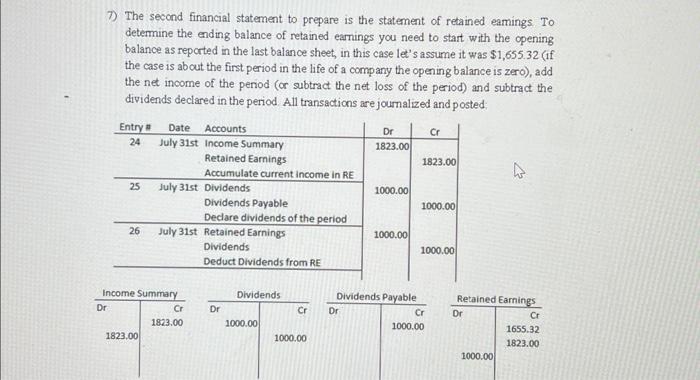

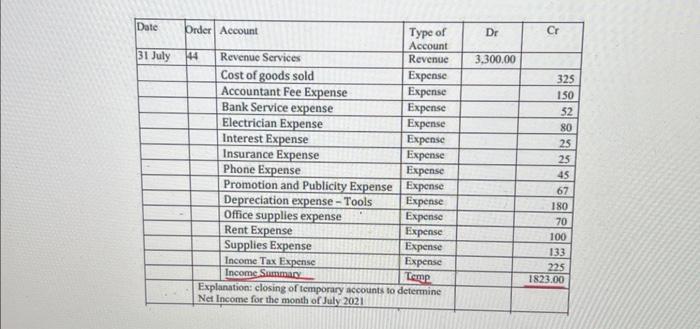

7) The second financial statement to prepare is the statement of retained eamings. To determine the ending balance of retained earnings you need to start with the opening balance as reported in the last balance sheet, in this case let's assume it was $1,655.32 (if the case is about the first period in the life of a company the opening balance is zero), add the net income of the period (or subtract the net loss of the period) and subtract the dividends declared in the period All transactions are journalized and posted: \begin{tabular}{|l|l|l|l|r|r|} \hline Date & Order & Account & \begin{tabular}{l} Type of \\ Account \end{tabular} & Dr & Cr \\ \hline 31 July & 44 & Revenue Services & Revenue & 3,300.00 & \\ \hline & Cost of goods sold & Expense & & 325 \\ \hline & Accountant Fee Expense & Expense & & 150 \\ \hline & Bank Service expense & Expense & & 52 \\ \hline & Electrician Expense & Expense & & 80 \\ \hline & Interest Expense & Expense & & 25 \\ \hline & Insurance Expense & Expense & & 25 \\ \hline & Phone Expense & Expense & & 45 \\ \hline & Promotion and Publicity Expense & Expense & & 67 \\ \hline & Depreciation expense - Tools & Expense & & 180 \\ \hline & Office supplies expense & Expense & & 70 \\ \hline & Rent Expense & Expense & & 100 \\ \hline & Supplies Expense & Expense & & 133 \\ \hline & Income Tax Expense & Expense & & 225 \\ \hline & Income Sammar & & 1823.00 \\ \hline & \begin{tabular}{ll} Explanstion: closing of temporary accounts to deternine \\ Net Income for the month of July 2021 \end{tabular} & & \\ \hline \end{tabular} 7) The second financial statement to prepare is the statement of retained eamings. To determine the ending balance of retained earnings you need to start with the opening balance as reported in the last balance sheet, in this case let's assume it was $1,655.32 (if the case is about the first period in the life of a company the opening balance is zero), add the net income of the period (or subtract the net loss of the period) and subtract the dividends declared in the period All transactions are journalized and posted: \begin{tabular}{|l|l|l|l|r|r|} \hline Date & Order & Account & \begin{tabular}{l} Type of \\ Account \end{tabular} & Dr & Cr \\ \hline 31 July & 44 & Revenue Services & Revenue & 3,300.00 & \\ \hline & Cost of goods sold & Expense & & 325 \\ \hline & Accountant Fee Expense & Expense & & 150 \\ \hline & Bank Service expense & Expense & & 52 \\ \hline & Electrician Expense & Expense & & 80 \\ \hline & Interest Expense & Expense & & 25 \\ \hline & Insurance Expense & Expense & & 25 \\ \hline & Phone Expense & Expense & & 45 \\ \hline & Promotion and Publicity Expense & Expense & & 67 \\ \hline & Depreciation expense - Tools & Expense & & 180 \\ \hline & Office supplies expense & Expense & & 70 \\ \hline & Rent Expense & Expense & & 100 \\ \hline & Supplies Expense & Expense & & 133 \\ \hline & Income Tax Expense & Expense & & 225 \\ \hline & Income Sammar & & 1823.00 \\ \hline & \begin{tabular}{ll} Explanstion: closing of temporary accounts to deternine \\ Net Income for the month of July 2021 \end{tabular} & & \\ \hline \end{tabular}