Question

7 part B) For the two-period (each period is 6 months) binomial option pricing model, 0=50, , and the annual interest rate with semiannual compounding

7 part B)

For the two-period (each period is 6 months) binomial option pricing model, 0=50, , and the annual interest rate with semiannual compounding is 6%. =52.5, =48.0Calculate the probability (p) and the stock price moving up in one time step?

(a) 0.5555(b) 0.6666(c) 0.7777*(d) 0.8888(e) Cannot be calculated.

part c)

Continuing with the previous problem, what is the value of a call option with strike price $50 and time-to-maturity = year.

(a) $1.89*(b) $1.83(c) $1.94(d) None of the above(e) Cannot be calculated

part d)

Continuing the previous 2 problems, what is the value of a call option with strike price $50 and time-to-maturity = 1 year.

(a) $3.24(b) $3.14(c) $3.06(d) $3.05*(e) $3.00

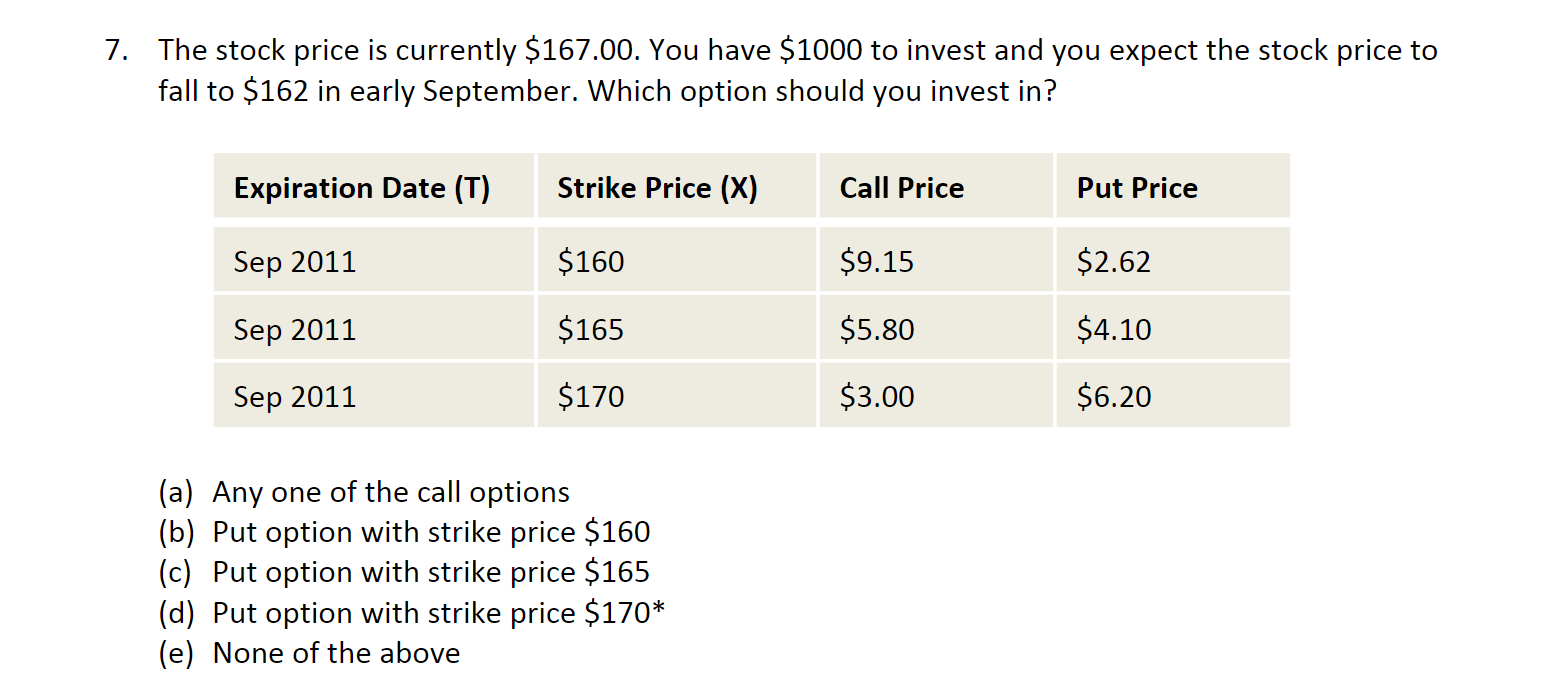

7. The stock price is currently $167.00. You have $1000 to invest and you expect the stock price to fall to $162 in early September. Which option should you invest in? Expiration Date (T) Strike Price (x) Call Price Put Price Sep 2011 $160 $9.15 $2.62 Sep 2011 $165 $5.80 $4.10 Sep 2011 $170 $3.00 $6.20 (a) Any one of the call options (b) Put option with strike price $160 (c) Put option with strike price $165 (d) Put option with strike price $170* (e) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started