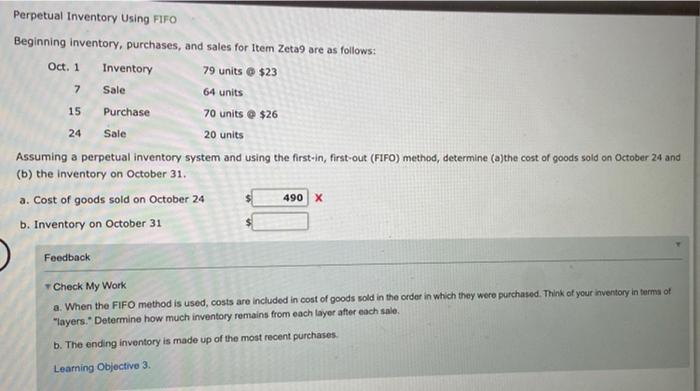

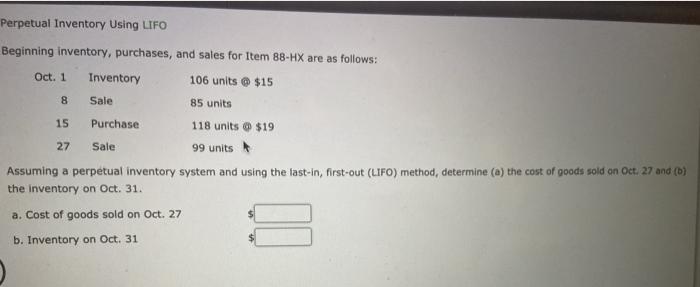

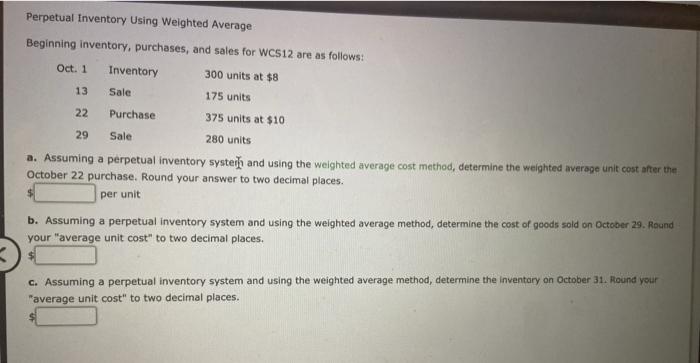

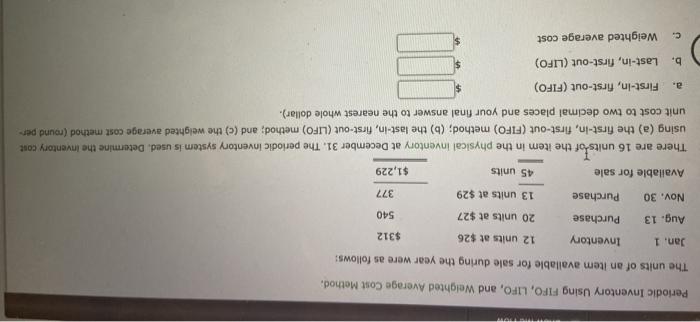

7 Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 79 units $23 Sale 64 units 15 Purchase 70 units @ $26 20 units Assuming a perpetual inventory system and using the first-In, first-out (FIFO) method, determine (a)the cost of goods sold on October 24 and (b) the inventory on October 31. a. Cost of goods sold on October 24 490 x b. Inventory on October 31 24 Sale Feedback Check My Work a. When the FIFO method is used, costs are included in cost of goods sold in the order in which they were purchased. Think of your inventory in terms of "layers.. Determine how much inventory remains from each layer after each sale. b. The ending inventory is made up of the most recent purchases Learning Objective 3. Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as follows: Oct. 1 Inventory 106 units @ $15 8 Sale 85 units 15 Purchase 118 units @ $19 27 Sale 99 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on Oct. 27 and (b) the inventory on Oct. 31. a. Cost of goods sold on Oct. 27 b. Inventory on Oct. 31 Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for WCS12 are as follows: Oct. 1 Inventory 300 units at $8 13 Sale 175 units Purchase 375 units at $10 22 29 Sale 280 units a. Assuming a perpetual inventory systein and using the weighted average cost method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of goods sold on October 29. Round your "average unit cost" to two decimal places. C. Assuming a perpetual inventory system and using the weighted average method, determine the inventary on October 31. Round your "average unit cost" to two decimal places. Periodic Inventory Using FIFO, LIFO, and weighted Average Cost Method. The units of an item available for sale during the year were as follows: Jan. 1 Inventory 12 units at $26 $312 Aug. 13 Purchase 20 units at $27 540 Nov. 30 Purchase 13 units at $29 377 Available for sale 45 units $1,229 There are 16 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cout using (a) the first-In, first-out (FIFO) method; (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method (round per unit cost to two decimal places and your final answer to the nearest whole dollar). a. First-In, first-out (FIFO) Last-in, first-out (LIFO) b. c. Weighted average cost