Answered step by step

Verified Expert Solution

Question

1 Approved Answer

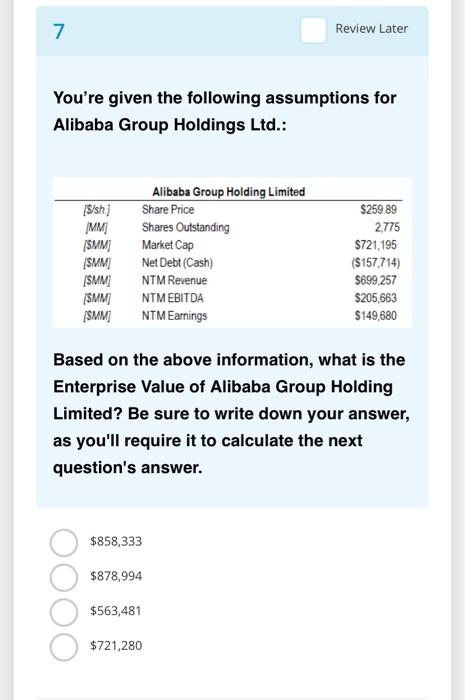

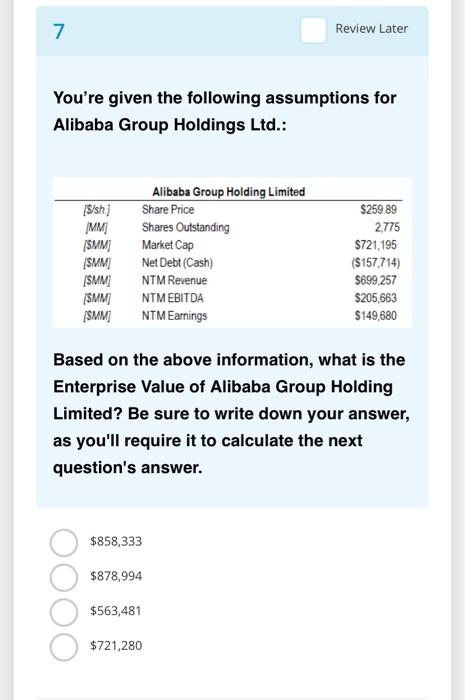

7. Review Later You're given the following assumptions for Alibaba Group Holdings Ltd.: {$/sh) [MM] SMM SMM SMM (SMM SMM Alibaba Group Holding Limited Share

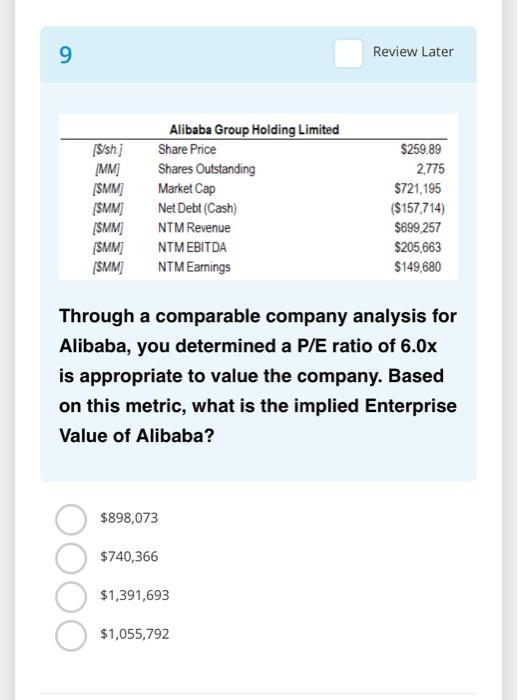

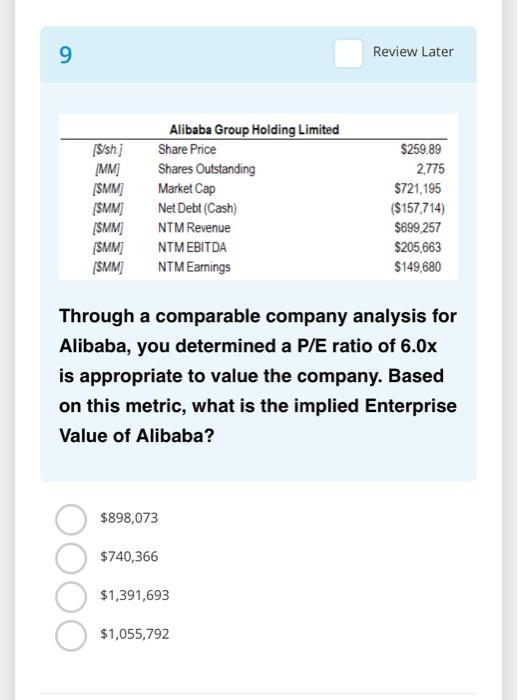

7. Review Later You're given the following assumptions for Alibaba Group Holdings Ltd.: {$/sh) [MM] SMM SMM SMM (SMM SMM Alibaba Group Holding Limited Share Price Shares Outstanding Market Cap Net Debt (Cash) NTM Revenue NTM EBITDA NTM Earnings $259.89 2.775 $721,195 ($157,714) $699,257 $205,663 $149,680 Based on the above information, what is the Enterprise Value of Alibaba Group Holding Limited? Be sure to write down your answer, as you'll require it to calculate the next question's answer. $858,333 $878,994 $563,481 $721,280 9 Review Later [S/sh.] AMM SMM {$MM [SMM (SMM SMM Alibaba Group Holding Limited Share Price Shares Outstanding Market Cap Net Debt (Cash) NTM Revenue NTM EBITDA NTM Earnings $259.89 2,775 $721,195 ($157,714) $699,257 $205,663 $149,680 Through a comparable company analysis for Alibaba, you determined a P/E ratio of 6.0x is appropriate to value the company. Based on this metric, what is the implied Enterprise Value of Alibaba? $898,073 $740,366 $1,391,693 $1,055,792

7. Review Later You're given the following assumptions for Alibaba Group Holdings Ltd.: {$/sh) [MM] SMM SMM SMM (SMM SMM Alibaba Group Holding Limited Share Price Shares Outstanding Market Cap Net Debt (Cash) NTM Revenue NTM EBITDA NTM Earnings $259.89 2.775 $721,195 ($157,714) $699,257 $205,663 $149,680 Based on the above information, what is the Enterprise Value of Alibaba Group Holding Limited? Be sure to write down your answer, as you'll require it to calculate the next question's answer. $858,333 $878,994 $563,481 $721,280 9 Review Later [S/sh.] AMM SMM {$MM [SMM (SMM SMM Alibaba Group Holding Limited Share Price Shares Outstanding Market Cap Net Debt (Cash) NTM Revenue NTM EBITDA NTM Earnings $259.89 2,775 $721,195 ($157,714) $699,257 $205,663 $149,680 Through a comparable company analysis for Alibaba, you determined a P/E ratio of 6.0x is appropriate to value the company. Based on this metric, what is the implied Enterprise Value of Alibaba? $898,073 $740,366 $1,391,693 $1,055,792

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started