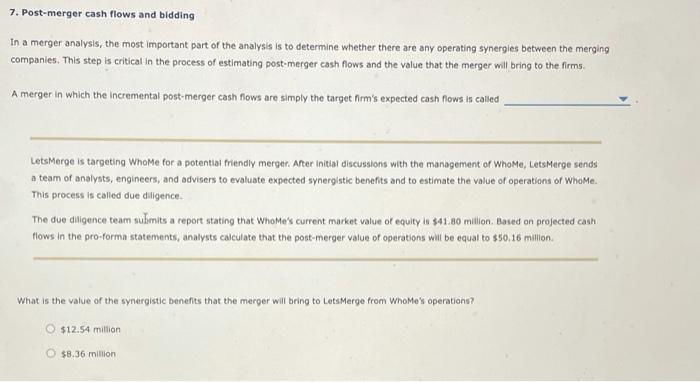

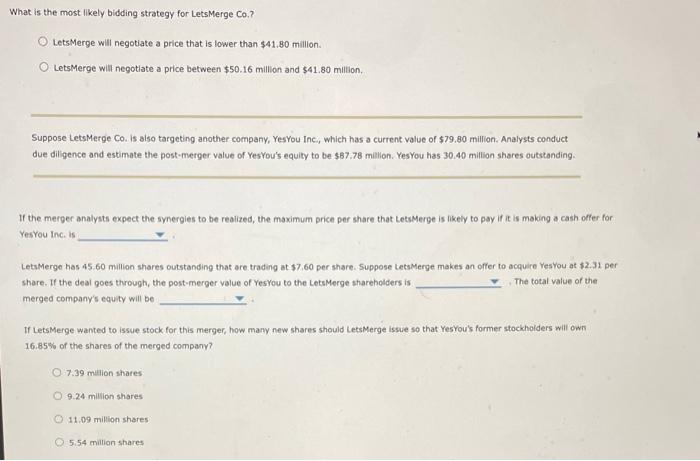

7. Post-merger cash flows and bidding In a merger analysis, the most important part of the analysis is to determine whether there are any operating synergies between the merging companies. This step is critical in the process of estimating post-merger cash flows and the value that the merger will bring to the firms. A merger in which the Incremental post-merger cash flows are simply the target firm's expected cash flows is called LetsMerge is targeting Whome for a potential friendly merger After initial discussions with the management of Whome, LetsMarge sends a team of analysts, engineers, and advisers to evaluate expected synergistic benefits and to estimate the value of operations or Whome. This process is called due diligence The due diligence team submits a report stating that Whome's current market value of equity is $41.80 million. Based on projected cash flows in the pro-forma statements, analysts calculate that the post-merger value of operations will be equal to $50,16 million What is the value of the synergistic benefits that the merger will bring to LetsMerge from Whome's operations? $12.54 million $8.36 million What is the most likely bidding strategy for LetsMerge Co.? LetsMerge will negotiate a price that is lower than $41.80 million. LetsMerge will negotiate a price between $50.16 million and $41.80 million, Suppose LetsMerge Co. is also targeting another company, YesYou Inc, which has a current value of $79.80 million. Analysts conduct due diligence and estimate the post-merger value of Yes You's equity to be $87.78 milion. YesYou has 30.40 million shares outstanding. a If the merger analysts expect the synergies to be realized the maximum price per share that LetsMerpe is likely to pay if it is making a cath offer for Yes You Inc. is LetsMerge has 45 60 million shares outstanding that are trading at $7.60 per share. Suppose LetsMerge makes an offer to acquire YesYou at $2.31 per share. If the deal goes through the post-merger value of YesYou to the LetsMerge shareholders is merged company's equity will be The total value of the If LetsMerge wanted to issue stock for this merger how many new shares should LetsMerge Issue so that Yes You's former stockholders will own 16.85% of the shares of the merged company? O 7.39 million shares 09.24 million shares 11:09 million shares 5.54 million shares