Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. The following accounts of Janet Manufacturing Co. appeared in its balance sheets on December 31, 2013 and December 31, 2014: Materials inventory 2013

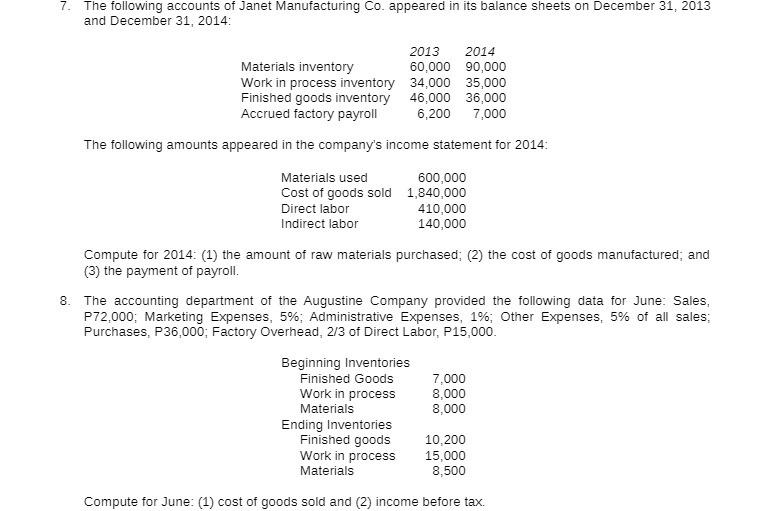

7. The following accounts of Janet Manufacturing Co. appeared in its balance sheets on December 31, 2013 and December 31, 2014: Materials inventory 2013 60,000 2014 90,000 Work in process inventory 34,000 35,000 Finished goods inventory Accrued factory payroll 46,000 36,000 6,200 7,000 The following amounts appeared in the company's income statement for 2014: Materials used 600,000 Cost of goods sold 1,840,000 Direct labor Indirect labor 410,000 140,000 Compute for 2014: (1) the amount of raw materials purchased; (2) the cost of goods manufactured; and (3) the payment of payroll. 8. The accounting department of the Augustine Company provided the following data for June: Sales, P72,000; Marketing Expenses, 5%; Administrative Expenses, 1%; Other Expenses, 5% of all sales; Purchases, P36,000; Factory Overhead, 2/3 of Direct Labor, P15,000. Beginning Inventories Finished Goods 7,000 Work in process 8,000 Materials 8,000 Ending Inventories Finished goods 10,200 Work in process 15,000 Materials 8,500 Compute for June: (1) cost of goods sold and (2) income before tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

7 Compute for 2014 1 Amount of raw materials purchased Not pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started