Answered step by step

Verified Expert Solution

Question

1 Approved Answer

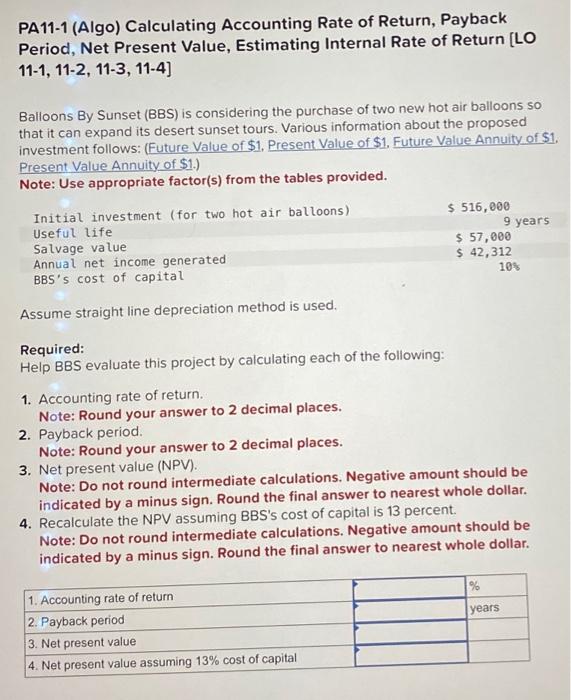

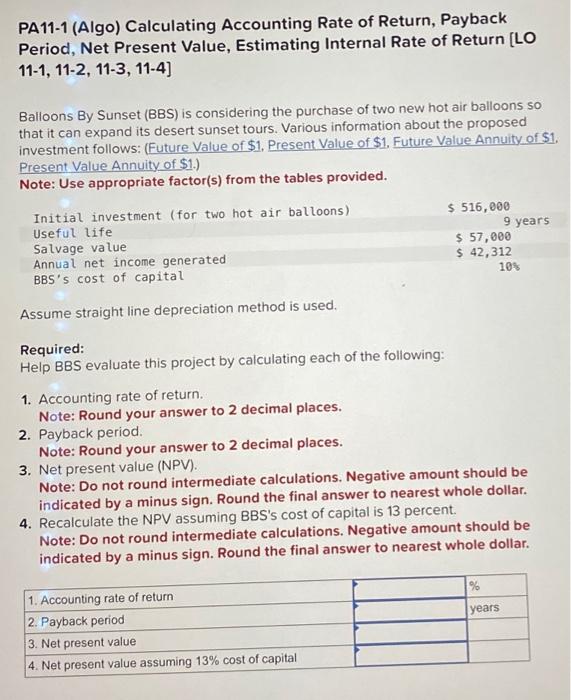

7 Period, Net Present Value, Estimating Internal Rate of Return [LO 111,112,113,114] Balloons By Sunset (BBS) is considering the purchase of two new hot air

7

Period, Net Present Value, Estimating Internal Rate of Return [LO 111,112,113,114] Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows: (Future Value of \$1, Present Value of \$1. Future Value Annuity of $1. Present Value Annuity of $1. Note: Use appropriate factor(s) from the tables provided. Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return. Note: Round your answer to 2 decimal places. 2. Payback period. Note: Round your answer to 2 decimal places. 3. Net present value (NPV). Note: Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar. 4. Recalculate the NPV assuming BBS's cost of capital is 13 percent. Note: Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started