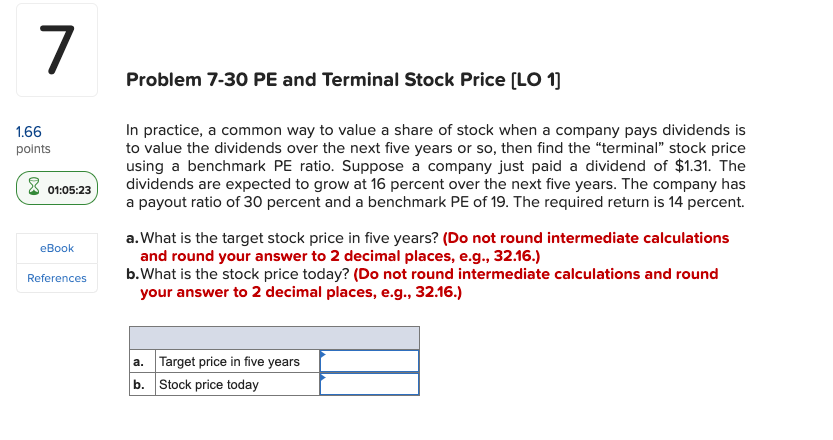

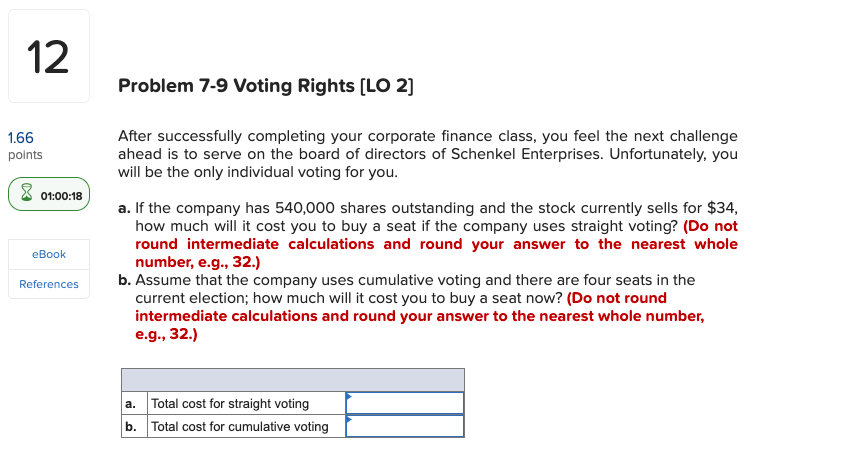

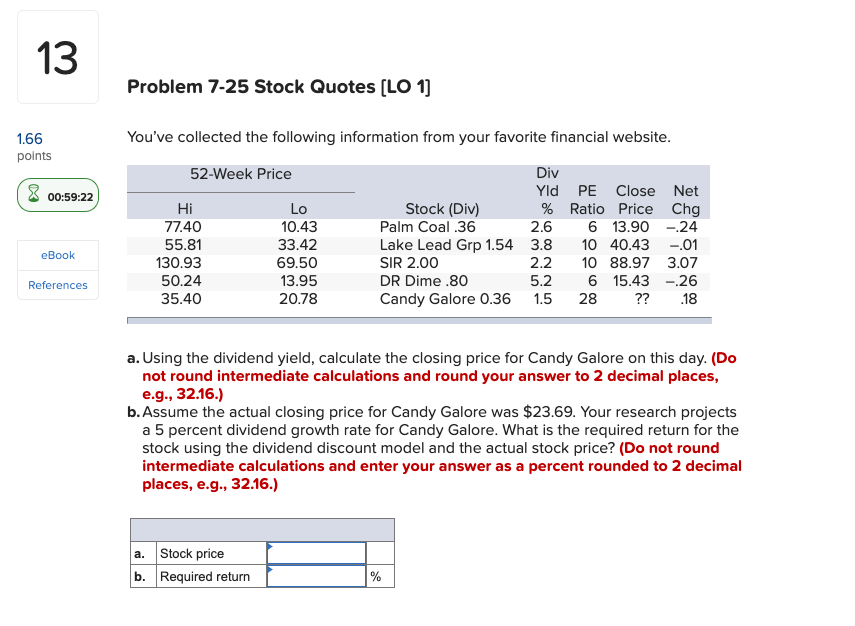

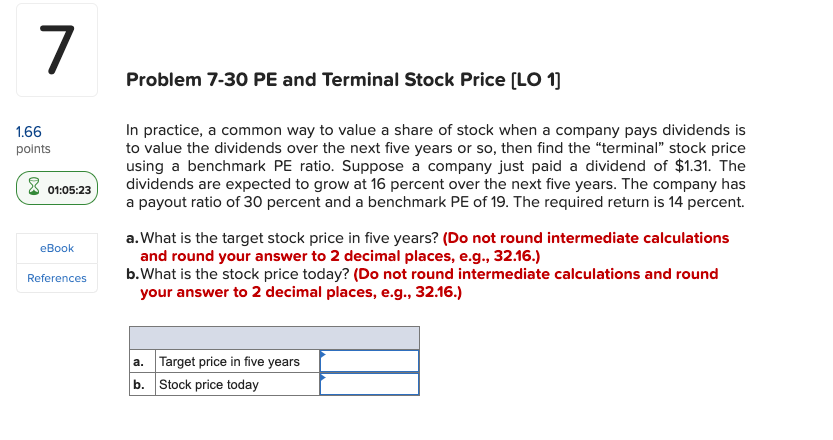

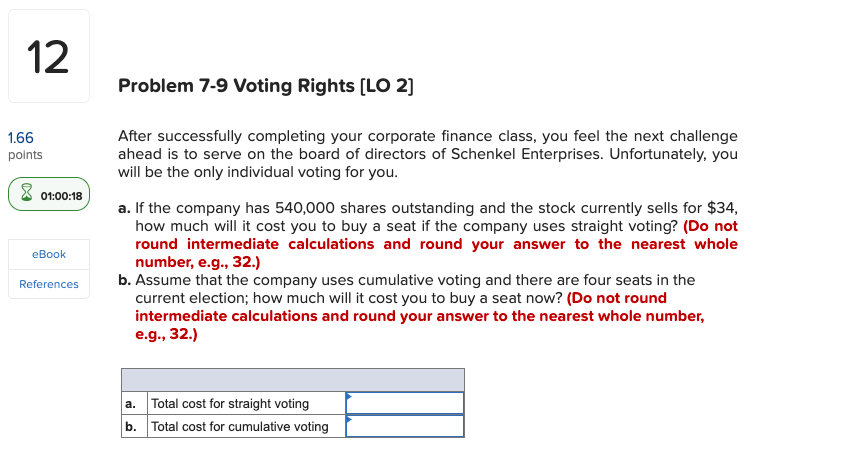

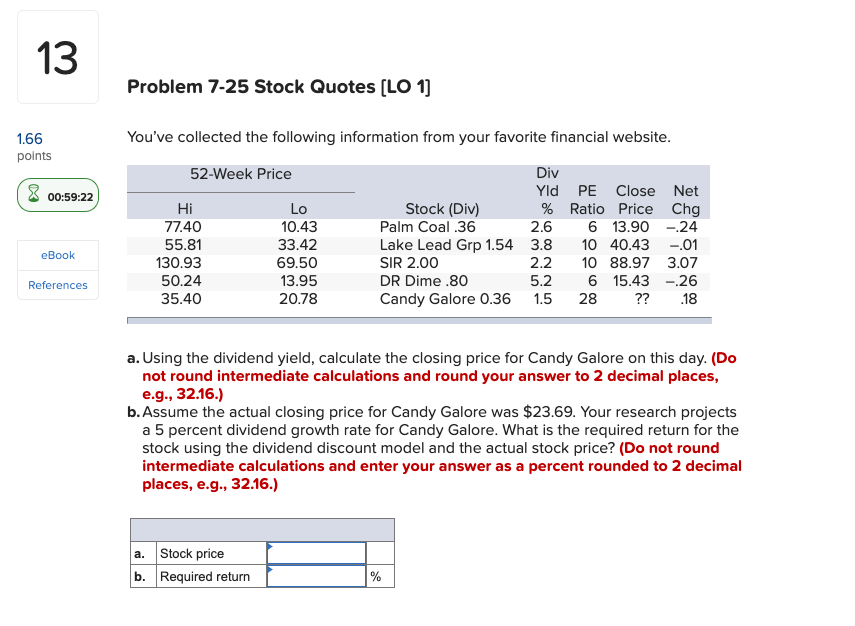

7 Problem 7-30 PE and Terminal Stock Price (LO 1) 1.66 points 8 01:05:23 In practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the next five years or so, then find the "terminal" stock price using a benchmark PE ratio. Suppose a company just paid a dividend of $1.31. The dividends are expected to grow at 16 percent over the next five years. The company has a payout ratio of 30 percent and a benchmark PE of 19. The required return is 14 percent. a.What is the target stock price in five years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the stock price today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) eBook References a. Target price in five years b. Stock price today 12 Problem 7-9 Voting Rights (LO 2] 1.66 points 01:00:18 After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of Schenkel Enterprises. Unfortunately, you will be the only individual voting for you. a. If the company has 540,000 shares outstanding and the stock currently sells for $34, how much will it cost you to buy a seat if the company uses straight voting? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. Assume that the company uses cumulative voting and there are four seats in the current election; how much will it cost you to buy a seat now? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) eBook References a. Total cost for straight voting b. Total cost for cumulative voting 13 Problem 7-25 Stock Quotes (LO 1] 1.66 points You've collected the following information from your favorite financial website. 52-Week Price 8 00:59:22 LO Hi 77.40 55.81 130.93 50.24 35.40 eBook Div Yld PE Close Net Stock (Div) % Ratio Price Chg Palm Coal.36 2.6 6 13.90 -24 Lake Lead Grp 1.54 3.8 10 40.43 -01 SIR 2.00 2.2 10 88.97 3.07 DR Dime.80 5.2 6 15.43 -26 Candy Galore 0.36 1.5 28 ?? 10.43 33.42 69.50 13.95 20.78 References .18 a. Using the dividend yield, calculate the closing price for Candy Galore on this day. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Assume the actual closing price for Candy Galore was $23.69. Your research projects a 5 percent dividend growth rate for Candy Galore. What is the required return for the stock using the dividend discount model and the actual stock price? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Stock price b. Required return %