Answered step by step

Verified Expert Solution

Question

1 Approved Answer

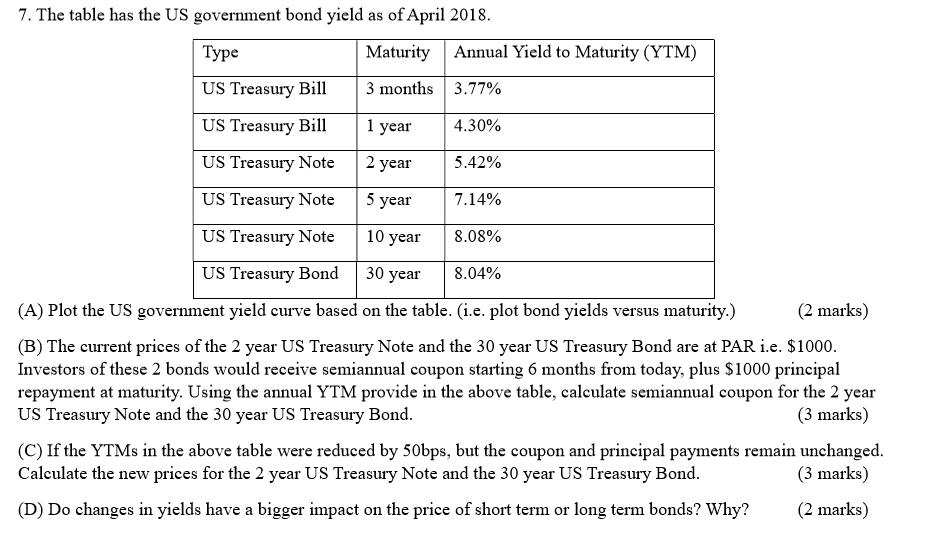

7. The table has the US government bond yield as of April 2018. Maturity Annual Yield to Maturity (YTM) US Treasury Bill 3 months

7. The table has the US government bond yield as of April 2018. Maturity Annual Yield to Maturity (YTM) US Treasury Bill 3 months 3.77% US Treasury Bill 1 year 4.30% US Treasury Note 2 year 5.42% US Treasury Note 5 year 7.14% US Treasury Note 10 year 8.08% US Treasury Bond 30 year 8.04% (A) Plot the US government yield curve based on the table. (i.e. plot bond yields versus maturity.) (2 marks) (B) The current prices of the 2 year US Treasury Note and the 30 year US Treasury Bond are at PAR i.e. $1000. Investors of these 2 bonds would receive semiannual coupon starting 6 months from today, plus $1000 principal repayment at maturity. Using the annual YTM provide in the above table, calculate semiannual coupon for the 2 year US Treasury Note and the 30 year US Treasury Bond. (3 marks) (C) If the YTMs in the above table were reduced by 50bps, but the coupon and principal payments remain unchanged. Calculate the new prices for the 2 year US Treasury Note and the 30 year US Treasury Bond. (3 marks) (D) Do changes in yields have a bigger impact on the price of short term or long term bonds? Why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started