Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. The theory of interest rate parity means that the A. interest rates are equal in two countries B. difference between a forward rate and

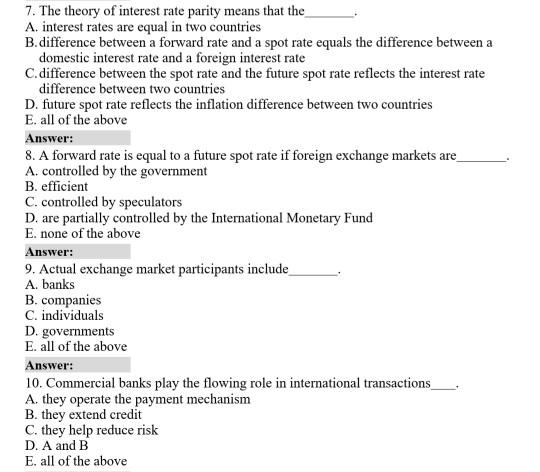

7. The theory of interest rate parity means that the A. interest rates are equal in two countries B. difference between a forward rate and a spot rate equals the difference between a domestic interest rate and a foreign interest rate C.difference between the spot rate and the future spot rate reflects the interest rate difference between two countries D. future spot rate reflects the inflation difference between two countries E. all of the above Answer: 8. A forward rate is equal to a future spot rate if foreign exchange markets are A. controlled by the government B. efficient C. controlled by speculators D. are partially controlled by the International Monetary Fund E. none of the above Answer: 9. Actual exchange market participants include A. banks B. companies C. individuals D. governments E. all of the above Answer: 10. Commercial banks play the flowing role in international transactions A. they operate the payment mechanism B. they extend credit C. they help reduce risk D. A and B E. all of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started