Answered step by step

Verified Expert Solution

Question

1 Approved Answer

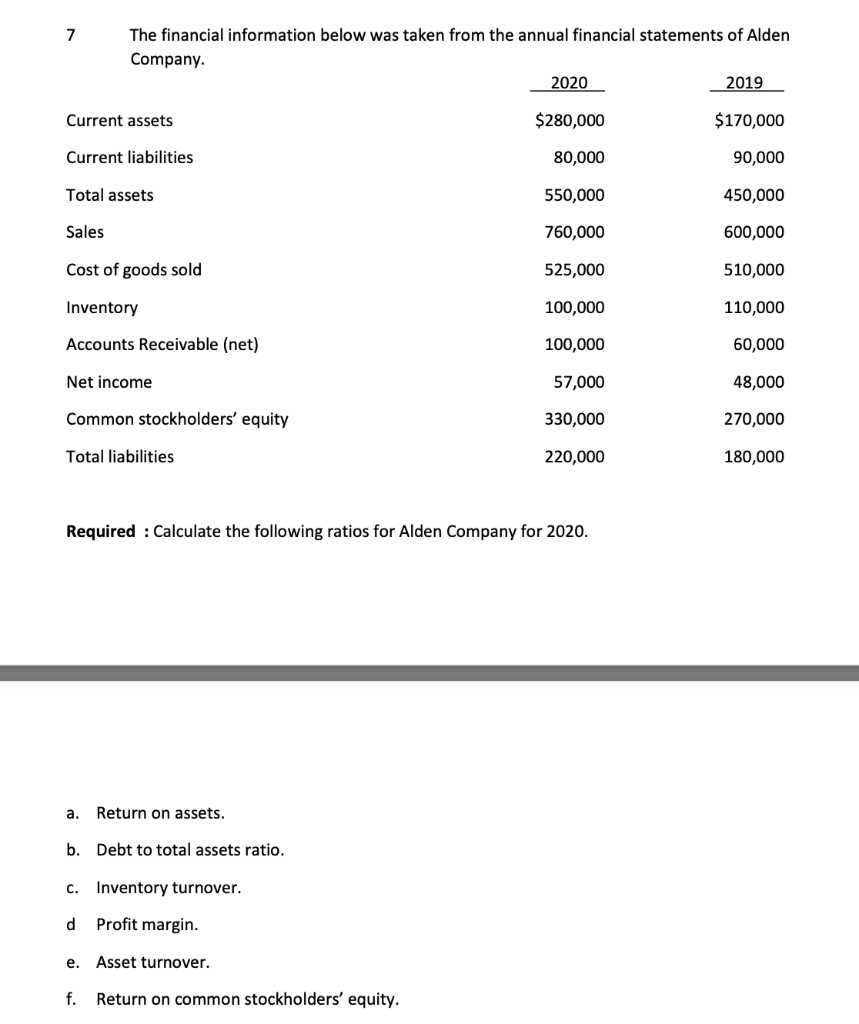

7 The financial information below was taken from the annual financial statements of Alden Company. 2020 2019 Current assets $280,000 $170,000 Current liabilities 80,000

7 The financial information below was taken from the annual financial statements of Alden Company. 2020 2019 Current assets $280,000 $170,000 Current liabilities 80,000 90,000 Total assets 550,000 450,000 Sales 760,000 600,000 Cost of goods sold 525,000 510,000 Inventory 100,000 110,000 Accounts Receivable (net) 100,000 60,000 Net income 57,000 48,000 Common stockholders' equity 330,000 270,000 Total liabilities 220,000 180,000 Required: Calculate the following ratios for Alden Company for 2020. a. Return on assets. b. Debt to total assets ratio. C. Inventory turnover. d Profit margin. e. Asset turnover. f. Return on common stockholders' equity.

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

CALCULATE THE FOLLOWING RATIOS FOR ALDEN COMPANY FOR THE YEAR ENDED 2020 1 Return on Assets Return o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started