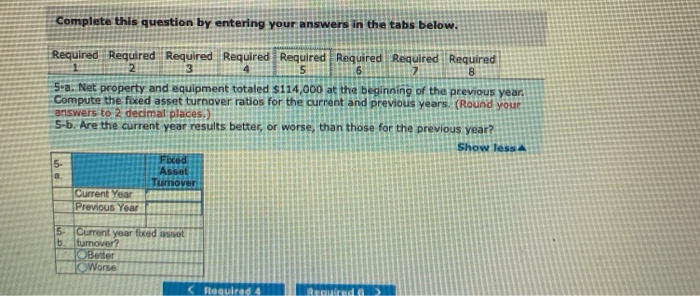

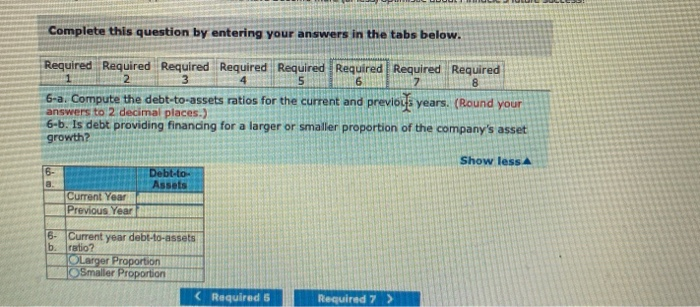

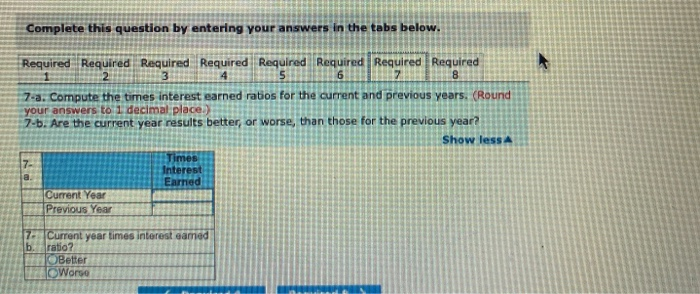

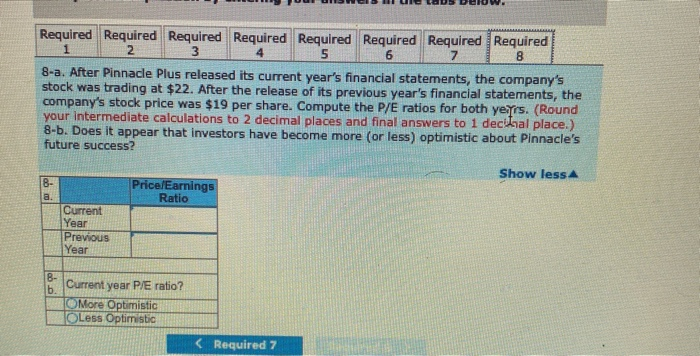

7 PA13-2 (Algo) Analyding Comparative Financial Statements Using Selected Ratlos [LO 13-4, 3-5) 28 Ints Pinnacle Pus declared and paid a cash didend of $7,000 in the current year its comparative financial statements. prepared at December 31, reported the following summartzed Information Current Year Previous Year Book Print $138,000 $115,000 60,000 56,080 70,000 59, 009 48,888 36,200 4.400 4,400 25,600 18,400 2.680 5,520 $ 17,928 $ 12, 880 eference Income Statement Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Interest Expense Income before Income Tax Expense Income Tax Expense (384) Net Income Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net Total Assets Accounts Payable Income Tax Payable Note Payable long-term} Total Liabilities Common Stock Ipar $18) Retained Earnings Total Liabilities and Stockholders Equity $ 74,728 $ 34,800 21,008 16,000 29, 308 42,000 99,808 199,000 $223, 220 $201.000 $ 46,000 $ 34, 6ee 1,100 zee 44,000 44,000 91, 100 79, 300 92,400 92, 4ee 40-220 29, 300 $223,720 $201,888 Required: 1. Compute the gross pront percentage in the current and previous years. Are the current year results better or worse than those for the previous year? 2. Compute the net profit margin for the current and previous years. Are the current year results better or worse than those for the previous year? 3. Compute the earnings per share for the current and previous years. Are the current year results better, or worse than those for the previous year? 4. Stockholders' equity totaled $104,000 at the beginning of the previous year. Compute the return on equity IROEI ratios for the current and previous years. Are the current year results better, or worse than those for the previous year? 5. Net property and equipment totaled $154.000 at the beginning of the previous year compute the fixed asset turnover ratios. for the current and previous years. Are the current year results better, or worse, than those for me previous year? 6. Compire the debt-to-assets ratios for the current and previous years, a debt providing financing for a larger or smater proportion of the company's asset growth 7. Compute the times interest earned ratios for the current and previous years. Are the current year results bellel of worse than those for the previous year? 8. After Pinnacle Plus released its current year's tnancial statements, the company's stock was trading at $22. After the release of its previous year's financial statements, the company's Stock Price was 319 perhate. Compute the statios for bom years. Does it appeat that restors have become more or leptimist about Pinnacles future success! Complete this question by entering your answers in the tabs below. Required Required Required Required Required Required Required Required 5 6 1-a. Compute the gross profit percentage in the current and previous years. (Round your answers to I decimal place.) 