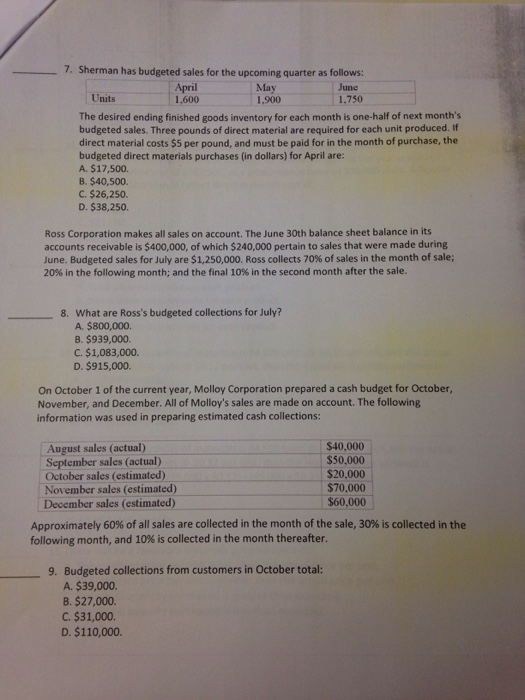

7. Sherman has budgeted sales for the upcoming quarter as follows: June 1.750 April 1,600 May Units 1,900 The desired ending finished goods inventory for each month is one-half of next month's budgeted sales. Three pounds of direct material are required for each unit produced. If direct material costs $5 per pound, and must be paid for in the month of purchase, the budgeted direct materials purchases (in dollars) for April are: A. $17,500. B. $40,500. C. $26,250. D. $38,250. Ross Corporation makes all sales on account. The June 30th balance sheet balance in its accounts receivable is $400,000, of which $240,000 pertain to sales that were made during June. Budgeted sales for July are $1,250,000. Ross collects 70% of sales in the month of sale; 20% in the following month, and the final 10% in the second month after the sale. What are Ross's budgeted collections for July? A. $800,000. B. $939,000. C. $1,083,000. D. $915,000. 8. On October 1 of the current year, Molloy Corporation prepared a cash budget for October, November, and December. All of Molloy's sales are made on account. The following information was used in preparing estimated cash collections: August sales (actual) September sales (actual) October sales (estimated) November sales (estimated) December sales (estimated) $40,000 $50,000 $20,000 $70,000 $60,000 Approximately 60% of all sales are collected in the month of the sale, 30% is collected in the following month, and 10% is collected in the month thereafter. 9. Budgeted collections from customers in October total: A $39,000. B. $27,000. C. $31,000. D. $110,000. 7. Sherman has budgeted sales for the upcoming quarter as follows: June 1.750 April 1,600 May Units 1,900 The desired ending finished goods inventory for each month is one-half of next month's budgeted sales. Three pounds of direct material are required for each unit produced. If direct material costs $5 per pound, and must be paid for in the month of purchase, the budgeted direct materials purchases (in dollars) for April are: A. $17,500. B. $40,500. C. $26,250. D. $38,250. Ross Corporation makes all sales on account. The June 30th balance sheet balance in its accounts receivable is $400,000, of which $240,000 pertain to sales that were made during June. Budgeted sales for July are $1,250,000. Ross collects 70% of sales in the month of sale; 20% in the following month, and the final 10% in the second month after the sale. What are Ross's budgeted collections for July? A. $800,000. B. $939,000. C. $1,083,000. D. $915,000. 8. On October 1 of the current year, Molloy Corporation prepared a cash budget for October, November, and December. All of Molloy's sales are made on account. The following information was used in preparing estimated cash collections: August sales (actual) September sales (actual) October sales (estimated) November sales (estimated) December sales (estimated) $40,000 $50,000 $20,000 $70,000 $60,000 Approximately 60% of all sales are collected in the month of the sale, 30% is collected in the following month, and 10% is collected in the month thereafter. 9. Budgeted collections from customers in October total: A $39,000. B. $27,000. C. $31,000. D. $110,000