Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. The motor vehicle was purchased by Bambi Construction on 1 July, 2019 and is used by Director. Based on market prices, the company sold

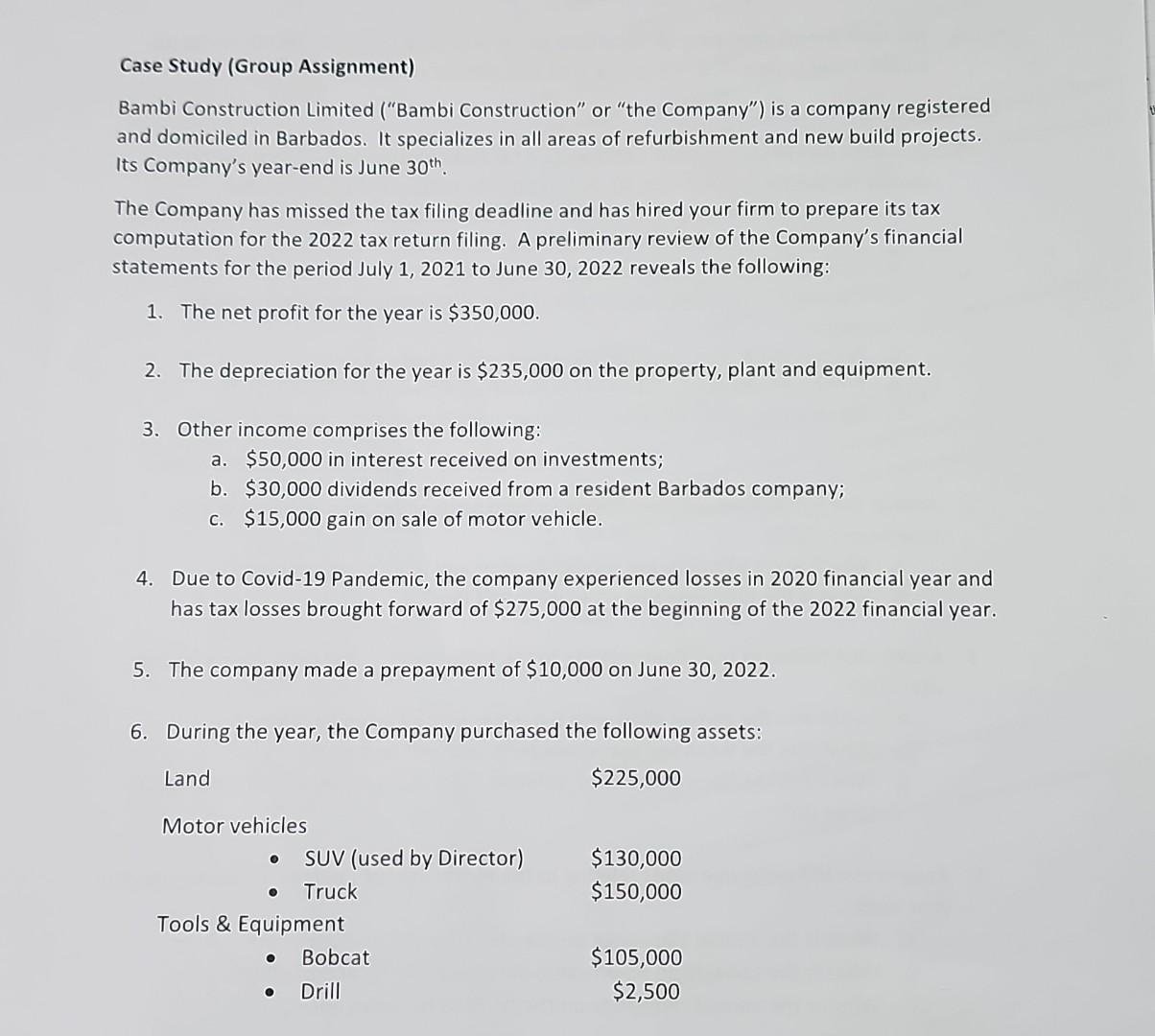

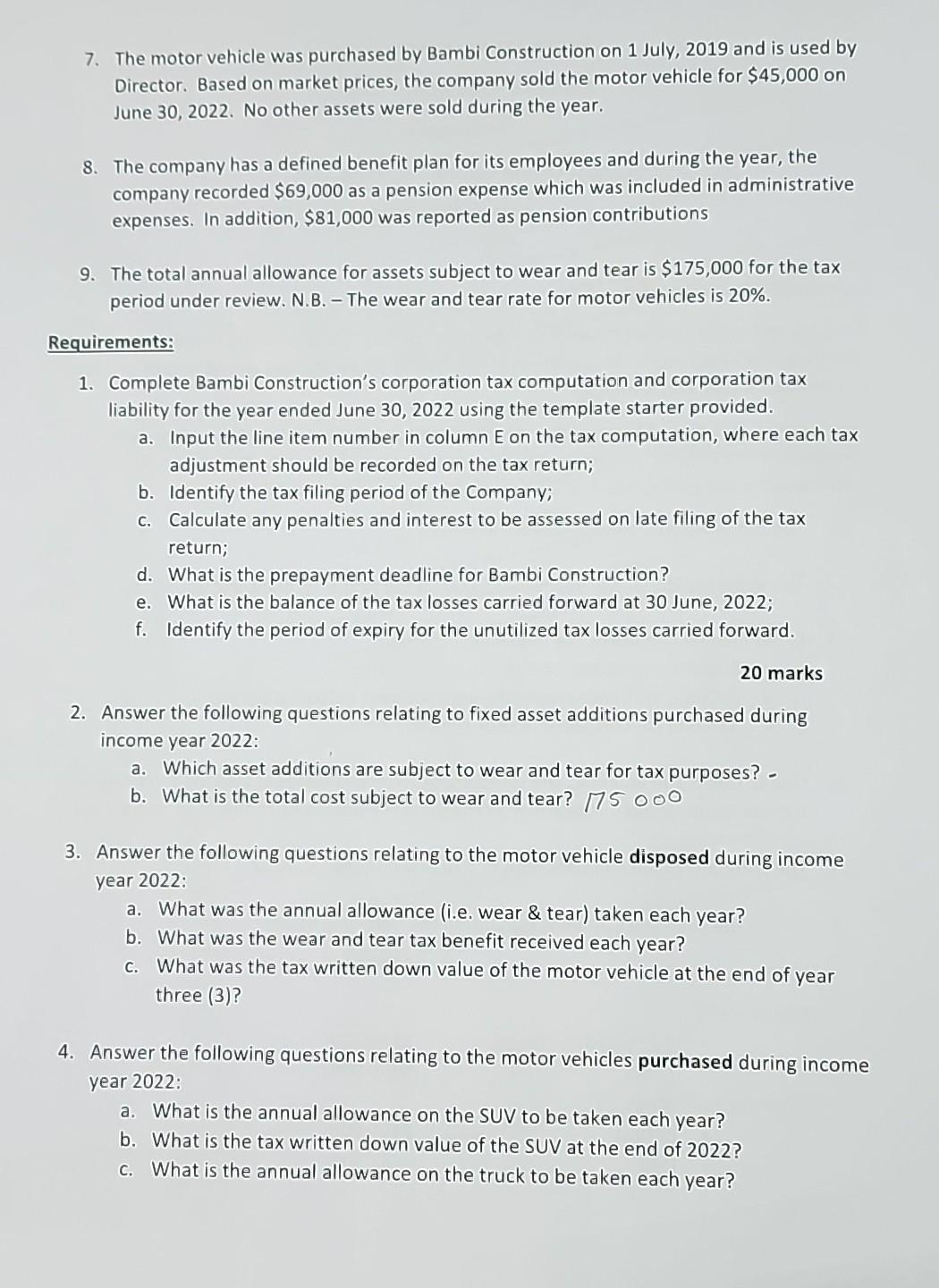

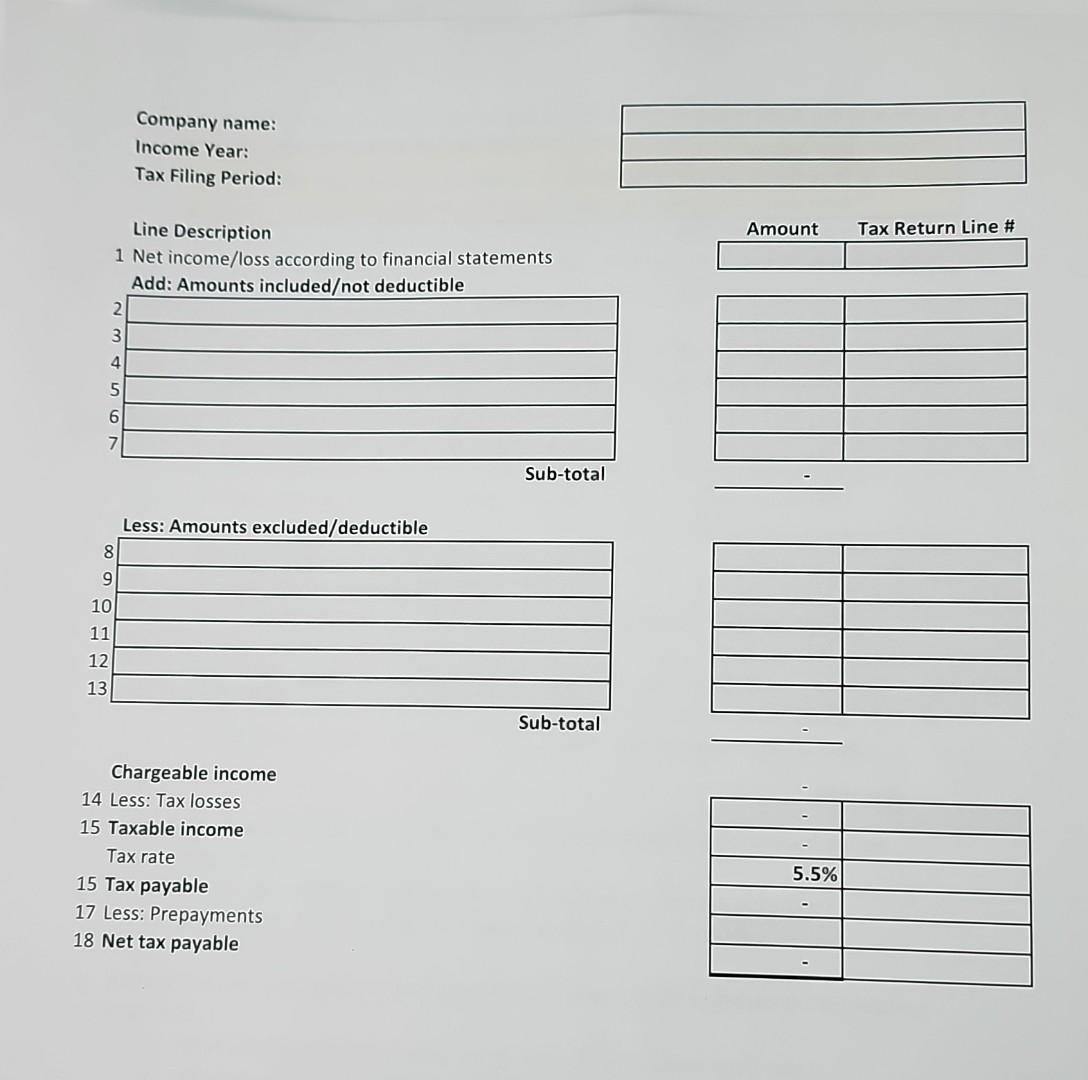

7. The motor vehicle was purchased by Bambi Construction on 1 July, 2019 and is used by Director. Based on market prices, the company sold the motor vehicle for $45,000 on June 30,2022 . No other assets were sold during the year. 8. The company has a defined benefit plan for its employees and during the year, the company recorded $69,000 as a pension expense which was included in administrative expenses. In addition, $81,000 was reported as pension contributions 9. The total annual allowance for assets subject to wear and tear is $175,000 for the tax period under review. N.B. - The wear and tear rate for motor vehicles is 20%. Requirements: 1. Complete Bambi Construction's corporation tax computation and corporation tax liability for the year ended June 30, 2022 using the template starter provided. a. Input the line item number in column E on the tax computation, where each tax adjustment should be recorded on the tax return; b. Identify the tax filing period of the Company; c. Calculate any penalties and interest to be assessed on late filing of the tax return; d. What is the prepayment deadline for Bambi Construction? e. What is the balance of the tax losses carried forward at 30 June, 2022; f. Identify the period of expiry for the unutilized tax losses carried forward. 