Answered step by step

Verified Expert Solution

Question

1 Approved Answer

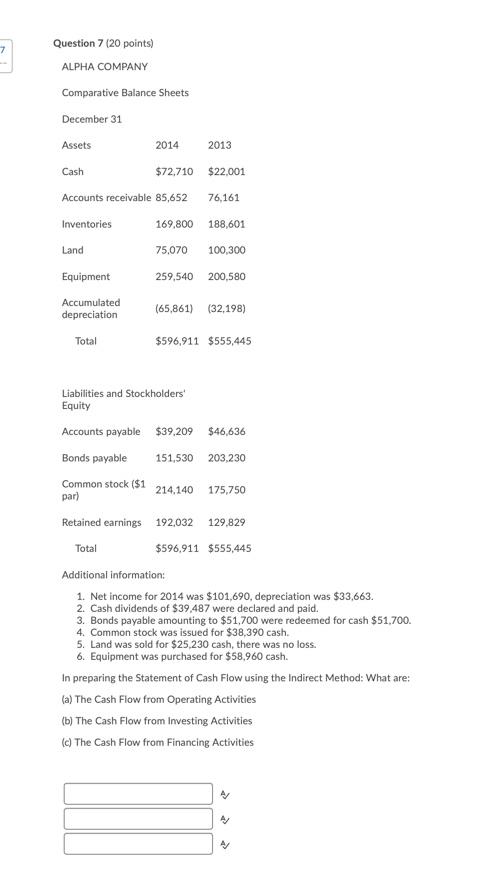

7 - Question 7 (20 points) ALPHA COMPANY Comparative Balance Sheets December 31 Assets Cash 2014 2013 $72,710 $22,001 Accounts receivable 85,652 76,161 Inventories

7 - Question 7 (20 points) ALPHA COMPANY Comparative Balance Sheets December 31 Assets Cash 2014 2013 $72,710 $22,001 Accounts receivable 85,652 76,161 Inventories 169,800 188,601 Land 75,070 100,300 Equipment 259,540 200,580 Accumulated (65,861) (32,198) depreciation Total $596,911 $555,445 Liabilities and Stockholders' Equity Accounts payable $39,209 $46,636 Bonds payable 151,530 203,230 Common stock ($1 214,140 175,750 par) Retained earnings 192,032 129,829 Total $596,911 $555,445 Additional information: 1. Net income for 2014 was $101,690, depreciation was $33,663. 2. Cash dividends of $39,487 were declared and paid. 3. Bonds payable amounting to $51,700 were redeemed for cash $51,700. 4. Common stock was issued for $38,390 cash. 5. Land was sold for $25,230 cash, there was no loss. 6. Equipment was purchased for $58,960 cash. In preparing the Statement of Cash Flow using the Indirect Method: What are: (a) The Cash Flow from Operating Activities (b) The Cash Flow from Investing Activities (c) The Cash Flow from Financing Activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started