1-b. Are the current year results better, or worse, than those for the previous year? Gross Profit Percentage Current Year 96 Previous Year % 20 Current year gross profit percentage? Better worse Complete this question by enterin your answers in the tabs below. Required Required Required Required Required Required Required Required 1 2 3 5 6 7 8 2-a. Compute the net profit margin for the current and previous years. (Round your answers to 1 decimal place.) 2-b. Are the current year results better, or worse, than those for the previous year? Show less Net Profit Margin Current Year Previous % Year 2- a 2. Current year net profit b. margin? Better Worse Complete this question by entering your answers in the tabs below. Required Required Required Required Required Required Required Required 1 2 3 4 5 6 7 8 3-a. Compute the earnings per share for the current and previous years. (Round your answers to 2 decimal places.) 3-b. Are the current year results better, or worse, than those for the previous year? Show less 3- Earnings per Share Current Year Previous Year a 3- b. Current year EPS? Better Worse Required 2 Required 4 > Required Required Required Requtred Required Required Required Required 2 3 6 8 4-a. Stockholders equity totaled $104,000 at the beginning of the previous year. Compute the return on equity (ROE) ratios for the current and previous years. Round your answers to 1 decimal place 4-6. Are the current year results better, or worse than those for the previous year? Show less Return on Equity Current Your Previous % Year 4- Current year refum on b. equity ratio? Better Worse Complete this question by entering your answers in the tabs below. 5 Z Required Required Required Required Required Required Required Required 6 8 5-a. Net property and equipment totaled $114,000 at the beginning of the previous year. Compute the fixed asset turnover ratios for the current and previous years. (Round your answers to 2 decimal places.) 5-b. Are the current year results better, or worse, than those for the previous year? Show less Fixed Asset 5 Tumover Current Year Previous Year 5- Current year focede b tumover? Better Worse Complete this question by entering your answers in the tabs below. Required Required Required Required Required Required Required Required 6 7-a. Compute the times interest earned ratios for the current and previous years. (Round your answers to 1 decimal place.) 7-b. Are the current year results better, or worse, than those for the previous year? Show less Times Interest Earned Current Year Previous Year 7- Current year times interest gamed b. ratio? Better Worso Required Required Required Required Required Required Required Required 1 2 3 5 6 7 8-a. After Pinnacle Plus released its current year's financial statements, the company's stock was trading at $22. After the release of its previous year's financial statements, the company's stock price was $19 per share. Compute the P/E ratios for both yeyrs. (Round your intermediate calculations to 2 decimal places and final answers to 1 dechal place.) 8-b. Does it appear that investors have become more (or less) optimistic about Pinnacle's future success? Show less 8- a. Price Earnings Ratio Current Year Previous Year 18- b. Current year P/E ratio? More Optimistic Less Optimistic