20 marks 2. Answer the following questions relating to fixed asset additions purchased during income year 2022: a. Which asset additions are subject to wear and tear for tax purposes? - b. What is the total cost subject to wear and tear? 175000 3. Answer the following questions relating to the motor vehicle disposed during income year 2022: a. What was the annual allowance (i.e. wear \& tear) taken each year? b. What was the wear and tear tax benefit received each year? c. What was the tax written down value of the motor vehicle at the end of year three (3)? 4. Answer the following questions relating to the motor vehicles purchased during income year 2022: a. What is the annual allowance on the SUV to be taken each year? b. What is the tax written down value of the SUV at the end of 2022? c. What is the annual allowance on the truck to be taken each year? Case Study (Group Assignment) Bambi Construction Limited ("Bambi Construction" or "the Company") is a company registered and domiciled in Barbados. It specializes in all areas of refurbishment and new build projects. Its Company's year-end is June 30th. The Company has missed the tax filing deadline and has hired your firm to prepare its tax computation for the 2022 tax return filing. A preliminary review of the Company's financial statements for the period July 1, 2021 to June 30, 2022 reveals the following: 1. The net profit for the year is $350,000. 2. The depreciation for the year is $235,000 on the property, plant and equipment. 3. Other income comprises the following: a. $50,000 in interest received on investments; b. $30,000 dividends received from a resident Barbados company; c. $15,000 gain on sale of motor vehicle. 4. Due to Covid-19 Pandemic, the company experienced losses in 2020 financial year and has tax losses brought forward of $275,000 at the beginning of the 2022 financial year. 5. The company made a prepayment of $10,000 on June 30,2022 . 6. During the vear. the Companv purchased the following assets: Company name: Income Year: Tax Filing Period: Line Description 1 Net income/loss according to financial statements Add: Amounts includedot deductible Sub-total Less: Amounts excluded/deductible Sub-total Chargeable income 14 Less: Tax losses 15 Taxable income Tax rate 15 Tax payable 17 Less: Prepayments 18 Net tax payable \begin{tabular}{|l|} \hline \\ \hline \\ \hline \end{tabular} Amount Tax Return Line \# \begin{tabular}{|l|l|} \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline- & \\ \hline- & \\ \hline 5.5% & \\ \hline- & \\ \hline & \\ \hline- & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started