Answered step by step

Verified Expert Solution

Question

1 Approved Answer

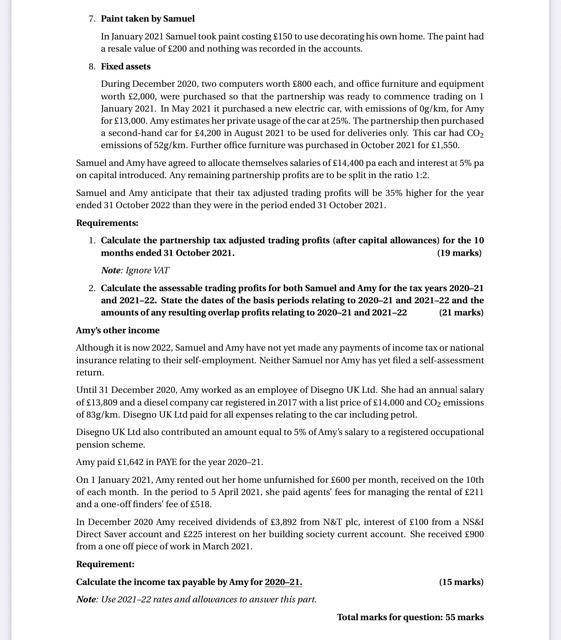

7. Paint taken by Samuel In January 2021 Samuel took paint costing 150 to use decorating his own home. The paint had a resale

7. Paint taken by Samuel In January 2021 Samuel took paint costing 150 to use decorating his own home. The paint had a resale value of 200 and nothing was recorded in the accounts. 8. Fixed assets During December 2020, two computers worth 800 each, and office furniture and equipment worth 2,000, were purchased so that the partnership was ready to commence trading on I January 2021. In May 2021 it purchased a new electric car, with emissions of Og/km, for Amy for 13,000. Amy estimates her private usage of the car at 25%. The partnership then purchased a second-hand car for 4,200 in August 2021 to be used for deliveries only. This car had CO emissions of 52g/km. Further office furniture was purchased in October 2021 for 1,550. Samuel and Amy have agreed to allocate themselves salaries of 14,400 pa each and interest at 5% pa on capital introduced. Any remaining partnership profits are to be split in the ratio 1:2. Samuel and Amy anticipate that their tax adjusted trading profits will be 35% higher for the year ended 31 October 2022 than they were in the period ended 31 October 2021. Requirements: 1. Calculate the partnership tax adjusted trading profits (after capital allowances) for the 10 months ended 31 October 2021. (19 marks) Note: Ignore VAT 2. Calculate the assessable trading profits for both Samuel and Amy for the tax years 2020-21 and 2021-22. State the dates of the basis periods relating to 2020-21 and 2021-22 and the amounts of any resulting overlap profits relating to 2020-21 and 2021-22 (21 marks) Amy's other income Although it is now 2022, Samuel and Amy have not yet made any payments of income tax or national insurance relating to their self-employment. Neither Samuel nor Amy has yet filed a self-assessment return. Until 31 December 2020, Amy worked as an employee of Disegno UK Ltd. She had an annual salary of 13,809 and a diesel company car registered in 2017 with a list price of 14,000 and CO emissions of 83g/km. Disegno UK Ltd paid for all expenses relating to the car including petrol. Disegno UK Ltd also contributed an amount equal to 5% of Amy's salary to a registered occupational pension scheme. Amy paid 1,642 in PAYE for the year 2020-21. On 1 January 2021, Amy rented out her home unfurnished for 600 per month, received on the 10th of each month. In the period to 5 April 2021, she paid agents' fees for managing the rental of 211 and a one-off finders' fee of 518. In December 2020 Amy received dividends of 3,892 from N&T plc, interest of 100 from a NS& Direct Saver account and 225 interest on her building society current account. She received 900 from a one off piece of work in March 2021. Requirement: Calculate the income tax payable by Amy for 2020-21. Note: Use 2021-22 rates and allowances to answer this part. (15 marks) Total marks for question: 55 marks

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Partnership tax adjusted trading profits after capital allowances for the 10 months ended 31 Octob...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started