Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7 - S 1 ] [ The following information applies to the questions displayed below. ] Tracer Advance Corporation ( TAC ) sells a tracking

S

The following information applies to the questions displayed below.

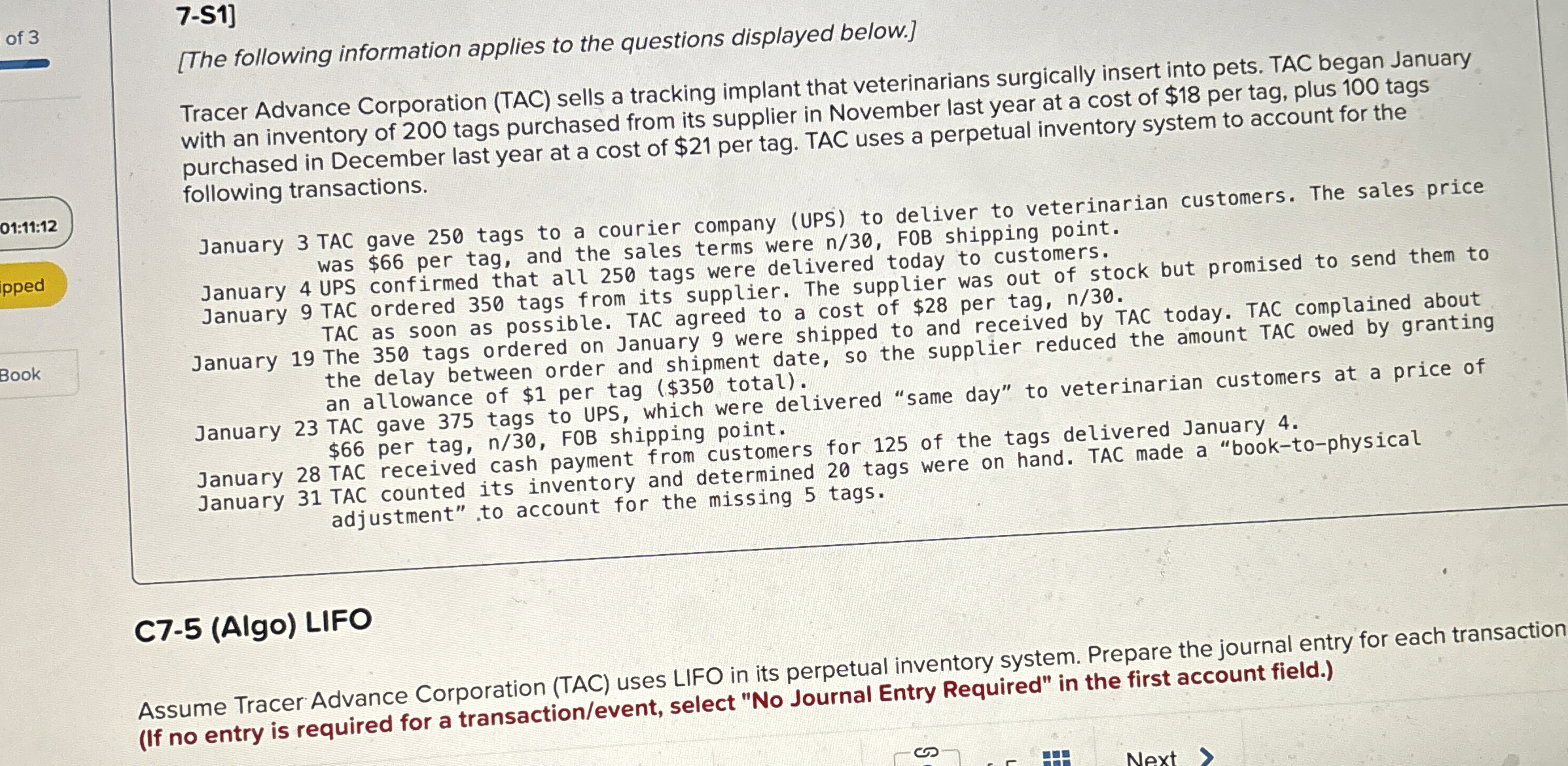

Tracer Advance Corporation TAC sells a tracking implant that veterinarians surgically insert into pets. TAC began January with an inventory of tags purchased from its supplier in November last year at a cost of $ per tag, plus tags purchased in December last year at a cost of $ per tag. TAC uses a perpetual inventory system to account for the following transactions.

January TAC gave tags to a courier company UPS to deliver to veterinarian customers. The sales price was $ per tag, and the sales terms were FOB shipping point.

January UPS confirmed that all tags were delivered today to customers.

January TAC ordered tags from its supplier. The supplier was out of stock but promised to send them to TAC as soon as possible. TAC agreed to a cost of $ per tag,

January The tags ordered on January were shipped to and received by TAC today. TAC complained about the delay between order and shipment date, so the supplier reduced the amount TAC owed by granting an allowance of $ per tag $ total

January TAC gave tags to UPS, which were delivered "same day" to veterinarian customers at a price of $ per tag, FOB shipping point.

January TAC received cash payment from customers for of the tags delivered January adjustment" to account for the missing tags.

CAlgo LIFO

Assume Tracer Advance Corporation TAC uses LIFO in its perpetual inventory system. Prepare the journal entry for each transaction If no entry is required for a transactionevent select No Journal Entry Required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started